Daily Update: Dallas Fed Down 22 Straight Months

STOCK NEWS

Zimmer-Biomet (ZBH): reported earnings of $1.79 which were in-line with expectations. Revenue of $1.83 billion was up 4.0% year over year which missed expectations by $10 million. The following is the revenue changes in each segment: Knees down 0.1%, Hips up 1.6%, S.E.T. up 8.6%, Dental down 7.3%, Spine, and CMF up 24.3%. 2016 revenues are expected to be $7.63 billion- $7.65 billion.

Southern Company (SO): reported earnings of $1.28 which beat estimates by $0.11. Revenue of $6.26 billion was up 15.9% year over year. This beat expectations by $280 million. CEO Thomas Fanning stated "We are pleased with the performance of our electric and gas businesses so far this year, including the strong performance of our wholesale generation subsidiary, Southern Power. For the first time, our reported earnings include results from Southern Company Gas, including the recent investment in the Southern Natural Gas pipeline. With these investments and the recently announced strategic alliance between our PowerSecure subsidiary and Bloom Energy, Southern Company continues to build the future of energy for the benefit of the customers and communities we are privileged to serve."

Public Service (PEG): reported earnings of $0.88 which beat estimates by 5 cents. Revenues of $1.9 billion were down 17.7% year over year. PSEG CEO Ralph Izzo stated “PSEG’s performance for the third quarter continues to demonstrate the benefits from our expanded investment program. A focus on controlling costs supported results as demand was aided by the warmer than normal weather experienced this past summer. Net Income was also impacted by our decision to retire the Hudson and Mercer coal-fired generating stations in 2017. The retirement of these units continues the evolution of PSEG Power’s assets into a portfolio of reliable, low-cost, flexible assets capable of competing in today’s energy market. This decision will allow us to meet market conditions and aids PSEG Power’s future cash flow and return profile.”

Cooper Tire & Rubber (CTB): reported Q3 EPS of $1.04 which beat estimates by 3 cents. Revenue of $750.91 million was down 4.0% year over year which missed estimates by $39.94 million. Americas tire sales dropped 4.2% to $673 million. International tire sales fell 5.1% to $113 million. Gross margins increased 70 basis points to 20.4%. 2016 guidance is for operating margins to be up modestly year over year.

ECONOMIC NEWS

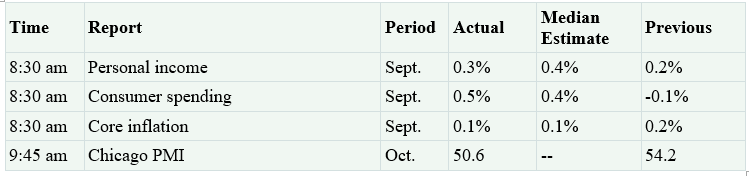

The Dallas Fed’s manufacturing outlook missed expectations for +2.0 as it was -1.5. This means it has been negative for 22 straight months. New orders and average workweek fell along with wages. Chicago PMI fell to 5-month lows coming in at 50.4. New orders and production fell. Production fell 5.4 points to 54.4 and new orders fell to their lowest point since May.

(Click on image to enlarge)

Disclosure: None.