CSX Earnings Preview

CSX Corporation (CSX) is set to report quarterly earnings after hours. Analysts expect revenue of $2.89 billion and EPS of $0.56. The revenue estimate implies a 5% decline Y/Y. Investors should focus on the following key items.

CSX Is Still Highly Sensitive To Coal

Rail traffic was on a tear in the first half of 2017, but it has not gotten off to a good start in 2018. For the week ended January 6, 2018 North America rail traffic was down 3.5% compared to the same week last year. Of the 10 carload commodity groups all showed a decline in traffic except Petroleum which was up over 6%. CSX's two largest carload groups are Industrial a (21% of total revenue) and Coal (18% of total revenue). North America rail traffic for both fell 2.2% and 5.5%, respectively. That could mean the outlook for rail traffic in Q1 2018 could be down.

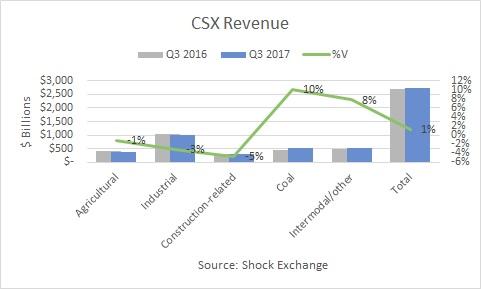

The company's Q3 revenue was up 1% Y/Y with Coal leading the way with 10% growth. Coal volume was up 5% Y/Y and was the only segment to demonstrate volume growth. International Coal volume increased as supply levels and favorable pricing conditions supported strong U.S. exports. Such exports offset a decline in U.S. volume.

Meanwhile, Industrial volume fell 5% due to a decline in crude-by-rail markets and a fall in North American vehicle production. Overall, I believe Coal will drive the narrative going forward; it has the potential to show out-sized growth in prices if China reduces its supply from North Korea amid geopolitical tensions.

Will CSX Reduce Its Cost Cutting Program?

Under former CEO Hunter Harrison CSX embarked on an aggressive cost cutting program. CSX laid off about 2,300 workers in 2017 and market chatter suggested more layoffs were to come. The layoffs raised two questions: How many layoffs are enough and would deep cuts to personnel hurt service levels and morale? I assumed CSX wanted to cut its 68% expense ratio to 58% in order to match Canadian Pacific's (CP), which is considered best-in-class. At Q3 2017 CSX's expense ratio was still around 68% so the company has a ways to go.

Questions over declining service quality were raised after management had to meet with the Surface Technology Board in Q3:

I think that we went through obviously some slippage service-wise in the third quarter, which we're not proud of, which we had a listening session last week with the Surface Transportation Board, with their team members. I think some of you were present. I think there was some mixed reporting there, but I can tell you this, I've been in this business a long time, and this company is back to where it was -- it's back to where it was, and it's better, and it's climbing, and I see those issues, generally speaking, behind us, which I'm very proud of that.

Two train derailments also did not help the company allay concerns about service quality. Whether these issues will result in a loss of business to other railroads or to the trucking industry remains to be seen. I expect management to speak to these concerns on the earnings call. Secondly, stagnant to declining revenue might make it difficult for CSX to maintain enough scale to put a dent in its expense ratio regardless of headcount reductions.

Harrison was expected to deliver a Canadian Pacific-like transformation at CSX. Is interim CEO Jim Foote the change agent Harrison had proven to be or will he abandon Harrison's cost-cutting measures? This will be a key question for the stock going forward.