Earnings Preview: Hotels Reporting This Week (H, HOT, MGM)

Changing trends and preferences over the past 5 years has put the hotel industry in the hot seat while giving the consumer more options. Companies like Expedia and Priceline provide thorough price comparisons across the whole industry to help consumers make more informed choices, while Airbnb bypasses hotels all together, providing alternative lodging arrangements. Regardless, many of these trends have left hotel companies vulnerable to inventory accumulation and deep discounts. However, early indications this earnings season suggest those trends might be beginning to turnaround. Last week we got strong earnings from Marriott and Expedia, suggesting that hotel demand is gaining traction. This week we get results from Hyatt, Starwood and MGM and perhaps a clearer picture of where the hotel industry is headed.

Hyatt Hotels Corporation (H)

Consumer Discretionary - Hotels, Restaurants & Leisure | Reports May 3, Before Market Opens

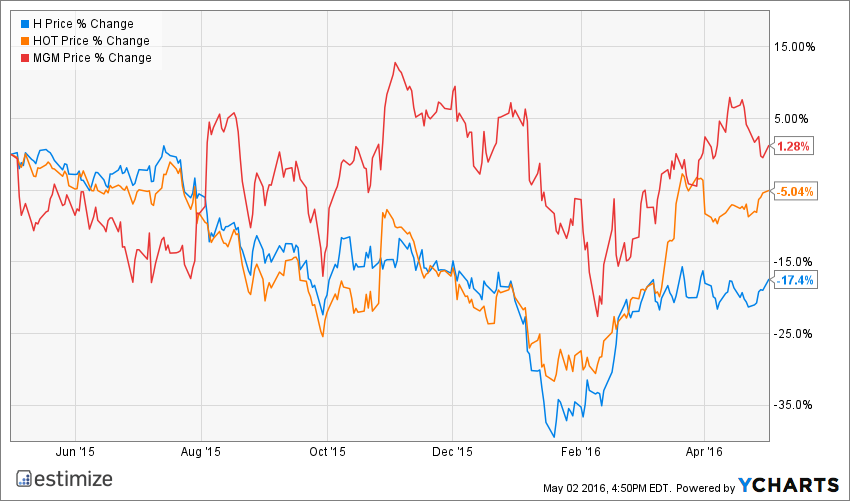

The Estimize consensus is calling for earnings per share of a quarter on $1.09 billion in revenue, 1 cent higher than Wall Street on the bottom line and $6 million on top. Compared to a year earlier, profits are forecasted to rise 122% with revenue increasing a meager 3%. On average, the stock comes into earnings season with positive momentum and tails off soon thereafter. Investors are looking for anything to spark share prices which are down 17.4% from a year earlier.

What to Watch: Hyatt is coming off a mixed fourth quarter in which it topped revenue expectations but fell short on profitability. Much of this dichotomy was due to strength in the U.S. markets and weakness globally. Domestic markets saw key metrics like RevPAR (revenue per available room) increase across all reporting segments. RevPAR for full services domestic hotels increased 4.2%, group room revenue increased 8.3% and select service hotels increased 6.4%. Hyatt also added nine new hotels to its portfolio across a number of major cities in the United States. On the other hand, Hyatt fared far worse in international markets primarily driven by unfavorable exchange rates and the continued slowdown in China. The hotel company saw double digit declines in Europe, Africa and Middle East segments with Asia Pacific segments declining nearly 5%. Unfortunately, many of Hyatt’s past problems will continue to pose a threat this quarter.

Starwood Hotels & Resorts Worldwide (HOT) Consumer Discretionary - Hotels, Restaurants & Leisure | Reports May 3, Before Market Opens

The Estimize community is looking for earnings per share of $0.61 on $1.35 billion in revenue, 3 cents higher than Wall Street on the bottom line and $6 million in sales. Compared to a year earlier, profits are expected to fall 6% with sales falling as much as 4%. Luckily, the stock doesn’t move much leading up and through earnings seasons so a slightly disappointing earnings shouldn’t be a setback.

What to Watch: The biggest news this quarter has been the back and forth negotiations between Starwood and Marriott. After all the hoopla, it would seem as if Starwood is going to be bought by Marriott instead of China’s Anbang that had placed a bid. The deal should benefit companies and consumers with substantial synergies. Meanwhile, more than half of Starwood’s properties are located outside the U.S. which significantly exposes them to exchange rate fluctuations and weakness in China. Last quarter, Starwood saw RevPar increase in North American locations but decline over 5% in all of its international segments. Nevertheless, earnings are expected to improve in North America moving forward while volatility abroad persists.

MGM Resorts International (MGM) Consumer Discretionary - Hotels, Restaurants & Leisure | Reports May 3, Before Market Opens

The Estimize consensus is looking for EPS of $0.13 on revenue of $2.29 billion, right in line with Wall Street on the bottom and nearly $20 million below on the top. Earnings per share estimates have dropped 17% since its last report and contribute to a forecasted 55% decline in profitability. Despite steadily declining earnings and a big miss last quarter, the stock has remained unscathed.

What to Watch: All eyes will be on casino performance in Las Vegas and Macau when MGM reports this week. The company is expecting steadily improving demand at its properties in Las Vegas to offset sluggish growth in Macau. Last quarter saw room revenue from Las Vegas increase 10% with a 12% increase in RevPAR while MGM China witnessed a decrease of 31% and 29%, respectively. The Chinese government’s focus on boosting tourism in the region may provide some relief from the ongoing decline in traffic and revenue. On the other hand, MGM Las Vegas is expected to continue to grow over the long term, driven by a strong event calendar and several successful investments on the Strip. MGM is also poised to spin off its properties to create a REIT to strengthen its balance sheet. The REIT will initially hold nine MGM resorts, 6 of them in Las Vegas, which could raise as much as $1.2 billion at a $18 to $21 price range. Overall, strong performances from Las Vegas, non gaming sectors and a lucrative REIT spinoff should be enough to weather MGM’s losses from Macau.

Photo Credit: Herry Lawford

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.