Consider Applied Materials For Its High Book-To-Bill Ratio

Applied Materials (AMAT), the worldwide leader in the manufacturing of semiconductor equipment, reported on August 18, better than expected earnings per share results for its third quarter ended July 31, 2016. Moreover, the company surprised by saying that new orders were $3.66 billion, up 6 percent sequentially and up 26 percent year over year. New orders were also 35 percent above analyst expectations of only $2.71 billion. As a result, AMAT's shares soared 7.1% on the next trading day.

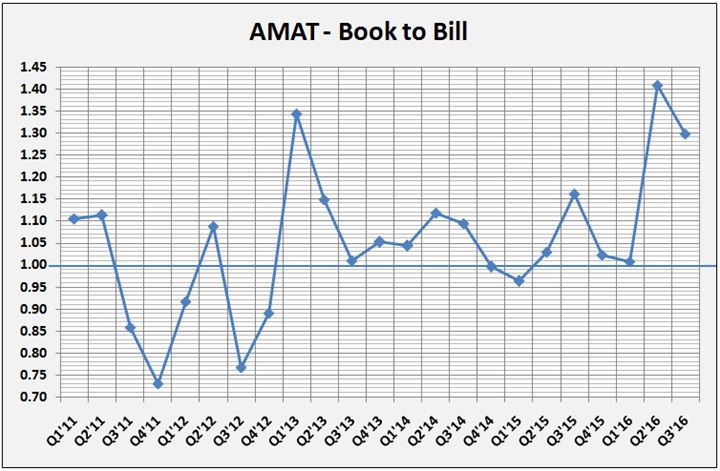

Book-to-Bill

One crucial parameter when analyzing a semiconductor company is the book to bill ratio, which is the ratio between new orders to actual sells. A book to bill greater than one means that new orders exceed sells. Applied's generated orders were $3.66 billion in the last quarter, and net sales were $2.82 billion, which gives a very high book to bill ratio of 1.30. Applied’s book-to-bill was in thirteen of its fifteen last quarters greater than one; this indicates growing demand for Applied’s products. The chart below shows Applied’s book-to-bill ratio for each quarter since 2011.

Applied Materials Stock Performance

Since the beginning of the year, AMAT's stock is already up 61.5% while the S&P 500 Index has increased 6.1%, and the Nasdaq Composite Index has also increased 6.1%. Since the beginning of 2012, AMAT's stock has gained 181.5%. In this period, the S&P 500 Index has increased 72.4%, and the Nasdaq Composite Index has risen 103.9%. According to TipRanks, the average target price of the top analysts is at $33.73, which indicates an upside of 11.9% from its September 30 close price, which appears reasonable, in my opinion.

AMAT Daily Chart

AMAT Weekly Chart

Charts: TradeStation Group, Inc.

Valuation

AMAT's valuation is good, the trailing P/E is at 23.78, and the forward P/E is low at 13.52. The price to free cash flow is at 22.18, the Enterprise Value/EBITDA ratio is at 15.34, and the PEG ratio is very low at 0.92.

Applied has recorded substantial EPS growth in the last few years. The company's annual average EPS growth over the last five years was at 10.1%, and the average annual estimated EPS growth for the next five years is very high at 18.2%.

Applied has been paying uninterrupted dividends since 2007. The annual dividend yield is at 1.33%, and the payout ratio is only 31.1%. The annual rate of dividend growth over the past five years was at 9.0%. However, Applied has not raised its quarterly dividend payment of $0.10 since May 2013.

Ranking

According to Portfolio123’s "Technamental" ranking system AMAT's stock is ranked first among all 66 S&P 500 tech stocks. The 20 top-ranked S&P 500 tech companies according to the ranking system are shown in the table below:

The "Technamental" ranking system is quite complex, and it is taking into account many factors like; valuation ratios, growth rates, profitability ratios, financial strength, efficiency ratios, technical factors and industry strength , as shown in the Portfolio123's chart below.

Back-testing over seventeen years has proved that this ranking system is very useful.

Summary

Applied Materials delivered better than expected third quarter results and surprised the market by saying that new orders were $3.66 billion, 35% better than analyst expectations. The company's book to bill ratio in the recent quarter was at 1.30, a book to bill ratio is a crucial parameter when analyzing a semiconductor company. AMAT's valuation is good; the PEG ratio is very low at 0.92, and the company generates strong cash flow and returns substantial capital to its shareholders by stock buyback and dividend payments. Moreover, AMAT's stock is ranked first among all 66 S&P 500 tech stocks, according to Portfolio123’s "Technamental" ranking system. The average target price of the top analysts is at $33.73, which indicates an upside of 11.9% from its September 30 close price, which appears reasonable, in my opinion.

I am long AMAT