FireEye Reward/Risk Finally Shifted Positive

FireEye (FEYE) has been a much maligned cybersecurity stock in 2016 with shares down 30% YTD, but seeing signals in the options market that shares are likely bottoming.

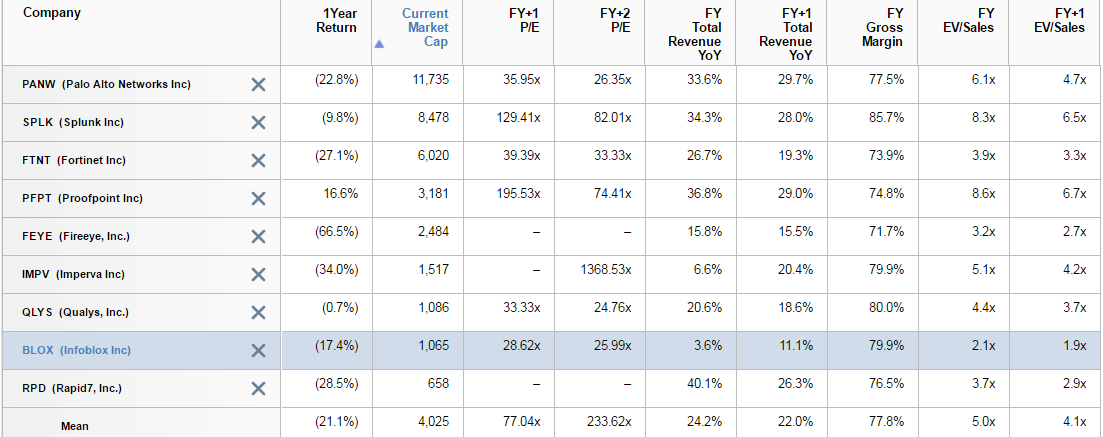

The $2.5B company now trades 3.6X Sales and 2.55X Book with $5.35/share in cash. At 2.7X FY17 EV/Sales, shares are cheap to peers with an average of 4.1X. On a quick side note, Infoblox (BLOX) is also a compelling value at 1.9X and is already exploring a sale, and has seen 2,250 January 2017 $22.50/$17.50 bull risk reversals open. Granted, both FEYE and BLOX are lagging peers in revenue growth, but in FEYE’s case, still targeting 15-20% annual revenue growth the next 3-5 years, and targets EPS profitability in 2019. FEYE is also trailing peers on gross margins. A peer comparison with some other metrics is below:

Analysts have an average target on shares of $18. Wunderlich cut shares to Hold with a $15 target after the latest quarter after billings and revenues missed consensus, and lowered guidance. Wunderlich commented that FEYE is seeing clear issued from shifting dynamics in the security marketplace, combined with internal sales execution issues, and thinks the restructuring and new product releases could reinvigorate the company. Imperial Capital also downgraded to In-Line with a $15 target, and sees some disruption from the organizational changes, but potential to renew growth in FY17. iti also cut to Neutral with an $18 target and did note potential for a takeout. JP Morgan and William Blair also downgraded shares, and sees the stock potentially in a holding pattern for several quarters until the restructuring changes and new products show improvements and renewed confidence in management. OpCo was one of the lone analysts to stay bullish seeing FEYE as a solid takeover candidate, and potential for FEYE’s cloud-based MVX engine, keeping an Outperform rating and lowering the target to $33.

In June, Bloomberg reported the FYE rebuffed multiple takeover proposals earlier this year after hiring Morgan Stanley to field interest. It turned down offers that were below the $30+/share it expected. One of those potential buyers was Symantec (SYMC) who turned its efforts to Blue Coat Systems.

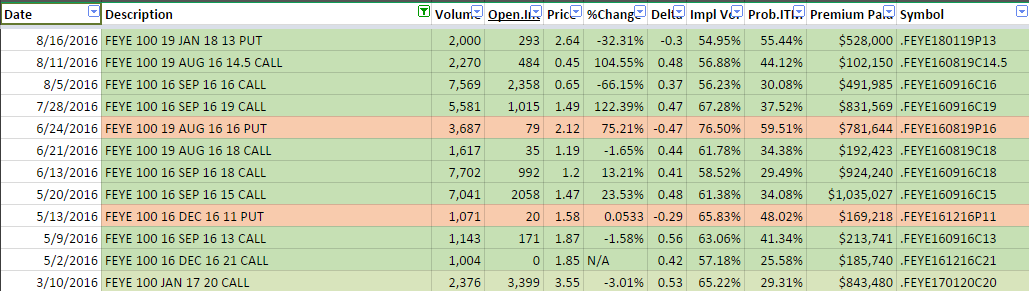

In the options market, a notable “calling a bottom” trade took place on 8/16 when a trader sold 2,000 January 2018 $13 puts to open in a $500,000+ trade, willing to buy 200,000 shares at $13, but the intention for shares to remain above that level longer term. FEYE’s September IV Skew is also showing inversion, signaling the options market sees more “risk” to an upside move, than to a downside one. Some other trade details are below with September a popular month holding a lot of call open interest:

From a technical perspective, FEYE shares appear to be putting in a third higher low, and weekly RSI also trending upwards, while a weekly RSI break above 50 is a nice buy signal for market timers. The price by volume view shows a move above $18.90 frees shares into a large volume pocket with upside to $26.

In conclusion, sentiment in FEYE has turned very negative with most sell-side analysts throwing in the towel, yet valuation has finally become compelling and the longer term growth opportunity remains. It’s attractiveness as a buyout target also is clear as most of its issues are with its management and salesforce, and a strategic buyer could expand its offerings and provide a larger distribution network. In terms of strategy, the September $15 calls at $0.70 are cheap as a more speculative trade, while a January 2017 $15/$12 bull risk reversal at a $1 debit is another way to trade it.

Not Investment Advice or Recommendation Any descriptions "to buy", "to sell", "long", "short" or any other trade related terminology should not be seen as a ...

more