Five Point Holdings Could Fall Suddenly On Lockup Expiration

November 6, 2017, concludes the 180-day lockup period on Five Point Holdings LLC (Pending: FPH).

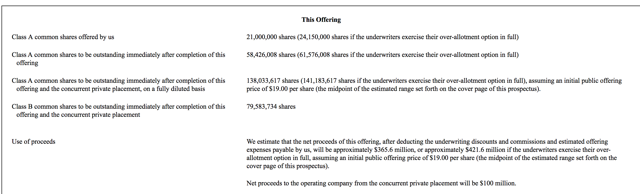

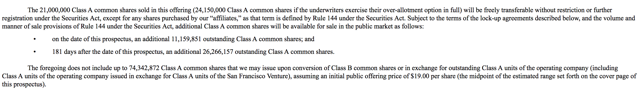

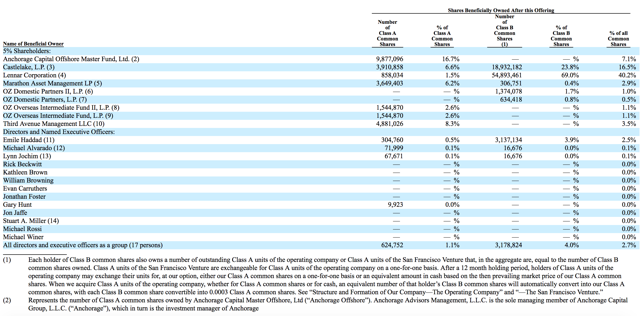

When the lockup period ends for FPH, the company's numerous pre-IPO shareholders, directors, and executives will finally be able to sell their more than 37 million previously-restricted shares. Just 21 million shares are currently trading pursuant to the offering.

We believe that there's a high probability that they will sell at least a portion of these previously restricted shares - FPH has a notably high number of restricted shareholders - nine corporate entities and venture capital firms and seventeen individuals. The potential for a sudden increase in stock available - and shareholders looking to sell it - may cause a sharp, short-term decrease in the price of Five Point Holdings shares.

(Click on image to enlarge)

Business Overview: Largest Owner and Developer of Land in Coastal California

Five Point Holdings is the largest owner and developer of master-planned, mixed-use communities in western counties in California. It currently has three existing communities: Newhall Ranch in Los Angeles, San Francisco Shipyard, and Candlestick Park in San Francisco, and Great Park Neighborhood in Orange County.

Its plans include construction of approximately 40,000 homes and 21 million square feet of commercial space and the accompanying infrastructure. Five Point Holdings has the zoning approvals for the general plan. The three areas represent some of the largest growth in California with the least amount of housing and space available. The communities will include commercial, educational, retail, and recreational elements in addition to parks, open spaces, and civic areas. Construction will take place over a 10-year period. The company was formerly known as Newhall Holding Company, LLC and changed its name to Five Point Holdings, LLC in May 2016. Five Point Holdings, LLC was founded in 2009 and is based in Aliso Viejo, California.

Financial Highlights

Five Point Holdings reported the following financial highlights for the second quarter of fiscal 2017 ended June 30:

-

Revenues increased by $6.0 million, or 83.5%, to $13.2 million for the three months ended June 30, 2017, from $7.2 million for the same period last years. The increase in revenue was primarily due to recognition of profit participation payments, marketing fees, and other builder fees attributed to prior period land sales. FPH reported no significant land sales closed escrow in the second quarters of 2017 or 2016.

-

Selling, general, and administrative expenses decreased by $29.6 million, or 51.5%, to $27.9 million for the second quarter 2017, from $57.5 million for the second quarter 2016.

-

FPH acquired a 37.5% percentage interest in Heritage Fields LLC, which is developing Great Park Neighborhoods. For the second quarter 2017, FPH recognized $2.4 million in equity losses from the investment in the Great Park Venture.

-

The consolidated net loss for the quarter was $24.3 million.

Management Team

Chair, CEO and President Emile Haddad has served in his position since May 2016. His previous experience includes senior positions at Lennar Corporation and Bramalea in Canada. Mr. Haddad received a civil engineering degree from the American University of Beirut.

EVP Lynn Jochim has served Five Point Holdings since May 2016. She previously served in positions at Lennar and Ernst & Young. Ms. Jochim received a Bachelor of Science degree in Business from California State University, Sacramento with an emphasis in real estate, land use, and finance.

Competition: Lennar, Irvine Company, Biomed Realty, and Others

Five Point Holdings competes with other commercial, retail, and residential property developers in the California market. These include Lennar (LEN), Irvine Company, Biomed Realty, and other local developers. Morningstar lists the company's peers as China Evergrande Group (OTCPK: EGRNF), Sun Hung Kai (OTCPK: SUHJF), and China Vanke (OTCPK: CHVKF).

|

Market Cap (mil) |

Net Income (mil) |

P/B |

P/E |

|

|

Five Point Holdings |

$838.0 |

($27.0) |

1.7 |

n/a |

|

China Evergrande Group |

$50,292.0 |

$21,908.0 |

3.2 |

15.5 |

|

Sun Hung Kai |

$49,409.0 |

$41,800.0 |

0.8 |

9.3 |

|

China Vanke |

$43,088.0 |

$22,947.0 |

2.2 |

10.9 |

|

Industry Average |

$6,591.0 |

$31,169.0 |

2.0 |

39.9 |

Early Market Performance

Five Point Holdings' IPO priced at $14 per share, well below its expected price range of $18 to $20. The stock closed on the first day of trading at $15.04. Since then, the stock reached a high of $16.45 on May 15 before declining to a low of $13.06 on September 22. Currently, FPH trades between $13 and $13.50.

Conclusion:

We believe that with such a significant number of pre-IPO insiders and shareholders - nine corporate entities and seventeen individuals - at least some of them will want to take their money off the table and invest in other ventures. These sales could flood the market with shares and cause a sharp, short-term downturn.

We recommend that risk-tolerant investors short shares of FPH ahead of the IPO lockup expiration on November 6, 2017. We recommend that investors cover short positions on November 7 and November 8, 2017.

Disclosure: I am/we are short FPH.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more