Dividend Income Update June 2016

With half the year officially under our collective belts a clearer picture of our full year of dividend income comes into view. June, of course, is a favorite month among dividend investors as end of quarter months usually signify higher than average passive income received. Looking back at the last six months I can see that my individual buys have really slowed. I have made only two separate buys in January and June with the other four months ending in just one buy each. Of course, this is a testament to my investing mantra of always remaining consistent with my buys no matter what the market is doing. I feel that it’s important to always deploy fresh cash as allowed to continually diversify and enhance future dividend income. With the recent market swoon and recovery it becomes increasingly difficult to figure near term investment choices. Time will tell where I ultimately deploy my July cash but rest assured at least one July purchase will be made. With that being said, let’s take a look back at my June dividend income.

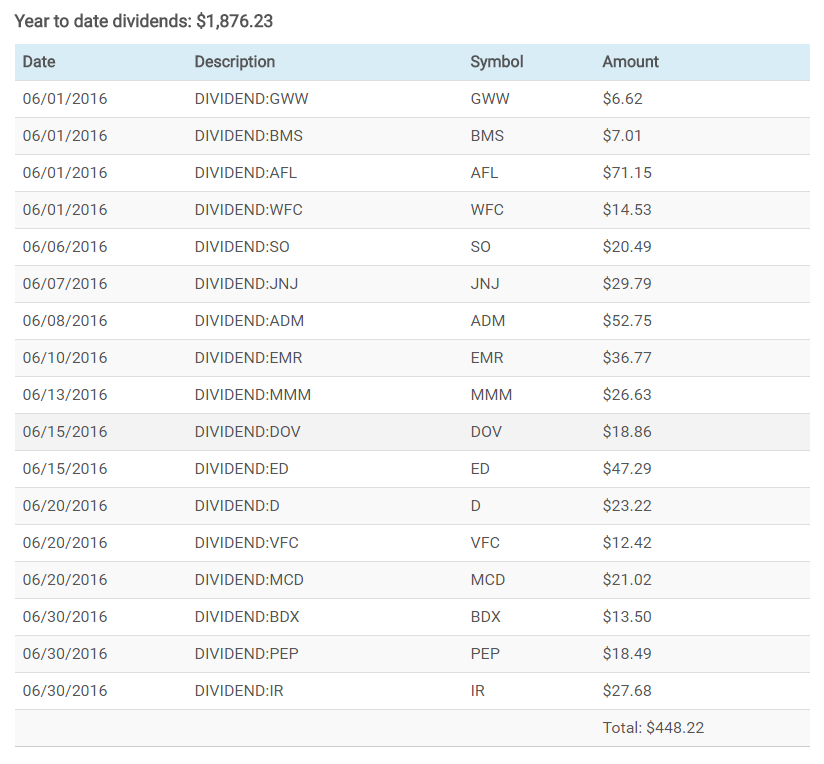

Dividend income from my taxable account totalled $448.22 up from $316.02 an increase of 41.8%from June of last year.

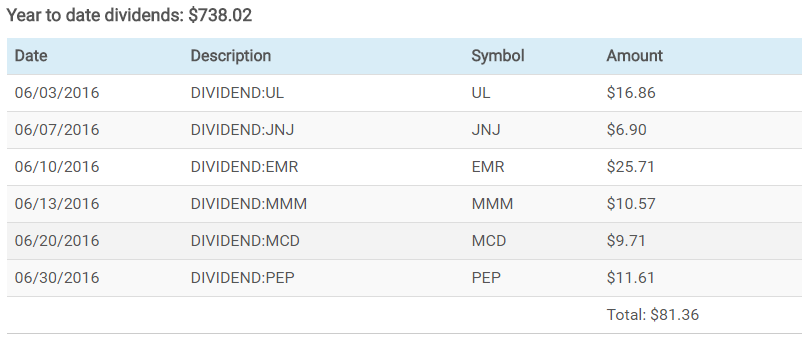

Dividend income from my ROTH account totalled $81.36 up from $74.54 an increase of 9.1% from this time last year.

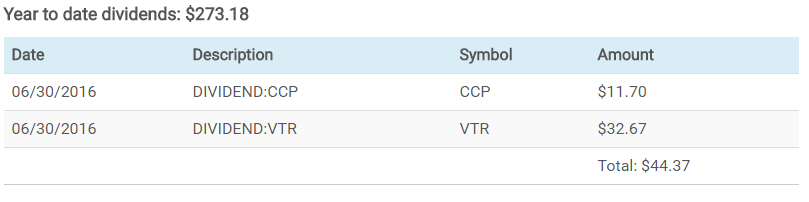

Dividend income from my IRA account totalled $44.37 up from $11.60 from this time last year. An increase of 282.5%.

Grand total for the month of June: $573.95 an increase of 42.7% from June 2015.

Brokerage Account

ROTH Account

IRA Account

Who says dividend growth investing doesn’t work? Just look at the figures above and see what fresh capital, dividend raises and compounding can do to year over year income. It’s truly magic in the making.

Disclosure: Long all above