Falling Taxes And Valuations Boost Energy Infrastructure Outlook

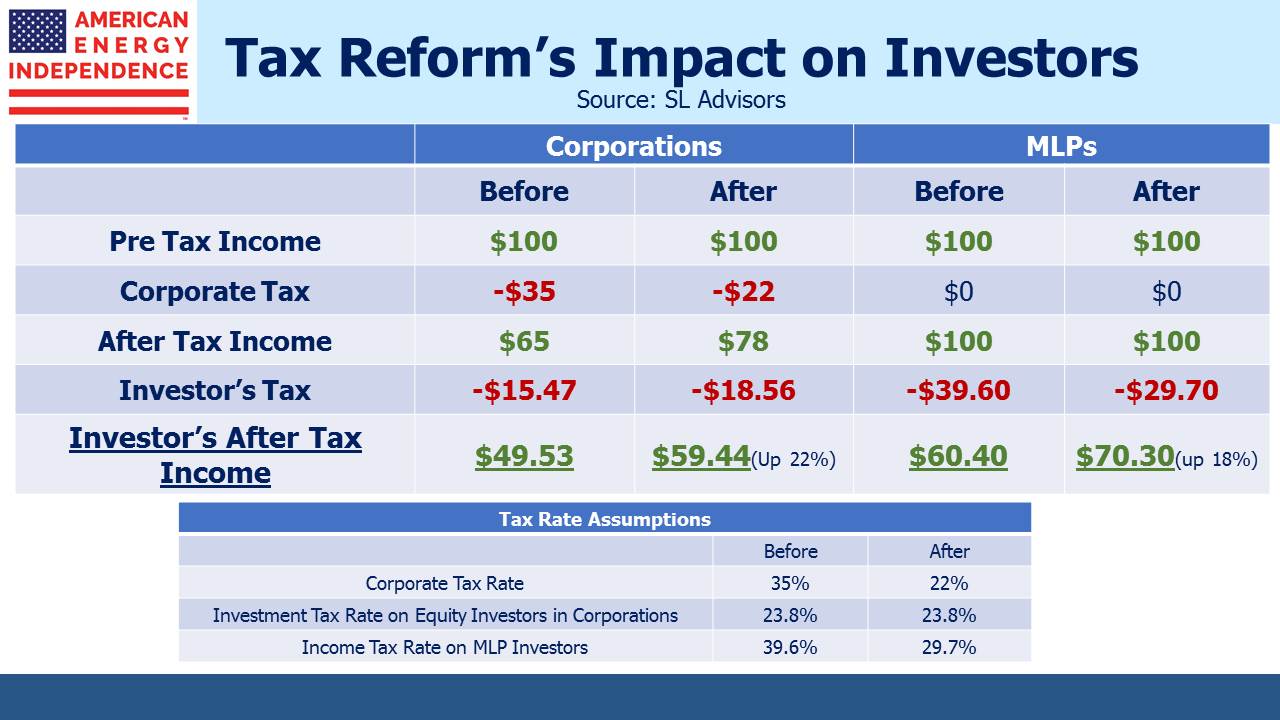

Tax reform removed the uncertainty surrounding treatment of MLPs, in that both House and Senate plans provide some additional benefit. Although the final bill will require negotiations to reconcile the different Senate and House versions, we’ve updated the table below to reflect a 22% corporate tax rate and the Senate treatment of pass-through income for MLP investors, which is less attractive than the House. Investors in both C-corps and MLPs will be better off, and if the House’s pass-through treatment prevails MLP investors will benefit further.

