Daily Update: Deutsche Bank Is Driving The Market

STOCK NEWS

Costco: Reported Q4 EPS of $1.77 which beat estimates by 4 cents. Revenues of $35.73 billion were down 2.1% which missed estimates by $1.08 billion. Comparable sales were flat. If gas price deflation and foreign currency swings are backed out, comparable sales were up 3% for the quarter. Merchandise costs as a percentage of revenue were up slightly. Costco has 715 warehouses and plans to open 9 more by the end of the year.

Deutsche Bank: CEO John Cryan sent out a letter to his staff about the recent worries about the bank. He made the following point “We fulfil all current capital requirements and our restructuring is well on track. We completed the disposal of the British insurer Abbey Life this week and the sale of our stake in the Chinese Hua Xia Bank will be finalised soon. This will further improve our capital ratio.”

McCormick: Reported Q3 EPS of $1.03 which beat estimates by 9 cents. Revenue of $1.09 billion was up 2.8% year over year, in-line with expectations. Sales were up 6% on a constant currency basis. Consumer segment operating income rose 11% and industrial operating income rose 14%. Diluted 2016 EPS guidance is $3.68 to $3.72.

Facebook: at Work is launching on October 10th. It is the firm’s effort to get into enterprise communication services. Facebook has built security features which make it into a separate platform when it comes to consuming and sharing data.

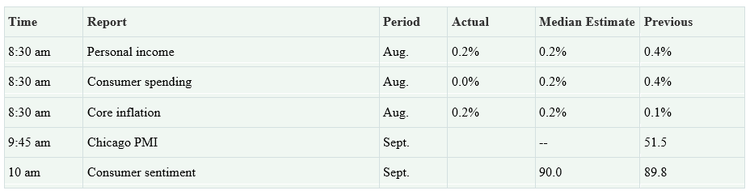

ECONOMIC NEWS

I’ll use this portion of the morning note to put the rest of the points Deustche Bank CEO made in his letter since it is driving the market.

“We have significantly decreased our market and credit risk in recent years. At no point in the last two decades has the balance sheet of Deutsche Bank been as stable as it is today.

Despite low interest rates and a difficult environment we posted a pre-tax profit of about 1 billion euros in the first half of 2016. Before extraordinary items like restructuring costs, we earned about 1.7 billion euros. This demonstrates the operating strength of Deutsche Bank.

In a situation like this, the most important factor is our liquidity reserves. Currently they still amount to more than 215 billion euros. This is an extremely comfortable buffer. This is clear proof of how conservatively we have planned. This is acknowledged by numerous banking analysts.”