Conatus Pharmaceuticals Up On Novartis Partnership But Run Might Be Just Beginning

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Recently Conatus Pharmaceuticals (CNAT) had announced that it had obtained a partnership with Novartis (NVS) to co-develop and possibly co-commercialize its drug Emricasan. This was announced in after-hours trade and the stock surged as much as 150% on this news. Before this announcement, the stock had been trading at around $1.91 per share valuing the company around $50 million in market cap. The deal made by Novartis to partner with Conatus involves the large interest for big pharmaceutical companies to get into the NASH space.

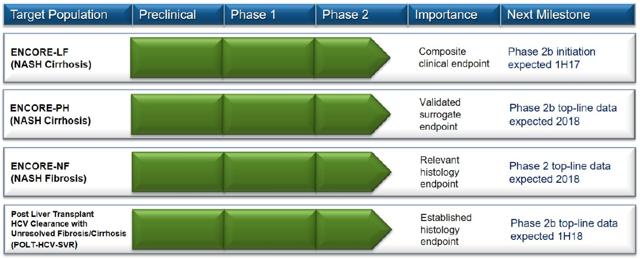

Back in 2016, there were many big pharma companies that wasted no time acquiring NASH biotech with rich pipelines. The reason why Conatus may have chosen not to sell itself is because management has stated, that its pan-caspase inhibitor Emricasan, can be used for other liver indications. Management has made it clear that it can use the cash for other acquisitions or develop a bigger pipeline targeting other liver etiologies. The deal was specifically for NASH Fibrosis and NASH Cirrhosis. That means Conatus can branch out to other liver diseases to build better value for its shareholders. This is the current pipeline in progress:

The reason why Conatus may have chosen not to sell itself is because management has stated, that its pan-caspase inhibitor Emricasan, can be used for other liver indications. Management has made it clear that it can use the cash for other acquisitions or develop a bigger pipeline targeting other liver etiologies. The deal was specifically for NASH Fibrosis and NASH Cirrhosis. That means Conatus can branch out to other liver diseases to build better value for its shareholders. This is the current pipeline in progress:

Major Deal

The deal allowed Conatus to receive an upfront payment of $50 million dollars. That was the first good part of the deal because this is cash that Novartis can't take back. If Novartis chooses to take the option to license Emricasan then Conatus is eligible to receive an additional $7 million in cash. In addition, if Conatus wants to it can also obtain up to $15 million in an upfront payment in the form of convertible promissory notes from Novartis. This all sounds very good but for the company, it is just the beginning. The deal is setup in such a way that Conatus has some freedom for other products.

The Deal Also entails other advantages such as:

- Shared investment cost - This means that Conatus will only be responsible for 50% of all phase 2b costs. Novartis will pay for the other half and that's a really good thing for any small-cap biotech company

- Full Phase 3 Cost - This is where Novartis will be responsible to pay the full cost of all phase 3 trials. Right now Conatus has 3 ongoing phase 2b clinical trials, with a fourth phase 2b trial on the way. If all these programs reach phase 3 Conatus will not be responsible to pay a dime on any of them. The whole burden of cost will be on Novartis

- Big Time Payment - This is where Conatus can earn a significant amount of development, regulatory, and commercial milestones. The amount of payment isn't small either. If Novartis chooses to take the option that will trigger the ability for Conatus to earn up to $650 million in cash as certain milestones are met.

- Double-digit sales - If Emricasan makes it to the market the single agent therapy will allow Conatus to earn up to double-digit tiered royalty sales.

- Single-digit sales - If Emricasan is properly developed as a combination therapy with Novartis' drug then Conatus is eligible for single-digit tiered royalty sales

- Share the wealth - Conatus has left itself in good shape with respect to this deal. It has the option to co-commercialize Emricasan in the United States if it chooses to do so. Depending upon the liver disease market it has the option to obtain additional profit and that's a good thing