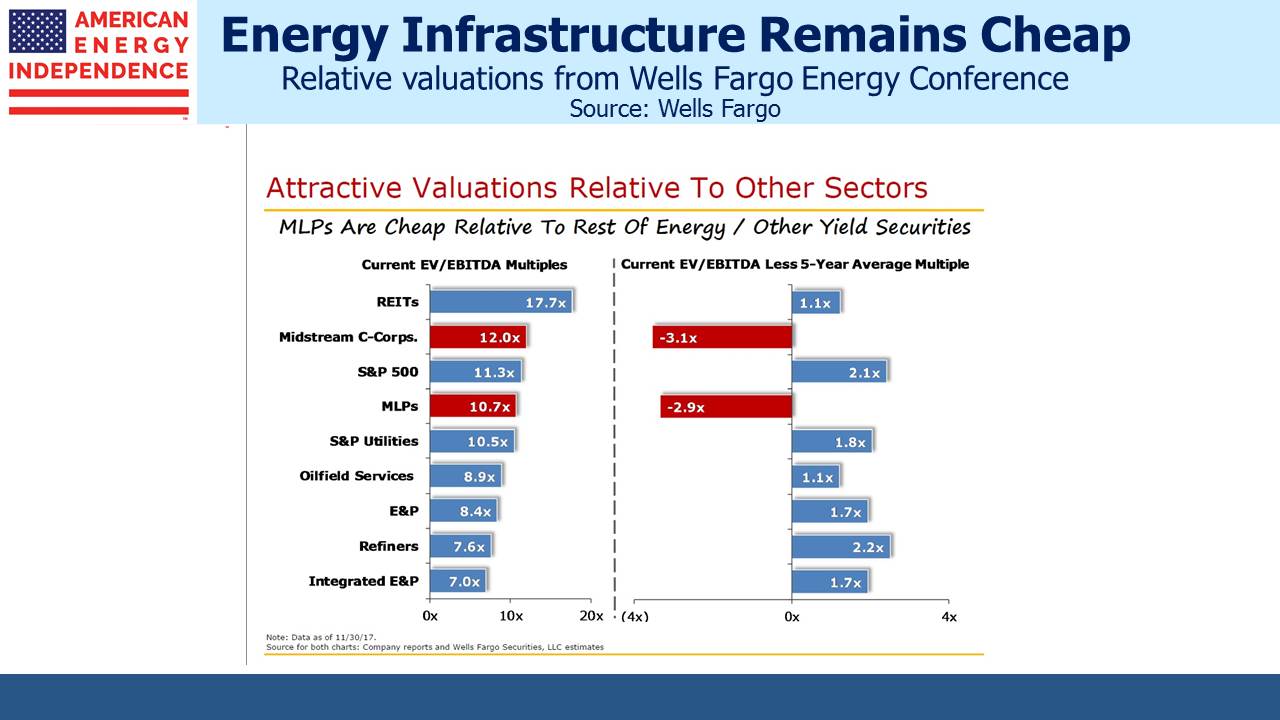

The 2017 Wells Fargo Pipeline and Utility Symposium held last week included the slide below. Energy infrastructure investors need little reminder – 2017 is turning out to be a forgettable year, which has reduced valuations to the levels shown in the chart. Tax loss selling continues, since most investors have substantial investment gains and unloading some energy losers mitigates the tax bill. There’s little other justification for such moves.

People often associate breakthroughs in energy research with electric vehicles (EVs) and use of renewables to provide power. But traditional energy businesses are also the subject of considerable research and development. NET Power, based in Houston, TX, has built a pilot power plant that uses natural gas but captures the resulting CO2. They claim to have built a zero-emission natural gas power plant. Investors have provided $150MM to develop the business. It’s obviously early, but if the technology turns out to be successful on a large scale, given the abundance of natural gas in the U.S., it could be a significant solution to fossil-fuel based carbon emissions. It could even provide a legitimate clean energy alternative to windmills and solar panels. It would represent yet another dimension to the benefits to America of the Shale Revolution. New technology is often exciting, and interesting energy research isn’t limited to wind and solar.

