Dividend Aristocrat AT&T Vs. Soon-To-Be Dividend Achiever Comcast

AT&T (T) and Comcast Corporation (CMCSA) are in constant competition for cable and Internet subscribers. Over the past few years, they have each made huge moves to boost their TV businesses.

And, they are both dividend stocks. AT&T is a legendary dividend stock. It is a member of the Dividend Aristocrats, which are companies that have raised their dividends for 25+ consecutive years.

You can see the entire list of Dividend Aristocrats here.

Comcast suspended its dividend from 1999-2008. But since it reinstated the dividend in 2008, it has increased its shareholder payout each year.

That means it won’t be long before Comcast qualifies as a Dividend Achiever, a group of companies with 10+ consecutive years of dividend increases.

AT&T and Comcast have similar business models, but they offer very different dividends.

When it comes to which dividend stock is better, the answer may depend on how long of an investing time horizon you have.

Business Overview

AT&T operates four main segments:

- Business Solutions (43% of revenue)

- Entertainment Group (32% of revenue)

- Consumer Mobility (20% of revenue)

- International (5% of revenue)

The wireless and TV businesses are its strongest areas right now.

Source: Fourth Quarter Earnings Presentation, page 6

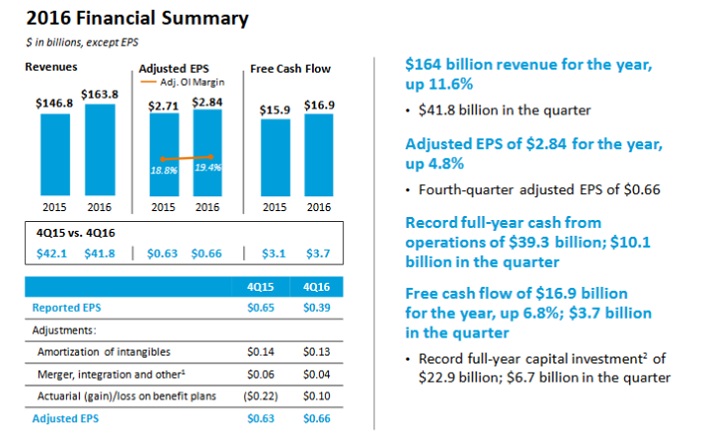

AT&T’s full-year revenue increased 11.6% in 2016, thanks mostly to its $49 billion acquisition of satellite TV provider DirecTV.

Source: Fourth Quarter Earnings Presentation, page 5

AT&T’s fourth-quarter results were fairly weak. Revenue declined 0.7% from the 2015 fourth quarter. However, thanks to cost cuts, adjusted earnings-per-share increased 4.7% for the quarter.

Meanwhile, Comcast is a highly-diversified company. In addition to Internet and TV service, Comcast has a large media and consumer business.

Comcast acquired the remaining 51% of NBCUniversal it didn’t already own in 2013, for $16.7 billion. NBCUniversal then acquired Dreamworks in 2016, for $3.8 billion.

As a result, Comcast is now a conglomerate, with the following operating segments:

- Cable Communications (60% of revenue)

- NBCUniversal (40% of revenue)

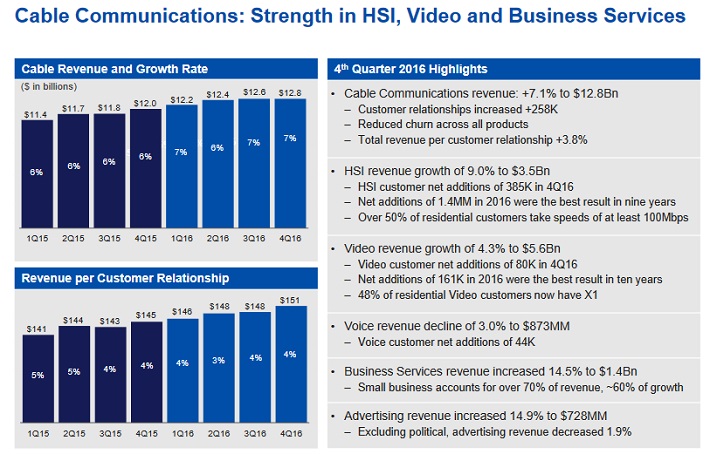

The cable communications segment includes video, Internet, voice, and business services. Cable communications revenue increased 6.6% in 2016, thanks largely to 8.5% growth in Internet service revenue.

Comcast achieved this revenue growth by adding customers, and increasing average revenue per user.

Source: Fourth Quarter Earnings Presentation, page 6

The NBCUniversal segment includes cable networks, broadcast television, a movie studio, and a theme park.

