Either GE Or Its Dividend, And Possibly Both, Are Set To Shrink

On Friday, 8 June 2018, General Electric (NYSE: GE) took a pass on cutting its dividend, as the company declared that it would sustain its current quarterly cash payouts to the company's shareholders at its current level of 12 cents per share.

In taking that action, GE's CEO John Flannery surprised the market by not taking the opportunity of cutting the company's dividends now, after having primed investors to expect such a move last month.

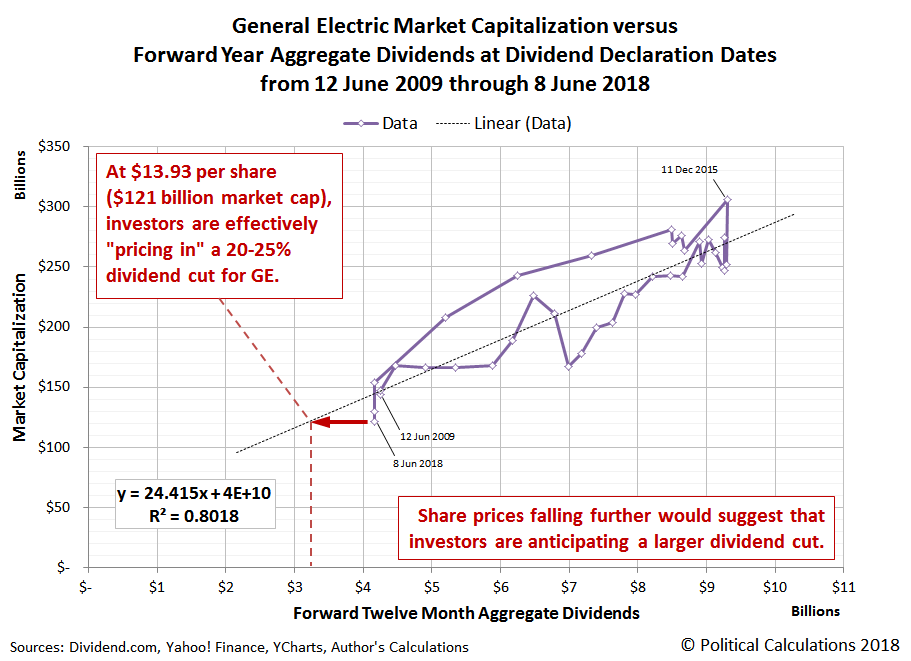

Not that investors aren't still expecting GE to cut its dividend. Although they breathed a sigh of relief and boosted GE's share price by 1% above its previous day's close at $13.93 per share, GE's market capitalization of $121 billion is consistent with investors still anticipating a 20-25% dividend cut in the future.

Alternatively, the chart above suggests that if GE can avoid cutting its dividend, its stock price is likely to rise from its current level.

That GE is still likely to cut its dividend in the future is underscored by recent bearish analysis by JP Morgan Stephen Tusa, who argues that "the bottom line is that we see the need to de-risk substantially, which includes the need for cash and a cut to the dividend to help with operational de-levering." Overall, Tusa sees GE needing some $30 billion in cash to pay down its corporate debt to more sustainable levels to avoid having its corporate credit rating cut.

If GE were to eliminate its dividend entirely, it would free up some $4 billion in cash annually to meet that need, where GE would have to continue selling off its assets to reduce its liabilities by the full $30 billion target identified by Tusa. Selling its stake in oilfield services firm Baker Hughes could raise $25 billion, where the remainder could be accomplished by the sales of other, smaller assets that the company is already in the process of selling.

No matter what, General Electric is set to become a very different, and smaller, company from what it has been. Either GE or its dividend, and quite possibly both, are still set to continue shrinking.

Data Sources

Dividend.com. General Electric Dividend Payout History. [Online Database]. Accessed 9 June 2018.

Yahoo! Finance. General Electric Company Historical Prices. [Online Database]. Accessed 9 June 2018.

Ycharts. General Electric Market Cap. [Online Database]. Accessed 9 June 2018.

Disclaimer: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more

@[Ironman](user:29175),I believe this article is misleading. If you look at a recent transcript, Flannery never primed investors, this was taken out of context,. It amounts to conjecture, but stated as fact.

Thanks for your comments. We're expressing our own takeaway from Flannery's earlier comments. I would agree that Flannery did not intend to set that expectation, but since investors reacted the way they did to those remarks, it would appear that we weren't alone in having that impression.

From a practical management standpoint, if a dividend cut was being considered for the immediate future, GE could have followed through with announcing it in June, where we think that the impact to its stock price would have been minimal because the expectation of a dividend cut among investors had already effectively lowered the stock price. In other words, the expectation was built in. And, to a certain extent, it still is.

If GE does ultimately follow through and announce another dividend cut later, we would describe the June meeting as a missed opportunity for GE's leadership to get the negative impact behind them earlier. That said, I hope the company's business outlook stabilizes and it doesn't have to come to that - we would much rather analyze the company's successful turnaround!

Thanks for sharing