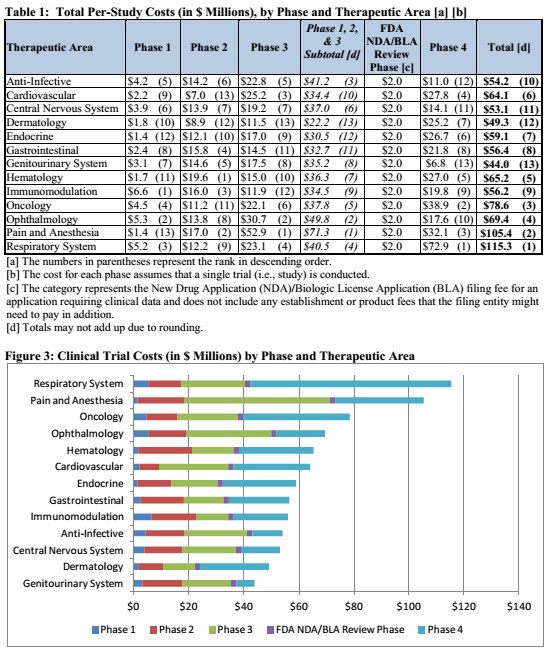

This deal has a lot of good stuff in it. The best part of the deal would be the potential to earn $650 million in cash over time, but there is something else that will help substantially. That is the fact that Novartis will be fully responsible for all phase 3 costs. This is a major point because on average a phase 3 trial cost a lot of money. This is evidenced by the graphic below:

As observed in both graphics above, the cost of a phase 3 trial is largely dependent upon what the target indication is. But taking a look at the phase 3 costs in the charts above, the average would be around $21.8 million. Keep in mind that probably accounts for the average. In addition, it also depends on other factors such as the recruited patient population. That is that phase 3 trials can range from 300 patients up to 1,500 patients or more. In that case the range of a phase 3 could cost more. For the sake of argument lets say Conatus was to run four phase 3 ENCORE liver disease trials on its own and have to pay the average cost for each. Four clinical trials costing an average of $21.8 million each would mean a final cost of $87.2 million. Now, with Novartis being fully responsible for all the phase 3 trial costs Conatus would save that much in its cash reserves. That means Conatus doesn't have to dilute shareholders and has enough cash to run its company until 2019. It still has to pay for half the costs of the phase 2b trials but most those trials are near completion anyways. In addition, as noted above CNAT received an upfront payment of $50 million with the potential to earn an additional $7 million if Novartis takes the option to license Emricasan. Excluding the potential to earn $650 million over time with clinical milestones, Conatus has enough cash until 2019.

One Condition

The main reason why Novartis chose to partner with Emricasan was that the drug targets an unmet medical need. A second reason would be that Emricasan, being a pan-caspase inhibitor, may have synergistic effects with Novartis' FXR agonists drugs. Both of these points will be explored fully below. For Novartis to choose to license Emricasan all Conatus has to do is start the phase 2b Liver Cirrhosis -- LC -- trial by the 1st half of 2017. If you take a look at other deals that require an option to license a drug big pharma puts strict contingencies. In this case, all Conatus has to do is start the phase 2b LC trial on time and then Novartis will choose if it wants to license the drug. This is an important milestone and one that will likely move the share price. This is because if Novartis licenses Emricasan that opens the ability for Conatus to earn up to $650 million in milestone payments over time.

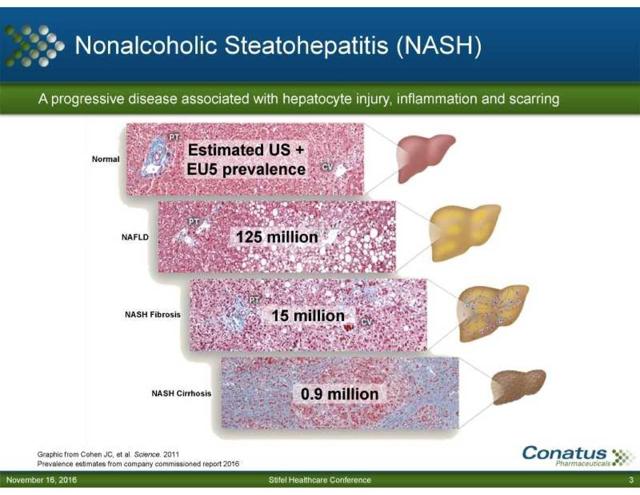

Liver Cirrhosis

Liver Cirrhosis is a deadly disease, one in which where there aren't many treatment options available for patients. The main treatment option now for a liver cirrhosis patient is a liver transplant. While a decent option, there are several problems that arise with respect to this option. For starters, there is a liver transplant wait list. Why is this a problem? Liver Cirrhosis claims the lives of 36,000 U.S. patients each year. As shown in the graph below worldwide there are an estimated 900,000 or more patients who have Liver Cirrhosis:

There are 7,000 liver transplants done on a yearly level. The problem with this is that there are 15,000 patients or more on the U.S. liver transplant wait list. This does not give a good outlook for patients that have to wait for a liver transplant. It is even possible that such patients might not live long enough to ever receive a liver transplant. According to the U.K. National Health Services, the average wait time for a liver transplant as an adult is 145 days and 72 days as a child. Living with a liver disease is bad enough as it is, but these patients also have to deal with the anxiety, stress, and other mental issues that go with it. This is strictly because of the wait list. These patients not knowing whether or not they will live long enough for a transplant is a tough event for them to handle. That is why there are support groups specifically set up to help patients deal with this mental issue.

