Dova Pharmaceuticals: A Different Business Model Could Lead To Success

Dova Pharmaceuticals Inc. (Pending:DOVA) expects to raise $58.6 million in its upcoming IPO ($67.6 million if the underwriters exercise their option to purchase additional shares). If the underwriters price the IPO at the midpoint of the price range, DOVA will have a market capitalization of $404 million.

We previewed this deal on our IPO Insights platform.

DOVA filed for the IPO on June 2, 2017.

IPO Underwriters: J.P. Morgan Securities, Jeffries LLC, and Leerink Partners

Business Summary: Pharmaceutical Company Developing Treatment for Thrombocytopenia

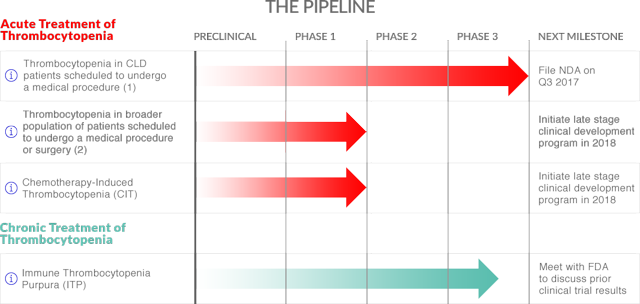

Dova Pharmaceuticals focuses on acquiring, developing, and marketing treatments for thrombocytopenia, a disorder characterized by a low blood platelet count. Its major drug candidate, avatrombopag, is an orally administered thrombopoietin receptor agonist. Dova has completed Phase III clinical trials for the treatment of thrombocytopenia in individuals with chronic liver disease.

(Click on image to enlarge)

(Source: Company Website)

Dova Pharmaceuticals acquired avatrombopag from Eisai, Inc. in March 2016. The treatment had met the primary and secondary endpoints in its clinical trials with a high statistical significance. Dova plans to submit a new drug application to the FDA in the third quarter of 2017.

The company was founded in 2016 and is based in Durham, North Carolina.

Use of Proceeds And Highlights From Management's Analysis

Dova Pharmaceuticals owns the global rights to avatrombopag. The company intends to build a sales force in the United States that targets the approximately 850 hepatologists, most of whom work at one of 150 domestic liver transplant centers. Dova notes that it may pursue third-party relationships to market the drug outside the States.

Dova has funded its operations primarily through capital contributions from PBM Capital Investments and some of its affiliates. Since its launch, Dova has incurred significant operating losses. As of March 31, 2017, the company had an accumulated deficit of $32.6 million, which is expected to grow as the company pursues other clinical, research, manufacturing, and marketing activities. From March 24, 2016 to December 31, 2016 and for the three months ended March 31, 2017, Dova incurred net losses of $27.2 million and $5.4 million.

Large Competitors: Bristol-Myers Squibb, Shire PLC, and Others

Dova faces competition to avatrombopag from companies developing similar treatments, including Protalex (OTCQB:PRTX), Immunomedics (IMMU), Shire PLC (SHPG), Bristol-Myers Squibb (BMY), argenx (ARGX), and Rigel Pharmaceuticals (RIGL).

Executive Management Highlights

President and CEO Alex Sapir has served Dova since January 2017. His previous experience includes senior positions at United Therapeutics Corporation, Guilford Pharmaceuticals, and GlaxoSmithKline. Mr. Sapir holds a B.A. in Economics from Franklin and Marshall College and an M.B.A. from Harvard Business School.

CFO Douglas Blankenship has served in his position since March 2017. His previous experience comes from senior positions at Genentech, Roche Pharmaceuticals, and Amgen Technology Ireland. Mr. Blankenship holds a B.S. in Accounting from California Polytechnic State University, San Luis Obispo and an M.B.A. from The Wharton School, University of Pennsylvania.

Conclusion: Consider An IPO Allocation

While Dova is still running a deficit, the young company has already completed two Phase 3 clinical trials. Based on these results, a NDA is planned for submission to the FDA in Q3 2017.

Dova's model of acquiring, as well as internally developing, product candidates could set the company apart from competitors.

We are also impressed by company management.

Overall we are encouraged by the company's progress and suggest investors consider a modest investment.

Author's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in DOVA over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more