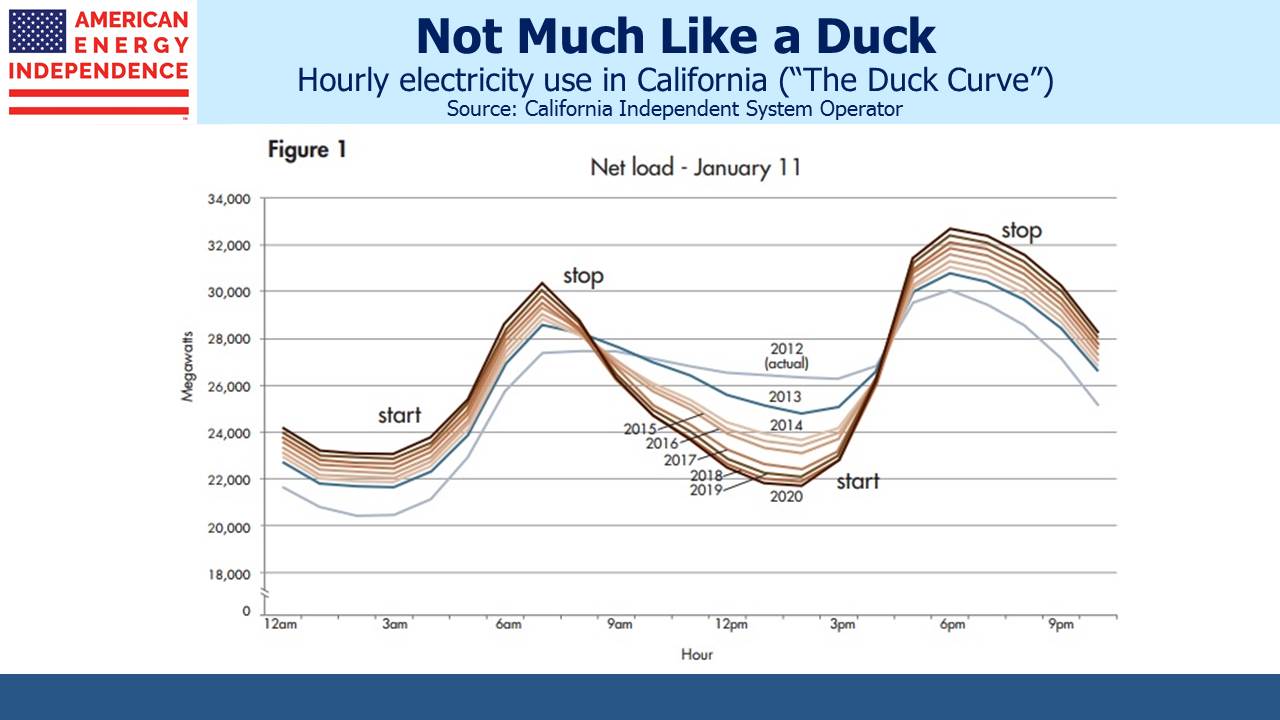

The “Duck Curve” represents the demand for electricity during a typical day. The version from California’s Independent System Operator (ISO) highlights that peak electricity demand occurs at breakfast time when people are getting ready for work or school, and at dinner time when they return home. Although solar-generated electricity is growing, it’s worth noting that demand is highest when the sun is low in the sky or it’s dark. Therefore, traditional power plants such as natural gas are critical to providing power when it’s most needed. A speaker at a recent conference organized by R.W. Baird noted the potential problem this presents for the green credentials of EV owners, in that the obvious time to charge them is in the evening when renewables are less likely to be the source of electricity.

Regular readers will not expect us to be bullish on Bitcoin. Its recent take-off has been spectacular to watch, rather like a rocket that will inevitably crash even while its ascent is riveting. We’re reaching the stage where comparative valuations are startling: on Wednesday aggregate crypto-currency valuationexceeded the market capitalization of JPMorgan for example. CEO Jamie Dimon has called Bitcoin a fraud. You could own all the bitcoins that exist, or approximately half the publicly held energy infrastructure in the U.S. The correct choice isn’t obvious to everyone. The CME and CBOE’s proposed Bitcoin futures contracts must be the strongest evidence yet that parts of the U.S. finance industry have completely lost the plot, oblivious to their ostensible role of helping savers fund retirement in favor of creating gambling products.

What receives less attention than Bitcoin’s price is the energy consumed to “mine” new units. The computing power required to solve the increasingly complex algorithms that allow cryptocurrency units to be manufactured now consumes 29 Terrawatt Hours of electricity annually. This is more than the consumption of 159 countries. One analyst estimates that this costs $1.5BN, based on using cheap electricity in places such as China. Using recent growth rates, by next Summer crypto-currency production will consume the equivalent of America’s electricity output, and by 2020 the entire world’s. Somewhere, something will give. We’ll be spectators.

Disclosure: None.