This is why Conatus Pharmaceuticals has to shine because it gives patients another treatment option. One in which they won't have to wait on a list for. Conatus is the only one of two biotech companies in development for a drug for Liver Cirrhosis with Emricasan. There is another drug in development for Liver Cirrhosis and that stems from a small-cap biotech company known as Galectin Therapeutics (GALT). Galectin has an ongoing trial in Liver Cirrhosis that is currently in phase 2 testing. It is testing its IV drug GR-MD-02 to treat portal hypertension in patients with NASH Cirrhosis. The trial is known as NASH-CX and has enrolled an estimated 156 patients. Results of this trial will be known by October 2017 according to the Galectin trial part of the clinicaltrials.gov website. While this may directly compete with Conatus, there is one major setback that GR-MD-02 has suffered. That was the fact that it had failed a phase 2a study in patients with advanced NASH fibrosis back in September of 2016. This means that Galectin has to achieve success with this trial if it wants to compete in the NASH Cirrhosis disease space.

Both Conatus and Galectin Therapeutics are the only two biotech companies working to find a functional treatment for Liver Cirrhosis. It would be ideal for some type of relief to come for these patients so they don't have to rely on a wait list.

Liver Function

A severely decompensated liver is a very bad thing to occur for anyone. That is because the liver is largely responsible for many functions in the human body. One can't hope to function without having a properly working liver. This is why if Emricasan achieves its endpoints in the ongoing clinical trials, it will change the paradigm in liver cirrhosis care for a long time to come. So just how important is the liver in the human body? Well many of these points illustrate why a fully functioning liver is important:

The Liver can......

- Allow the body to easily fight off infections by removing bacteria from the blood

- Remove some toxic byproducts of certain medications given to patient

- Makes bile -- acid structure -- to digest fats. this helps with the absorption of Vitamin D, A, E, and K

- Make a large majority of proteins that the body needs

- Breakdown food for nutrients that the body can use for energy

Emricasan Mechanism Of Action

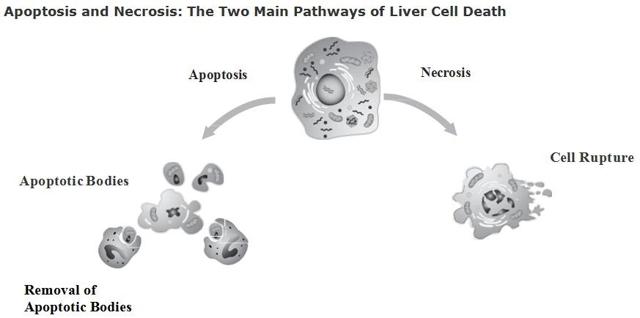

To understand what the Emricasan drug is built to do, there must be an understanding of what occurs in liver cirrhosis or liver disease. The liver is good at self-healing on its own but when many problems -- known as insults in the liver disease world -- occur it can create a tough environment. One in which the liver has a hard time healing itself. A liver that is damaged by an insult -- whether it be Hepatitis C, inflammation, etc. -- has to heal itself using collagen fibers. The fibers form in between the cells and cause the fibrosis effect of NASH. The liver must launch all these collagen fibers in hopes of repairing the liver, but with so much damage it fails to do so. In other words, the excessive amount of collagen fibers because more harm than good leading to NASH fibrosis. Once the collagen fibers reach the scarring phase in the liver it is known as NASH cirrhosis. This greatly impacts liver function in the body as noted above on the "liver function" portion of this article. The main issue with NASH fibrosis and Cirrhosis is "apoptosis" or programmed cell death. When these cells die it causes the liver to attempt to repair itself with collagen fibers. The apoptosis situation is explained in the graphic below:

With apoptosis occurring it is difficult for the liver to heal itself. That is where Emricasan comes into play. This mechanism of action is that it is a pan-caspase inhibitor. By Emricasan halting apoptosis or cell death, it might reduce both inflammation and fibrosis in the liver. Think about that for a second. The collagen fibers are responsible for the fibrosis and eventual scarring to liver cirrhosis. If Emricasan can halt or stop apoptosis that would reduce the amount of collagen fibers being formed in the liver. With a reduction in the amount of collagen fibers being formed that would cause two good things to happen. First, there would be less fibrosis/cirrhosis in the liver. Secondly, it would give a chance for the liver to heal itself. Remember, as noted above, the liver always attempts to heal or repair itself. If Emricasan works by stopping or halting apoptosis, then the liver has the freedom to heal itself. The whole point of Emricasan is that the longer a patient takes the drug, the more it works. That's the beauty of the drug itself. The more it is taken, the more it continues to work on bringing back the liver to where it can function. That is Conatus' hope as well. It hopes that by patients taking Emricasan it can eventually lead the NASH Fibrosis, NASH Cirrhosis back to a normal functioning liver over time. This is all great but how exactly does Conatus measure the amount of cell death in the liver? It is measured by a liver protein called Cytokeratin 18 -- CK18. During Apoptosis the CK18 is cleaved in the liver by caspases and then released into the patient's bloodstream. In other words, liver cirrhosis/fibrosis can be measured with a simple blood test. Conatus has run many clinical trials with Emricasan in over 650 patients to date and CK18 has shown to be elevated in the blood of all the patients with Liver cirrhosis.

