Dorsey’s Duo Giving FAANG A Run

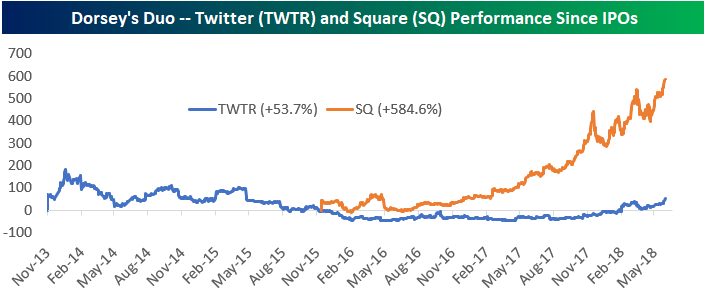

Last October we published a post titled “Dorsey’s Duo Not Doing So Bad.” At the time, Twitter (TWTR) CEO Jack Dorsey was taking heat because the stock was down 30% from its IPO price. But payment-processing company Square (SQ) — the other company Jack Dorsey runs — was on fire. While TWTR was down 30%, Square (SQ) was up 263%.

Fast forward eight months to today — shares of Square have nearly doubled since last October (they’ve gone from $32 to $61), while Twitter (TWTR) is up 122%.

As shown below, TWTR shares are now up 53.7% from their IPO price, while SQ shares are up 584.6%.

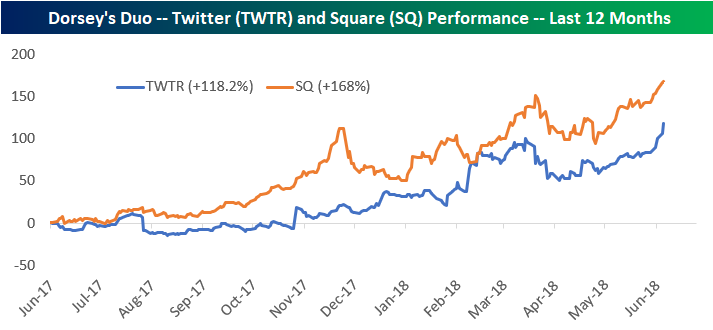

Over the last year, TWTR is now up 118.2%, while SQ is up 168%:

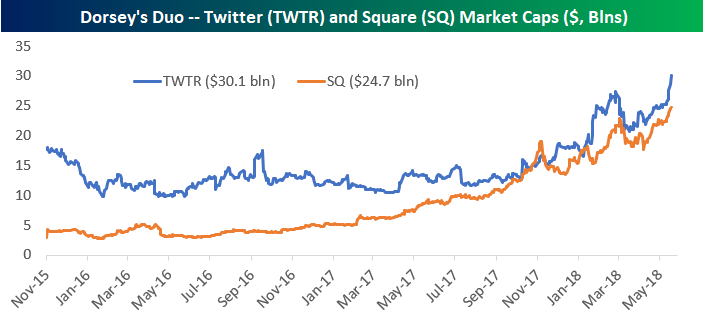

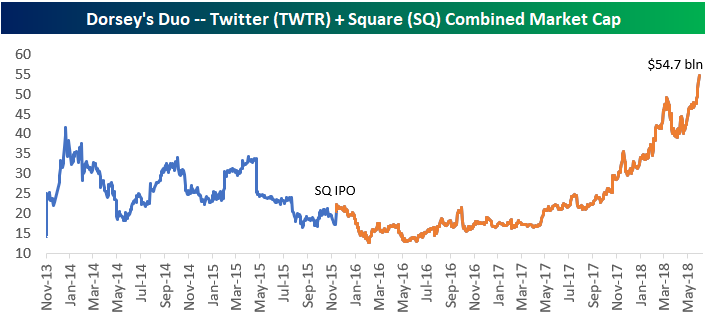

Looking at market caps, as of this morning when TWTR traded up to $40 on news that it was being added to the S&P 500, the company was worth $30.1 billion.Square (SQ) is not too far behind at $24.7 billion.

On a combined basis, “Dorsey’s Duo” of TWTR and SQ are now worth $54.7 billion.A year ago they were worth less than $20 billion.

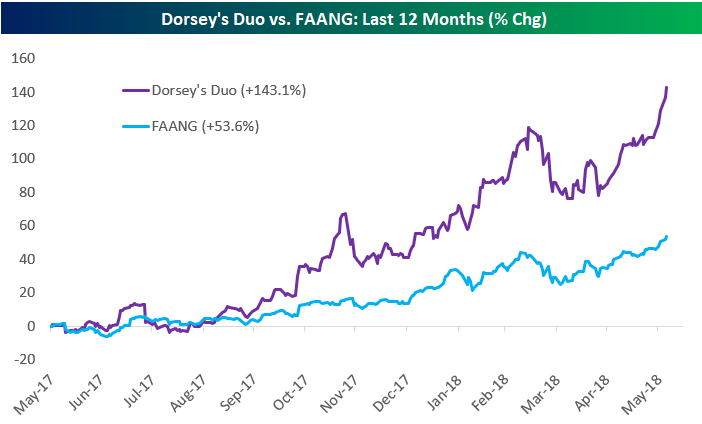

The “FAANG” stocks have the fun acronym, but Dorsey’s Duo of TWTR and SQ are actually performing better.SQ is up more than any FAANG stock over the last year, while TWTR is ahead of all the FAANG stocks except NFLX, which is up 126% vs. TWTR’s gain of 118%.

Looking at TWTR and SQ vs. the portfolio of five FAANG stocks, the 12-month change is not even close. Dorsey’s Duo is up 143%, while FAANG is up 53.6%.

How quickly things can change.Jack Dorsey was being heavily criticized for trying to run two companies at once last year at this time. Now? Crickets.