Don’t Get Caught When This Bubble Bursts

The market has performed impressively recently given the sovereign challenges in Greece, Puerto Rico, and Ukraine that dominate the headlines; not to mention the recent plunge in Chinese equities which authorities seem to have arrested over the past week. It is in my opinion that my favorite high beta sector in the market is due for a significant pullback.

On top of the regional troubles, this quarterly earnings season has been a ruse in my opinion with most companies posting better than expected profits on expectations that were lowered over the past two months. That is the equivalent of applauding an athlete for making it over the bar after the judges lower it, keeping the illusion of success alive.

Despite the collapse in profits from the S&P 500, the market has managed to grind up even through the Federal Reserve completing its last quantitative easing program last October. The market has been driven up mostly by momentum and high beta stocks as investors bid up anything than can promise solid potential future growth rates given how tepid demand is globally right now. I don’t believe the market will continue to behave this well. Here’s how I am preparing my portfolio to weather any significant pullback in the small cap biotech sector.

The enthusiasm for the small cap biotech sector is quite something right now. This is understandable given the top gainers within the market during the first half of 2015 is dominated by names from this space. It is hard to keep track of all the small biotech/biopharma stocks that have doubled, tripled or quadrupled in the first six months of the year. Not to look a gift horse in the month, given Eagle Pharmaceuticals’s (NASDAQ: EGRX) 464% gain has easily been the best gainer in the one year history of the Small Cap Gems portfolio, but this sort of rally cannot continue.

I was out in San Francisco early in the week giving a biotech presentation at the Money Show as well as an interview around the biotech space for one of the largest financial websites in China. Ninety percent of the questions that I received from attendees to both events were all around the small biotech arena. No one seemed to want to discuss the less volatile large cap names in the sector that still offer reasonable valuations that should make up the bulk of any diversified biotech portfolio.

I can understand euphoria around this space right now. Some of the small cap equities I have profiled right here on these pages like ZIOPHARM Oncology (NASDAQ: ZIOP), Synergy Pharmaceuticals (NASDAQ: SGYP), and Halozyme Therapeutics (NASDAQ: HALO) have provided absolutely outstanding returns to readers who bought these stocks at the time. As well, the small cap biotechs have gotten the recently launched Biotech Gems portfolio off to a stellar start.

I hate to be a Nervous Nellie here, but trees simply do not grow to the sky. It also feels like more and more we are overdue for some sort of decent pull back given the gains of the last year. This is a good time to re-emphasize that 50% to 75% of the weighting in most well-diversified biotech portfolios should be geared to the more stable large cap part of the sector. Many of these names still offer solid value and will sell-off to a much lesser degree should we see a decline or change of sentiment on the sector.

The last time we had a major swoon within the biotech space was last year in early March. In a brutal six to eight week stretch, large caps gave up 20% to 30% of their value, and many small cap concerns sold off 50% to 70% in a very short amount of time. I have been weighting some of the large cap names within my biotech portfolio more heavily as we get deeper into summer.

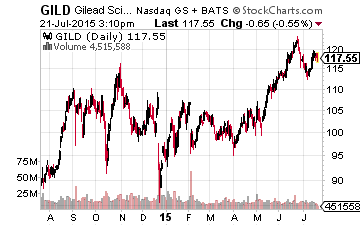

This starts with Gilead Sciences (NASDAQ: GILD), a dominant player in the HIV and hepatitis C markets, which might be the cheapest large cap growth stock in the market right now. The biotech juggernaut should see a 30% to 35% year-over-year increase in earnings in 2015 on a 15% to 20% rise in revenues. The company just initiated its first dividend payment and will buy back some $15 billion in stock over the next few years with its rapidly growing free cash flow. Despite this, the stock goes for approximately 11 times this year’s likely earnings, a major discount to the overall market multiple.

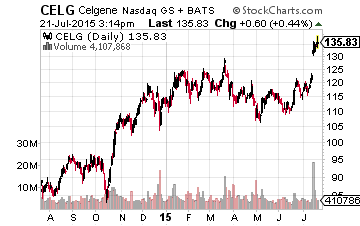

Another of my large cap core biotech growth stocks, Celgene (NASDAQ: CELG); is up more than 10% since I last profiled it on these pages. Celgene made a couple of strategic deals in July since that article ran that enhances its long term growth prospects. The company recently announced a $1 billion partnership deal with Juno Therapeutics (NASDAQ: JUNO) which significantly deepened its exposure to the emerging field of immunotherapy and was also well-received by investors.

More importantly, last week the company picked up Receptos (NASDAQ:RCPT) for just over $7 billion. Receptos has a late stage trial compound that has a high chance of being approved. Celgene believes the drug could eventually produce $4 billion to $6 billion in peak sales. If this turns out to be an accurate forecast, this acquisition will greatly enhance revenue and earnings growth in coming years. Celgene does sell at a slight premium to the overall market multiple which is more than justified by its superior growth prospects.

Neither of these large cap biotechs will provide the huge returns that some of my small cap biotech selections have delivered over the past few years. However, they should outperform the overall market over many years to come. In addition, if we do get a sentiment shift on the biotech sector they should hold up just fine.

Positions: Long EGRX, ZIOP, SGYP, ...

more