Dividend Aristocrats In Focus Part 21 Of 54: 3M

3M (MMM) is the second largest diversified manufacturer in the world by market cap, trailing only behemoth General Electric (GE). In part 21 of my Dividend Aristocrats In Focus series I take a look at the growth prospects and competitive advantage of 3M.

Business Overview

3M is a well diversified manufacturer. The company operates in 5 segments. Each segment is broken down below along with the percent of total revenue it contributed to 3M in the company’s most recent 2nd quarter of 2014:

- Industrial: 34% of revenues

- Safety & Graphics: 18% of revenues

- Electronics & Energy: 17% of revenues

- Health Care: 17% of revenues

- Consumer: 14% of revenues

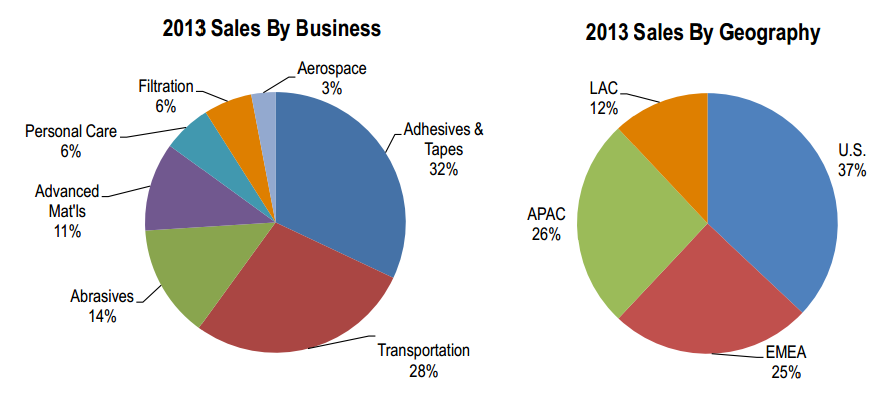

The industrial segment is by far the largest of 3M’s five business segments based on revenue. The industrial segment produces nearly twice the amount of revenue as any other segment. produces adhesives, abrasives, tapes for industrial purposes, and filtration systems. It also produces specialty additives, auto body repair solutions, and car DIY kits. The industrial segment’s 2013 revenue by geography and industry is shown in the image below:

Source: 3M Citi Industrial Conference Presentation

The safety and graphics segment produces respiratory, hearing, and eye protection solutions. It also creates reflective signs for traffic direction, ID cards like passports, roofing material, and building and architectural design safety solutions.

The company’s electronics and energy segment produces electrical vinyl rubber, flexible circuits, insulation tapes, and fiber and copper splicing, among other products. Interestingly, the segment generates over 60% of its revenue in the Asia Pacific region.

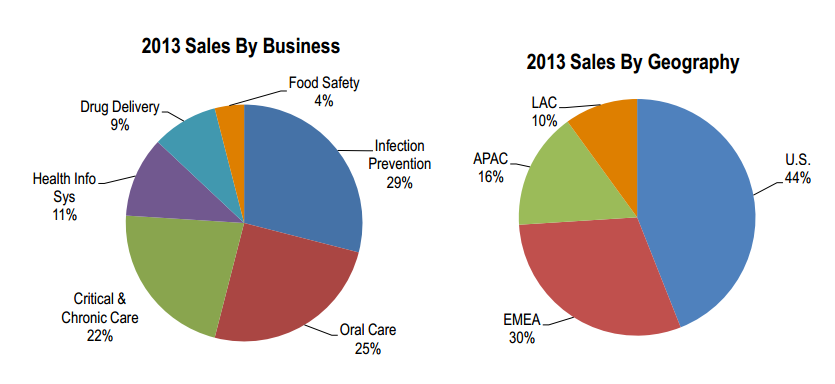

The health care segment produces skin and wound care products, infection prevention products, oral care, drug delivery inhalation systems, and coding and reimbursement software, among other health related products. The segment’s revenue is shown in the image below sorted by both region and industry:

Source: 3M Citi Industrial Conference Presentation

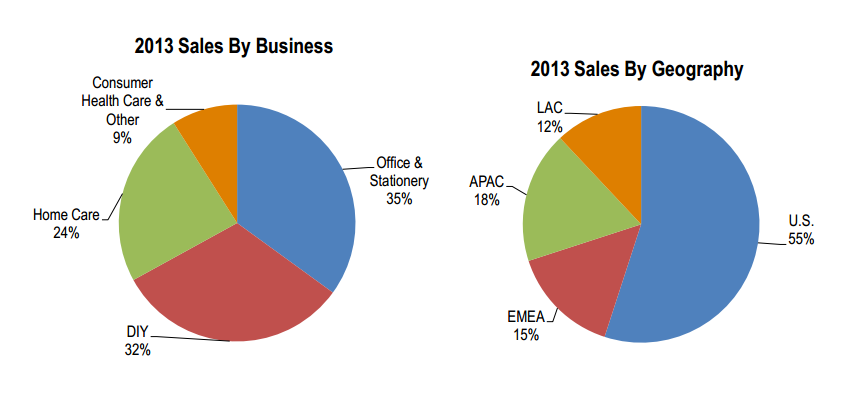

The fifth and final consumer segment generates the least revenue for 3M, but is also the most familiar to US consumers. The consumer segment produces tape, home air filtration products, and Post It notes, among other products. The segment’s 2013 sales by both business and geography are shown below:

Source: 3M Citi Industrial Conference Presentation

Competitive Advantage

As shown above, 3M produces products for a variety of industries. The company sells its products to governments, other businesses, and consumers. As a result, 3M has extensive experience and technical know-how in fields that are generally unrelated. The company’s competitive advantage rests with its ability to leverage its research and development departments in various industries to create new and innovative products. Additionally, the company can ‘scale’ innovations in one segment to others. For example, a better adhesive found in the consumer segment could be used to create products for the industrial segment and health care as well.

