Featured Stocks In December’s Dividend Growth Model Portfolio

This report highlights last month’s top performers and features a stock from the current portfolio.

Recap from November’s Picks

Our Dividend Growth Stocks Model Portfolio outperformed the S&P 500 in November. The Model Portfolio rose 2.0% on a price return basis and rose 2.3% on a total return basis. The S&P 500 rose 1.7% on both a price and total return basis. The portfolio’s best performing stock was Discover Financial Services (DFS), which was up 12%. Overall, 17 out of the 30 Dividend Growth Stocks outperformed the S&P last month, and 23 had positive returns.

The long-term success of our model portfolio strategies highlights the value of our Robo-Analyst technology, which scales our forensic accounting expertise (featured in Barron’s) across thousands of stocks.

The methodology for this model portfolio mimics an All-Cap Blend style with a focus on dividend growth. Selected stocks earn an Attractive or Very Attractive rating, generate positive free cash flow (FCF) and economic earnings, offer a current dividend yield >1%, and have a 5+ year track record of consecutive dividend growth. This model portfolio is designed for investors who are more focused on long-term capital appreciation than current income, but still appreciate the power of dividends, especially growing dividends.

Featured Stock from December: Amgen Inc.

Amgen Inc. (AMGN), hybrid biotech and pharmaceuticals firm, is the featured stock from December’s Dividend Growth Stocks Model Portfolio. AMGN was a featured Long Idea in May 2017 and also earns a spot on the Focus List – Long and Most Attractive Stocks Model Portfolios.

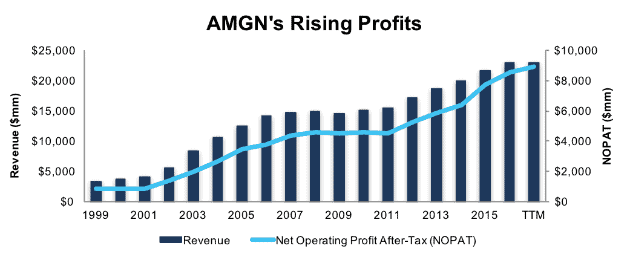

Over the past decade, AMGN’s revenue has grown by 5% compounded annually while after-tax profits (NOPAT) have grown by 8% compounded annually, per Figure 1. AMGN’s NOPAT margin has improved from 27% in 2006 to 39% over the last twelve months. In addition to NOPAT growth, AMGN’s return on invested capital (ROIC) has improved from 15% in 2006 to a top-quintile 22% TTM.

Figure 1: AMGN’s Revenue & NOPAT Growth Since 1999

Sources: New Constructs, LLC and company filings

Steady Dividend Growth Supported by FCF

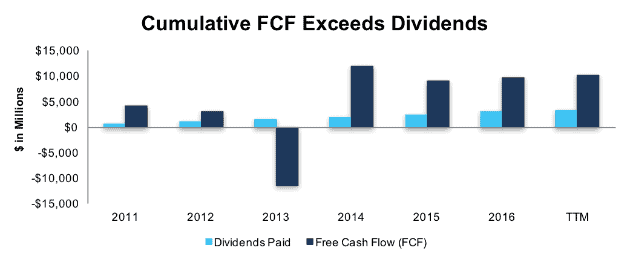

AMGN has increased its regular dividend each year since 2011. The current annualized dividend has grown from $0.56/share in 2011 to $4.60/share in 2017, or 42% compounded annually. Growing free cash flow (FCF) has fueled dividend growth in the past, and we expect the same for the future. Despite spending $9.5 billion on Onyx Pharmaceuticals in 2013, AMGN generated cumulative FCF of $26.4 billion (21% of current market cap) from 2011-2016. Over the same time, the company paid out cumulative dividends of $10.3 billion. Over the last twelve months, AMGN generated $10 billion in FCF and paid out $3.3 billion in dividends.

Companies with FCF well in excess of dividend payments provide higher quality dividend growth opportunities because we know the firm generates the cash to support the current dividend as well as a higher dividend. On the flip side, the dividend growth trajectory of a company where FCF falls short of the dividend payments over time cannot be trusted to grow or sustain its dividend because of inadequate free cash flow.

Figure 2: Free Cash Flow (FCF) vs. Regular Dividend Payments

Sources: New Constructs, LLC and company filings

AMGN Remains Undervalued

AMGN rose 15% in 2017, which underperformed the S&P 500 (up 19%). Currently near $178/share, AMGN has a price-to-economic book value (PEBV) ratio of 1.0. This ratio means the market expects AMGN’s NOPAT to never meaningfully grow from current levels. This expectation seems rather pessimistic for a firm that has grown NOPAT by 15% compounded annually since 1998.

If AMGN can maintain current NOPAT margins (39% TTM) and grow NOPAT by 3% compounded annually over the next decade, the stock is worth $211/share today – a 20% upside. Add in Amgen’s 2.6% dividend yield and history of dividend growth, and it’s clear why this stock is in December’s Dividend Growth Stocks Model Portfolio.

Auditable Impact of Footnotes & Forensic Accounting Adjustments

Our Robo-Analyst technology enables us to perform forensic accounting with scale and provide theresearch needed to fulfill fiduciary duties. In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Amgen’s 2016 10-K:

Income Statement: we made $2.1 billion of adjustments with a net effect of removing $813 million in non-operating expense (4% of revenue). We removed $1.4 billion related to non-operating expenses and $629 million related to non-operating income. See all adjustments made to AMGN’s income statement here.

Balance Sheet: we made $49.8 billion of adjustments to calculate invested capital with a net decrease of $26.3 billion. Apart from excess cash, the most notable adjustment was $5.4 billion (8% of reported net assets) related to asset write-downs. See all adjustments to AMGN’s balance sheethere.

Valuation: we made $82.4 billion of adjustments with a net effect of decreasing shareholder value by $598 million. The largest adjustment to shareholder value was $40.9 billion in excess cash. This cash adjustment represents 32% of AMGN’s market value. Despite the net decrease in shareholder value, AMGN remains undervalued.