Distribution Volume Holds Near Thursday's Highs

Friday saw some big volume, although there was a relatively tight price action to close near the highs of Thursday.

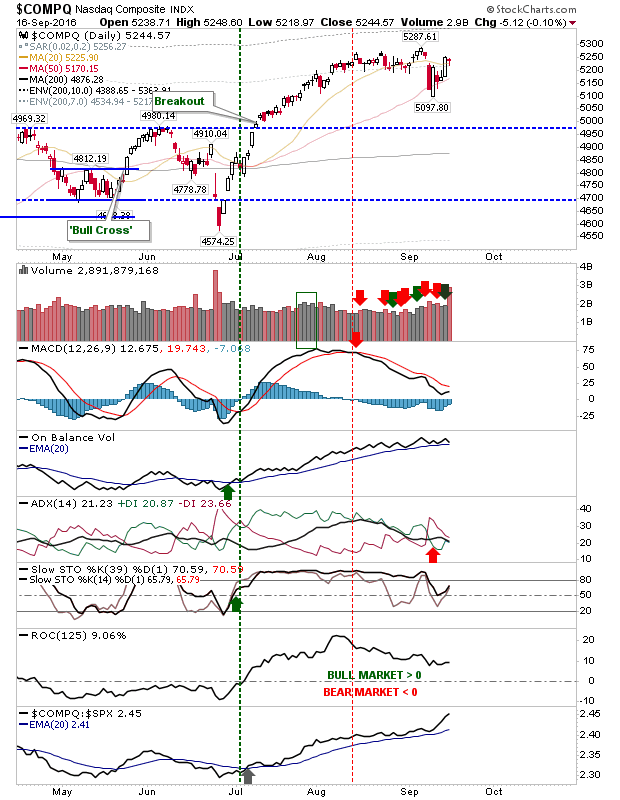

Best of the action looked to belong to the Nasdaq as it knocks on the door of 5,287. A gap higher on Monday opens up for a push to new all-time highs. Watch if it coincides with a MACD trigger 'buy', this will strengthen the validity for the move higher and encourage technical buying.

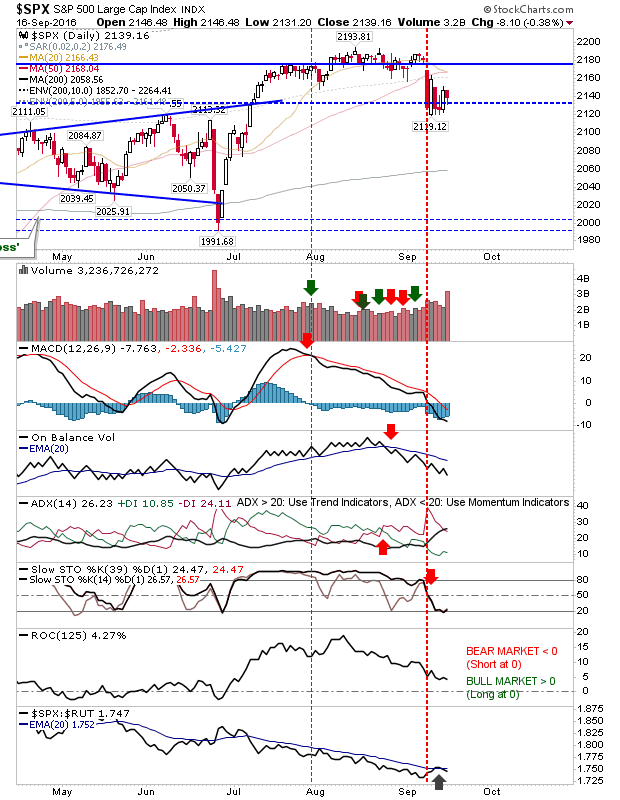

Large Caps have more work to do as jobs data losses remain dominant. A bearish cross of the 20-day MA against the 50-day MA sets up another overhead supply point for shorts to attack. Other than oversold conditions, there is little of positive technical note for the S&P.

It's a similar picture for the Russell 2000 as for the S&P. This index is underperforming relative to the S&P and Nasdaq which puts it at the bottom of the pile for attractive buyers. However, a positive start from the Nasdaq should help power gains for the Russell 2000, but the index will have to get past 20-day and 50-day MA resistance.

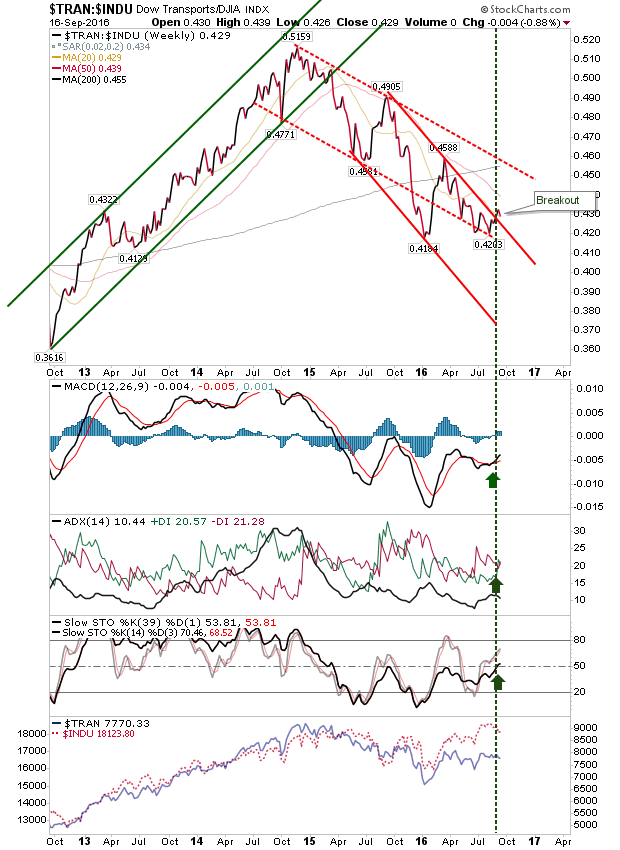

While longer term charts are still in bears' favor, there is an indication shorter term strength is contributing to a reversal in the long term. First of these to come around is the Dow Theory - Dow:Transports relationship. There is a positive channel break with a technical 'buy' signal; can this end a 2-year+ decline?

While I remain disappointed with my Copper stop-out, commodities remain the value sector:

For next week, keep an eye on Tech indices. Value players can look to play the commodity opportunity, but need to be more flexible than I have been with the stop (i.e. smaller position with a wider stop).

Disclosure: None.

Thanks for sharing