Dividend Income Update May 2018

The beginning of every month is exciting for all dividend income investors as we look back at the previous month and see how much passive dividend income our portfolios generated. No doubt, these are the best posts to write and read online as it only provides further proof that dividend investing can work over time and that anyone can create an ever growing passive income stream. Looking back at my May totals I see that my year over year progress is still moving at a nice clip and I look forward to calculating my half year 2018 totals in a few weeks to see where I stand relative to last year. With that being said, let’s take a look back at my May 2018 dividend income.

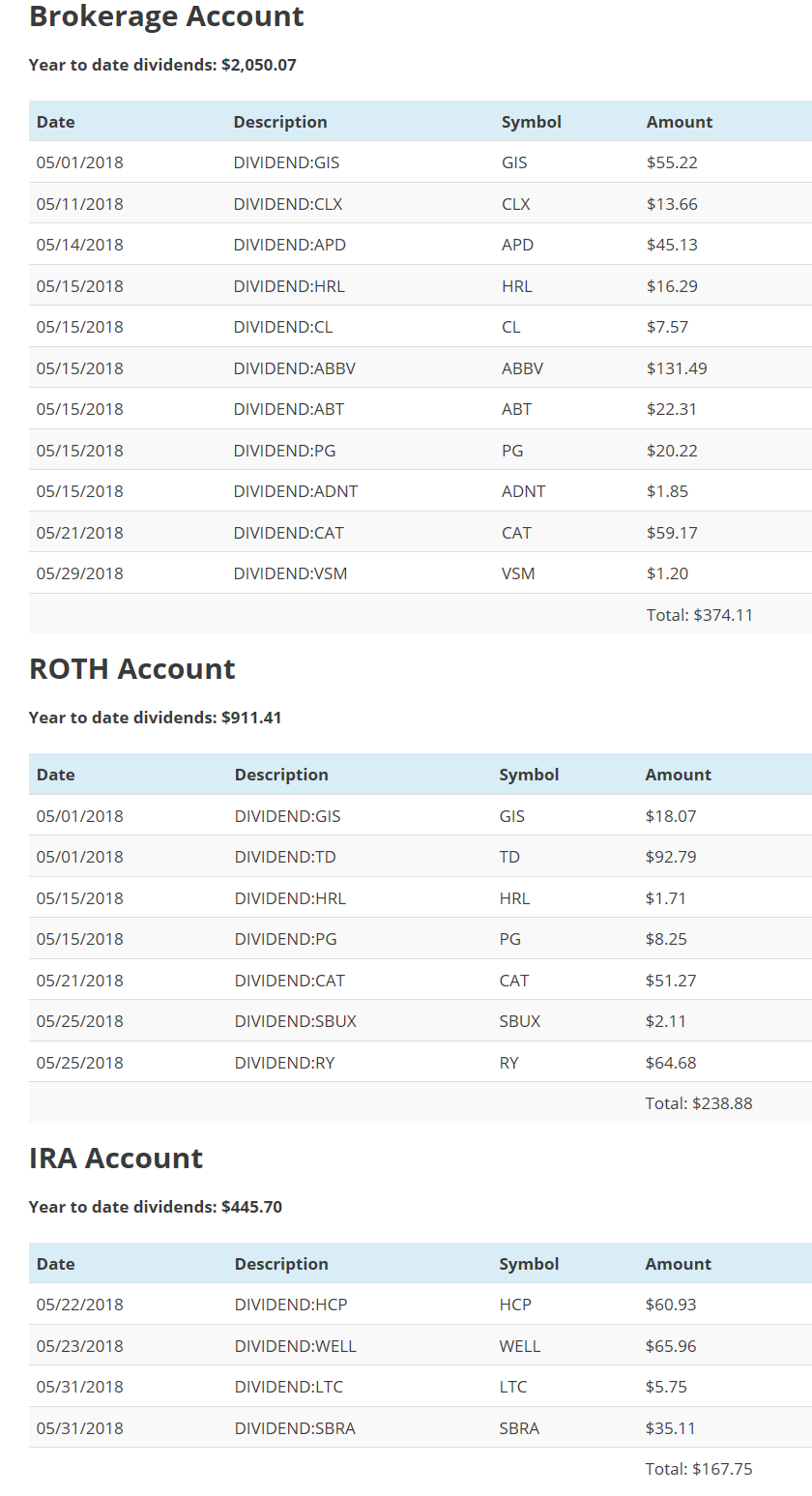

Dividend income from my taxable account totaled $374.11 up from $296.58 an increase of 26.1% from May of last year.

Dividend income from my ROTH account totaled $238.88 up from $196.06 an increase of 21.8% from this time last year.

Dividend income from my IRA account totaled $167.75 up from $91.74 from this time last year. An increase of 82.9%.

Grand total for the month of May: $780.74 an increase of 33.6% from May 2017.

Looking at the figures above I cannot complain as my dividend train keeps chugging along churning out that passive income despite currency headwinds, economic headwinds, terror across the world, saber rattling from North Korea, Russian troops in Ukraine, The Nigerian delta under attack curbing the flow of oil, floods, earthquakes, volcanos, etc. etc. I think you get the point. There will ALWAYS be negative financial, civil, health news and more. Even during the best economic times there will always be an opinion citing concerns. The question is will you react to the headlines or stay the course?