Cotiviti Holdings IPO: Consider An Investment

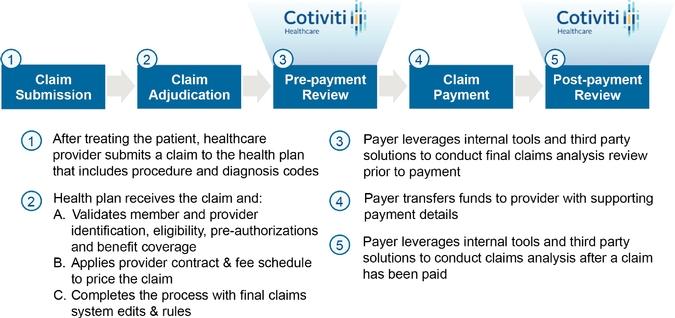

Cotiviti Holdings (Pending:COTV) filed an S1/A with the Securities and Exchange Commission on May 16 for its upcoming IPO. The company expects to raise up to $273.15 million. Cotiviti Holdings, based in Atlanta, Georgia, provides payment solutions that are analytics-based to ensure accuracy, primarily for the healthcare industry. The company serves more than 40 healthcare organizations, including Medicare, Medicaid and commercial managed healthcare plans. It also provides payment solutions to the retail industry, working with more than 40 retailers, including eight out of the top 10 largest retailers in the U.S.

Cotiviti Holdings plans to make an initial offering of 12.5 million shares of its class B common stock at a price range of $17 to $19. It will also have an over-allotment of an additional 1.875 million shares of its class B common stock that the underwriters can option to purchase within 30 days.

The underwriters include Goldman Sachs (NYSE:GS), JPMorgan Chase (NYSE:JPM), Baird, Barclays (NYSE:BCS), William Blair, Citigroup (NYSE:C), Credit Suisse (NYSE:CS), Morgan Stanley (NYSE:MS), RBC Capital Markets (NYSE:RBC) and SunTrust Robinson Humphrey.

Business Summary

Per its filings, Cotiviti Holdings was formed in 2014 through the merger of Connolly Superholdings, Inc., and iHealth Technologies, Inc. Connolly was a leader in providing post-payment solutions for accuracy while iHealth was a leader in providing pre-payment solutions for accuracy. The merger allowed Cotiviti Holdings to greatly expand its ability to provide solutions for its customers. The company reports it had total revenues of $541.3 million for 2015 and $142.7 million for the three-month period ending in March 2016. The company's net income for 2015 was $13.9 million and for the three-month period ending in March, $8.1 million.

Overview of the Executive Management

CEO Doug Williams served as the CEO of iHealth Technologies from its founding in 2001. Prior to that, Mr. Williams held a variety of strategic positions at Cigna Healthcare, Magellan Specialty Health and Vivra.

Chief medical officer and executive vice president Dr. Richard Pozen co-founded iHealth Technologies. He has more than 40 years of experience in the medical field, training at Montefiore Hospital and Georgetown University Hospital before serving on the faculty in the department of cardiology at the University of Miami. He founded Cardiology Network, Inc. and held leadership positions at Magellan Specialty Health and Vivra.

Financial Highlights and Potential Risks

Cotiviti has a market cap of $1,615.1 million. In the past 12 calendar months, the company has had total revenues of $564.4 million and a net income of $17.8 million. The company reported a net income of $13.9 million on $543.1 million of total revenue for 2015, a significant improvement over the $26 million loss on $441 million of total revenue for 2014.

The company reports potential risks as including improvements made by its clients in their own internal payment accuracy systems. It also indicates that its success depends on its ability to expand its reach into new payment systems and sell new solutions to its currently existing customer base. The company also indicates that interruptons to its systems could adversely impact the company's ability to do business. It also points to the risks involved with cybersecurity and hacking as the company deals with large volumes of sensitive data.

Conclusion: Buy COTV

As one of the largest payment auditors for the healthcare industry in the U.S., Cotiviti Holdings is currently in a good position. It increased both its total revenues and net incomes substantially from 2014 to 2015, and the first three months of 2016 demonstrate even more growth.

We think the Goldman-led IPO could be successful and suggest investors consider purchasing shares.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in COTV over the next 72 ...

more