Emergency Vehicle Manufacturer, REV Group, Looks Strong Ahead Of IPO

Summary

REV Group (NYSE: REVG) is expected to IPO on Friday (1/27/2016) and raise $250M through the offer of 12.5M shares at an expected price range of $19 to $21. At the proposed mid-point, REV Group would command a market cap value of $1.27 billion.

Underwriters for the IPO include: Goldman Sachs, Morgan Stanley, Baird, BMO Capital Markets, Credit Suisse, Deutsche Bank, Jefferies, Wells Fargo Securities, and Stifel.

As with the other major IPOs this week, we previewed this deal on our IPO Insights platform.

The deal is current oversubscribed.

Business Overview

REV Group is a leading designer, manufacturer, and distributor for emergency and specialty vehicles sold throughout the US. The company sells products for: essential needs (i.e. ambulances and school buses), industrial and commercial (i.e. street sweepers) and consumer leisure (i.e. recreational vehicles and luxury buses). Its products are sold to: municipalities, government agencies, private contractors, consumers and industrial and commercial end users. The company has grown through acquisitions of complementary vehicle lines and since its founding in 2010 has fully integrated nine acquisitions.

We previewed this deal on our IPO Insights platform.

(Source)

Executive Management Highlights

Tim Sullivan has served as CEO and director of REV Group since August 2014. Prior to joining the company, Sullivan was Chairman and Chief Executive Officer of Gardner Denver, Inc. (2013 to 2014) and the Chairman and Chief Executive Officer of Bucyrus International, Inc., (2000 to 2011). Mr. Sullivan holds a bachelor of science degree in business administration from Carroll University and a master of business administration degree from Arizona State University's Thunderbird School of International Management.

Dean Nolden has served as Chief Financial Officer of REV Group since January 2016. Previously he held numerous executive positions at the Manitowoc Company, Inc. (1998-2016). Nolden earned a bachelor of business administration from the University of Wisconsin-Madison and a master of business administration from Marquette University.

Financial Performance

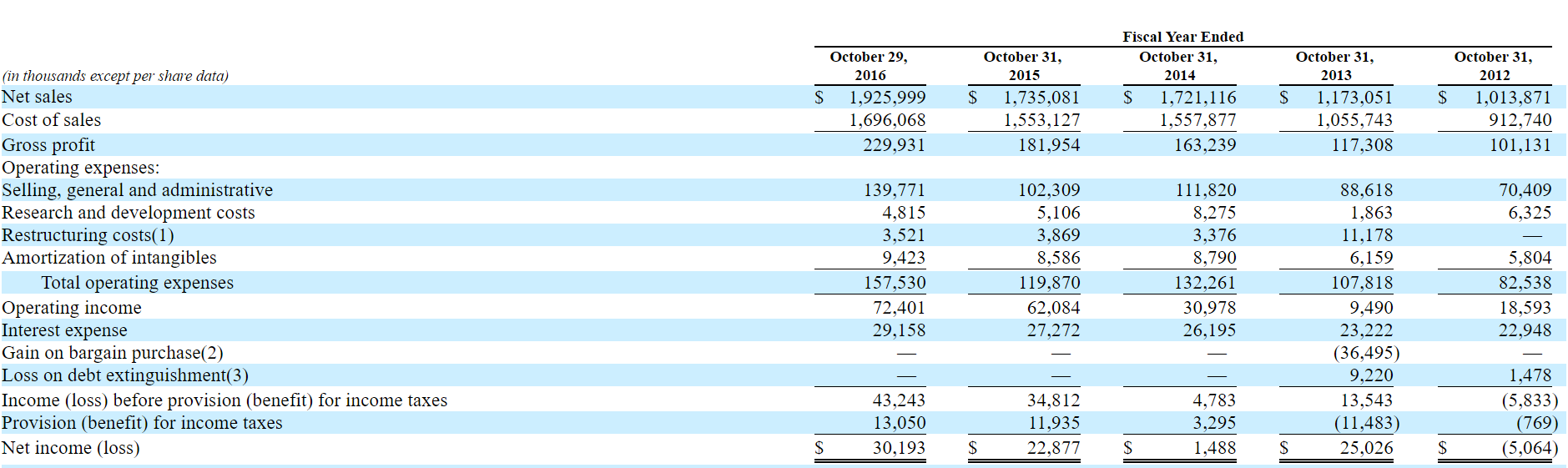

REV Group's has steadily grown revenue from $1.72B, $1.74B, and $1.93B million for fiscal year 2014, 2015, and 2016, respectively, representing a CAGR of 3.8%. At the same time, the company has improved operating performance and grown net income. Net income grew from $1.5 million in 2014 to $23 million in 2015, and $30 million in 2016, representing a CAGR of 173%. Between 2014 to 2016, REV Group grew adjusted net income at a CAGR of 56% and adjusted EBITDA at a CAGR of 27%.

(Click on image to enlarge)

(Source)

The specialty vehicle market is estimated at $11B, of which REV Group market size is ~$2B billion. According to REV Group, there has been a demand deficit with the past few years as state governments and municipalities have reduced budgets in the wake of the financial crisis, however it expects demand to increase due to improving economic conditions.

As of June 30, 2016 REV Group had total liabilities of $683 million and $17.2 million in cash.

Competition

Top competitors in the specialty vehicle market include: Navistar International (NYSE:NAV), Winnebago (NYSE:WGO), Thor Industries (NYSE:THO), and Oshkosh (NYSE:OSK). At an estimated price/sales multiple of (0.69x), REV would trade at a lower price/sales multiple than WGO (0.88x), THO (1.14x) and OSK (0.83x) and a higher price/sales multiple of NAV (0.28x).

|

TKR |

Market Cap |

Price/Sales |

|

REV |

1.27B |

0.69x |

|

NAV |

2.15B |

0.28x |

|

WGO |

$995.28M |

0.88x |

|

THO |

5.11B |

1.14x |

|

OSK |

5.23B |

0.83x |

(Source: GoogleFinance)

Conclusion: Consider Buying In

REV Group is growing revenue and has made tremendous improvement in its operating performance resulting in improved profit margins, including a CAGR of 173% in net income between 2014 and 2016.

At its current valuation, we are enthusiastic about this IPO and recommend investors consider purchasing a modest allocation.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in REVG over the next 72 hours.

more