Delta Air Lines, Inc. Dividend Stock Analysis

Here we go! Another fun loving dividend stock analysis, because that’s what Dividend Diplomats do! Today’s analysis will be over Delta Air Lines, Inc. (DAL) and the fun-loving, high above the clouds – airline industry. Let’s hop on the flight, take our seat and see what Delta and the airline industry has in store for us dividend investors!

The stock – delta airlines, inc. (DAL)

I travel quite a bit for work. Reward programs are clutch and key to me, as well as customer service when it comes to flying. There has been one airline that by far surpasses all of my flying experiences and that has been Delta Airlines, Inc. or DAL. On a flight that was delayed they comped me rewards points, they provide extra little snacks and drinks, somehow, every time I am on a flight with them. Wild enough (other airlines, take note), when your employees are professional & courteous to customers/guests, this goes a LONG way, trust me! As I take my flights, I started to think – wait, how are these companies as dividend growth stocks? Those companies being DAL and their main competitors. Are their dividends as sweet as it is to fly with DAL? Are they on the “up and up”? Earnings have looked fairly solid over the last 3 years, and this has helped with their repurchase of shares back into treasury, of course. Can their dividend, though, take me to new heights? Do they have the right metrics for a stock purchase? Let’s run them through the screener!

About our dividend stock screener

For those of you who are new followers, we run the Dividend Diplomat stock screener to identify potentially undervalued dividend growth stocks to analyze and potentially purchase. The Dividend Diplomats like to stick to 3 metrics when evaluating dividend stocks for considerations of a purchase. In our comparison, we will also compare the company we are analyzing to a competitor to gauge how the company performs in their respective industry, in addition to comparing them to the broader market. Here are the 3 metrics:

1. Price to Earnings (P/E) Ratio: We like to look for a P/E ratio that is below the S&P 500. The reason why we look for this is to show signs of undervaluation.

2. Payout Ratio: We further like to look for a company with a payout ratio of less than 60%. We choose 60% so the company has plenty of room to further expand their dividend in future years – it’s that simple.

3. Dividend Increase History: Additionally, we analyze companies that have a proven track record of increasing their dividend. We don’t go straight for the Dividend Aristocrats, but you have to have recent history, including the prior period, of increasing that yield.

With these dividend stock screening metrics, we may include additional items for consideration; however, these companies must break through the 3 barriers above. Now, onto our detailed analysis of DAL and the other BIG players in the air that we all love – all of which are direct competitors to DAL, that is Southwest Airlines (LUV) & American Airlines (AAL). United Airlines (UAL), doesn’t make the cut, as they do not pay a dividend!

Dividend stock analysis

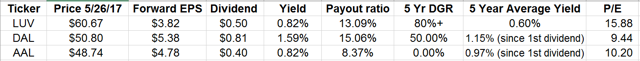

1.) Dividend Yield: Here we go, all 3 companies are typically low yielders. LUV and AAL yield almost spot on the same, but DAL comes in first place here, no doubt, almost doubling the competitors yield. If I go low, I typically don’t want to be too far away from the S&P 500 yield, which is around that 2% mark, and LUV/AAL yield is too low for me in this instance. Delta – flying a bit higher than the comp! Obviously payout ratio & growth rates play a huge part in this competition, as well.

2.) Payout Ratio: I typically love the sweet spot of 40-60% payout ratio, where the company provides close to half of their earnings back to shareholders and keeps the other half for growth of the business. In this case – airline carriers, more than likely due to the ever changing environment and customer desires in the industry, hold on to MUCH more of their earnings than I typically see. With the growth rate on deck next, there is NO concern to me that DAL, LUV and AAL would not be able to fuel their dividend growth going forward, they can keep pushing more cash to investors without much of a concern. All 3 are winners here.

3.) Dividend Growth Rate: Uhm… WOW? Is that what I can say? First AAL is off the chopping block here, having NO change to their dividend since they announced their $0.10/quarter a few years ago. DAL has been pumping it to investors, though, ever since their first dividend in the 2nd quarter of 2013, I love it. LUV, obviously was hard to calculate, but their DGR was well over 80%, yikes! All incredible here, and I think I like DAL in this situation, due to their 2x dividend yield than LUV, sorry Southwest : ) Both are great here, but I like DAL’s balance so far, if you want to call it that.

4.) 5-Year Dividend Yield Average: Since some have not paid a dividend for 5 years yet, I simply did the average yield since dividend inception. I’m going on a whim here and saying Delta or DAL here takes the window seat, as they have the best advantage over their inception dividend yield average, which is a sign of undervaluation. This more than likely is due to the amazing dividend growth rates experienced, with the stock price not catching up, I’ll take it!

5.) Price to Earnings (P/E) Ratio: Very interesting here, eh? All are VERY Low, which is nice to see. AAL & DAL are taking the cake here, as of now, but I truly like DAL more, as my customer service experience has been much better + they have a better dividend approach, more consistency and have a growth rate. This ratio, again, is to fund undervaluation, which in this case – all of them show undervaluation in comparative to the market as a whole and DAL is sitting tight with the lowest : )

Dividend stock analysis conclusion

Wow, Wow, Wow. I am loving what DAL has in store here, just superb dividend remarks across the board, with the slight scoff at the lower than market yield. I believe they make up for it with the insane dividend growth, which they can maintain for years and years to come, as long as no one gets dragged off a plane… too soon? But in all seriousness, these 3 airlines are doing fairly well and I like Southwest > American simply due to dividend growth; however, Delta takes the crown in this scenario due to solid growth, solid yield, payout ratio is incredible, as well as P/E.

I am intrigued to potentially purchase shares here, I may be doing so in the future, but not in the exact instance. I’ll have to read on the industry a little bit more and would LOVE DAL in the 1.80% dividend yield range, which would be a handful of dollars less than where they are at. Correction in the market any time soon? Please?? I do still love their customer service and overall flying experience + rewards program. If that changes, as well, that will change my perception of them!

Anyone own DAL already or another company above? Anyone staying away from the airline industry due to the poor public media that is being displayed on the news and internet? Are you planning on buying one of the above, now that they were analyzed? Love or hate any of the 3 above? Always curious on these questions! Talk soon and good luck investing!

Disclaimer:

Disclaimer: I do not recommend any decision to the reader or any user, please consult your own research. Thank you.