Finding Bargains Among S&P 500 Stocks

The S&P 500 index suffered a significant decline last October; from its 52-week high of 2939.86 on October 3, it dropped 11.44% to as low as 2603.54 on October 29. However, it has recuperated 6.82% since then to close on November 9 at 2781.01. Nevertheless, 70 companies among the S&P 500 index components have seen their stocks dropping more than 30% from their 52-week highs.

Some of these declines can be justified by deteriorating performance of these companies. However, some of the share price drops have been exaggerated and have been a result of companies temporarily becoming out of favor with investors without a real reason for such a decline. Among these companies, we can find some big bargains with a good chance of a significant price appreciation when the market recovers.

The table below presents the 30 companies among the S&P 500 index components that have shown the highest decline from their 52-week high, their market cap, their sector and the drop from their 52-week high to November 9 close price.

Source: Portfolio123

The highest number of companies have been from the Consumer Discretionary and the Information Technology sectors, with six companies from each one; four stocks have been from the Industrials and the Health Care sectors, three companies from the Financials and the Energy sectors, two stocks from the Communication Services sector, and one company from the Materials and Consumer Staples sectors.

Applied Materials

Shares of Applied Materials (AMAT), the worldwide largest manufacturer of semiconductor equipment, have fallen 45.1% from their 52-week high of $62.40 on March 12. In my opinion, this drop is entirely exaggerated. AMAT's fundamentals are excellent, and its valuation metrics are extremely low. In fact, its shares are traded now at a trailing twelve months price to earnings ratio of as low as 7.95, forward price to earnings ratio of 8.38, and its price to earnings to growth ratio (PEG) is very low at 0.59.

What's more, AMAT's Enterprise Value/EBITDA ratio is also very low at 6.47. According to James P. O'Shaughnessy, the Enterprise Value/EBITDA ratio is the best-performing single value factor. In his impressive book "What Works on Wall Street," Mr. O'Shaughnessy demonstrates that 46 years backtesting, from 1963 to 2009, have shown that companies with the lowest EV/EBITDA ratio have given the best return.

Moreover, AMAT generates strong free cash flow and returns substantial capital to its shareholders by stock buybacks and dividend payments. In February 2018, the company announced a $6 billion increase in its share repurchase authorization. In the last four quarters, AMAT repurchased 92 million shares or 9% of its outstanding shares. At the same time, it doubled the quarterly dividend to $0.20 per share. The current annual yield is at 2.33%, and the payout ratio is only 15%.

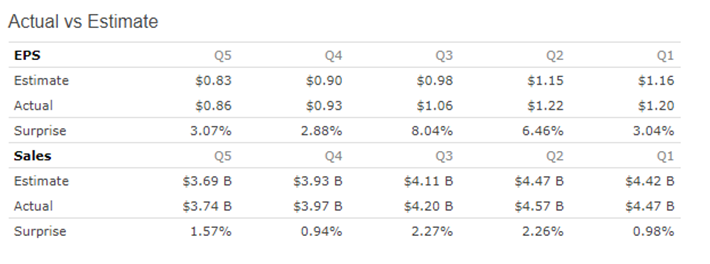

Applied Materials is scheduled to report its fourth-quarter fiscal 2018 financial results on Thursday, November 15, after market close. According to 20 analysts' average estimate, AMAT is expected to post a profit of $0.97 a share, a 4.3% increase from its actual earnings for the same quarter a year ago. The highest estimate is for a profit of $1.00 a share while the lowest is for a profit of $0.96 a share, not a big difference. Revenue for the quarter is expected to increase 0.8% year over year to $4.0 billion, according to 18 analysts' average estimate. There were two upward earnings per share revisions during the last 30 days. Since AMAT has shown earnings per share surprise in all its previous five quarters, as shown in the table below, there is a good chance that the company will beat estimates also in its fourth-quarter fiscal 2018 quarter.

Source: Portfolio123

Summary

The recent declines on the U.S. stock market have created an excellent opportunity to find some big bargains among S&P 500 stocks with a good chance of a significant price appreciation when the market starts to rally again. Among these companies, I find Applied Materials' stock as extremely undervalued with a high probability to bring a nice return to stockholders. According to TipRanks, the average target price of the top analysts is at $52.67, an upside of 53.65% from its November 9 close price, however, in my opinion, shares could go even higher.

I am long AMAT.

I have no business relationship in any stock or company mentioned in this article. This article is intended for informational and entertainment use only, and should not be ...

more