These businesses performed very well in 2016—NBCUniversal revenue increased 7% in 2016, driven by 13% growth in the theme parks business.

Growth Prospects

In an era of cord-cutting, the boundaries between television and Internet become thinner with each passing year. Cord-cutting is the recent trend of consumers ditching high-priced cable packages, in favor of smaller packages and Internet streaming options.

As such, AT&T and Comcast have turned into fierce rivals, when it comes to Internet and cable subscribers.

AT&T and Comcast both have a lot to lose from the cord-cutting trend. But while they have both made huge pushes into television in recent years, they have done so in different ways.

AT&T’s crown jewel is its wireless service business. People love their smartphones and tablets, which has benefited AT&T tremendously.

Its TV business is anchored by television service, particularly after the DirecTV deal.

By contrast, Comcast has broadened its TV business, by investing in content. Comcast owns the NBC network, and also operates movie studios.

Comcast is better insulated against cord-cutting going forward, which is why the company’s growth is so strong.

Even if consumers cancel their pricey cable packages in favor of a skinny bundle, NBC will still be included. Cord-cutting would also not affect Comcast’s movie studio and theme park businesses.

The takeaway is that Comcast may continue to generate stronger growth than AT&T. Cord-cutting changes the way consumers receive content, but does not affect the content itself.

AT&T expects 2017 revenue and adjusted earnings-per-share to increase in the low-single digits. Meanwhile, Comcast has not provided a 2017 forecast, but analysts expect 8.5% earnings growth.

Dividend Matchup

AT&T and Comcast both pay dividends, but they are vastly different dividend stocks. AT&T is a high-yield dividend stock, with a 4.7% dividend yield.

By comparison, Comcast has a much lower current yield, of 1%.

This makes a huge difference in the short term. AT&T provides more than four times as much dividend income as Comcast.

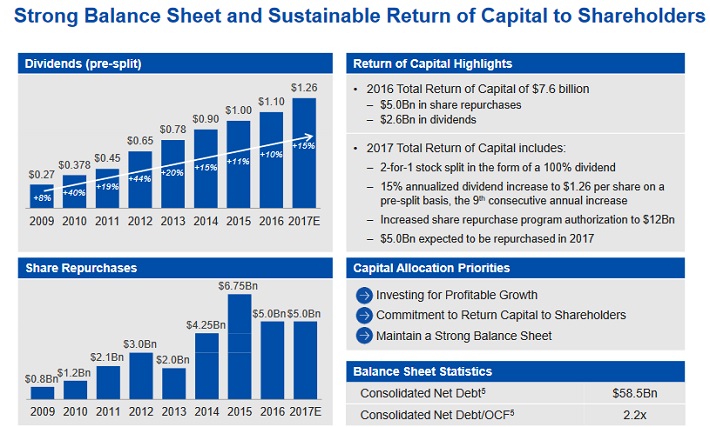

The trade-off is that Comcast grows its dividend at a much faster rate than Comcast. The company recently increased its dividend by 15%.

Over the past five years, Comcast has increased its dividend by 14% each year, on average.

Source: Fourth Quarter Earnings Presentation, page 10

For its part, AT&T increased its payout by just 2% per year, in the same time. AT&T’s blend of high-yield, low-growth is reminiscent of another major telecom giant, Verizon Communications (VZ).

Comcast can raise its dividend at much higher rates than AT&T, because its lower yield leaves more room for growth. Based on 2016 performance, Comcast and AT&T have payout ratios of 35% and 70%, respectively.

Comcast’s much higher dividend growth rate means that, over time, it could generate a higher yield on cost than AT&T.

Yield on cost measures an investor’s current dividend income, as a percentage of the initial investment. For example, a 10% yield on cost means that an investor is earning 10% of his or her original investment, in dividends.

Assuming each stock continues to raise future dividends at their trailing five-year growth rates, in 15 years AT&T investors would have a yield on cost of about 6.3%.

However, Comcast would generate an 8% yield on cost after 15 years. This shows the benefit of rapid dividend growth.

As a result, which dividend stock is the better investment, depends on the type of investor.

Final Thoughts

AT&T and Comcast both have strong brands, highly profitable business models, and future growth potential.

AT&T’s dividend yield is more than double the 2% average dividend yield in the S&P 500. As a result, it is a much better stock selection for an investor looking for current income, such as retirees.

Comcast is not an attractive stock for these investors, because its dividend yield is about half the S&P 500 average.

That being said, its double-digit annual dividend growth would result in greater income potential down the road. Therefore, Comcast is the better stock for dividend growth investors.

Disclosure:

Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers ...

more

Thanks for sharing