3M also possesses a competitive advantage thanks to its long history and well established supply chain and manufacturing footprint. Smaller businesses and new entrants would find it extremely difficult to match the infrastructure that 3M has created. The company’s global scale gives it the ability to manufacture and source products in the best locations possible, rather than only in one country.

Finally, the company has a trusted and well-recognized brand. The 3M brand carries weight consumers, businesses, and governments. 3M’s long history of innovation and success has created significant brand equity that lesser known competitors and new entrants are unable to match.

Growth Prospects

3M has been very clear with its long-term growth goals. The company is targeting 4% to 6% organic revenue growth and 9% to 11% EPS growth. The company plans to spur growth through increasing research and development spending to 6% of revenues. In 2012, the company spent 5.5% of revenues on research and development, and 5.6% in 2013. Additional research and development spending will help the company create innovative products at a faster pace.

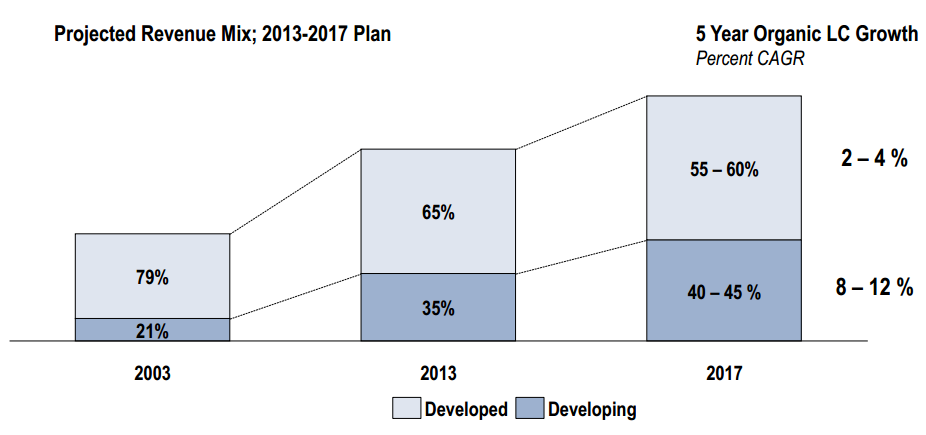

In addition to research and development spending, 3M is pushing to expand in the developing world. The company currently generates about 1/3 of its revenue in developing markets. Their goal is to generate 40% to 45% of revenue in developing markets by 2017. The company is expecting 8% to 12% organic growth in the developing world, and just 2% to 4% in the developed world. The disparity in growth rates is due to the faster growing GDP of the developing world as compared to the developed world. The image below shows how far the company has come in developing markets.

Source: 3M Bernsein Conference Presentation

3M has exceeded expectations so far in 2014. The company posted EPS of $1.91 for its most recent 2nd quarter 2014, up 11.7% versus the same quarter a year ago. Constant currency sales increased 4.8% versus the same period a year ago, at the lower end of expected long-term growth. The company managed double-digit EPS growth through organic revenue growth, expanding its operating margin through price increases and efficiency gains, and reducing the company’s share count through share repurchases.

Going forward, I project 3M will hit its 9% to 11% EPS growth targets. The company is expertly managed and focused on maximizing shareholder value by constantly examining its large manufacturing and product portfolio to determine if assets need to be divested, and what businesses would make the best strategic acquisitions. The company further has strong growth prospects in the developing world. Its health care division posted strong 12% organic revenue growth in the developing world for its most recent quarter. Overall, I believe shareholders will benefit from the diversity of 3M and its strong growth prospects in the developing world going forward. As stated earlier, I expect a 9% go 11% EPS growth rate for the company over the next several years.

Dividend Analysis

3M has paid increasing dividends for 56 consecutive years. The company has a fairly low payout ratio of 41%. It is extremely likely that 3M will continue to reward shareholders with increasing dividends for the foreseeable future. The company currently has a solid dividend yield of 2.5%, making it an ideal candidate for investors seeking stability, income, and growth.

Valuation

3M currently trades at a PE ratio of about 19. This is just above the S&P500’s current PE ratio of about 18. 3M has traded at a discount to the market’s PE ratio for much of the past decade. This is odd considering the company’s solid growth, stability, competitive advantages, and shareholder friendly dividend policy. Like most dividend Aristocrats, I believe 3M should trade at a premium of about 1.1x to the market’s P/E ratio due to its safety and high quality business.

If the market returns to its historical average PE ratio of 15, I place a fair valuation ratio of between 15 and 18 for 3M. At current market prices, the company’s PE ratio should fluctuate around 19.8. The company is currently trading at a PE ratio of 19, which is near fair value for current market levels.

Recession Performance

3M weathered the Great Recession of 2007 to 2009 well. The company saw slight downturns in both revenue per share and earnings per share during the recession, but quickly recovered to new EPS highs by 2010. The company’s EPS through the last recession and into the recovery to give you an idea of how the company fared:

- 2007 EPS of $5.60

- 2008 EPS of $4.89

- 2009 EPS of $4.52

- 2010 EPS of $5.75

3M is not completely recession resistant, but is able to remain profitable during recessions. Even long-term downturns do little to but the business at risk of failure.

Final Thoughts

3M is a high quality business with a long history of rewarding shareholders. It is currently a Top 25 stock based on the 8 Rules of Dividend Investing due to its solid growth rate, dividend yield, and payout ratio. In addition, 3M has a low price standard deviation of 23%, making it a solid investment for investors seeking growth, dividends, and stability.

Disclosure: I am not long any of the stocks mentioned in this article