Novartis Involvement

One could speculate all day on why Novartis chose to partner with Conatus but there are two important aspects to consider. The first of which is the fact that, as noted above, besides GR-MD-02, Emricasan is the only oral drug being developed to treat Liver Cirrhosis. There is, however, one other good reason. That reason involves the fact that Emricasan may have synergistic effects with Novartis' FXR agonist drug. This is what the Chief Scientific Officer of Novartis, Vasant Narasimhan, had to say about the partnership:

"Our collaboration with Conatus is a major step forward to delivering innovative oral treatments for NASH patients, who are in urgent need of new approved options"

In addition, he also stated that:

"Emricasan shows great promise as a single agent and in potential combination with our internal FXR agonists as a treatment for NASH patients"

The whole thing that Novartis wants is to be able to test its FXR agonist together with Emricasan. The whole goal is for Conatus to run all its phase 2b trials to completion. Once such programs reach completion, Novartis intends to run Emricasan in phase 3 trials as both a single agent and in combination with its FXR agonist.

Novartis currently has its FXR agonist in phase 2 clinical trial. The mechanism of action of its Farnesoid X Receptor is that it has been shown to be able to reduce fat, inflammation, and fibrosis in the liver. This clinical trial has already received Fast Track status from the FDA. So what makes this FXR agonist better than other NASH drugs currently in clinical development? Simply the fact that it is a non-bile acid. With it being a non-bile acid it doesn't run into the problematic side effects observed in Intercept Pharmaceuticals (ICPT ) OCA drug which is an obeticholic acid. Such an acid has shown to work good in NASH Fibrosis patients but has terrible side effects. Such problematic side effects observed in Intercept's trial are severe itching and serious cardiovascular events.

With Novartis' FXR agonist being a non-acid form of treatment, and being safe it is able to explore a possible combination therapy together with Emricasan -- which has also shown to be safe. This might work well but more testing will be needed to determine how good of a synergy can be achieved by the combination. It makes perfect sense though because Emricasan will attempt to halt apoptosis and inflammation. On the flip side, the FXR agonist will be responsible for reducing fibrosis and inflammation on the liver. The combination of the two drugs from each company might yield a better product than the two agents alone. Even Conatus agrees as the CEO Steven Mento has stated many times in presentations that the future of NASH care will probably be in combination therapies just like the Hepatitis C market. Of course, that point will have to be tested and analyzed further.

Clinical Trials

As noted before there are three clinical trials currently ongoing and one set to start in the 1st half of 2017. These trials are:

- POLT-HCV-SVR -- This is testing patients post liver transplant with Hepatitis C clearance who have unresolved fibrosis/cirrhosis

- ENCORE-NF --Deals with patients that have NASH Fibrosis

- ENCORE-PH -- Deals with patients that have NASH Cirrhosis but severe portal hypertension -- veins in liver constricted

- ENORE-LF -- Not yet started, expected to start in 1st half 2017 to treat patients with NASH cirrhosis

A few of these trials will be discussed below. With ENCORE-PH being similar to ENORE-LF both will be discussed accordingly as they both treat NASH Cirrhosis with a minor difference.

ENCORE-PH

The ENCORE-PH trial will be recruiting a total of 240 patients that have Liver Cirrhosis. These patients though will have extreme portal hypertension. That is that the trial will only recruit patients with HVPG greater than or equal to 12. The trial will test the mean HVPG change from baseline as compared to a placebo. Patients will be randomized to receive 5mg, 25mg, 50mg of Emricasan or a placebo instead. The patients will be dosed for a 24-week period. The thing to understand about this trial is that these Liver Cirrhosis patients have portal hypertension in the liver. That means that so much apoptosis and scarring has occurred in the liver that the blood vessels have been constructed. This forces the liver to create new veins around the liver that sometimes rupture. The whole point of Emricasan in this study is to be able to restore function to the constricted veins. By reducing scarring and cell death the veins might have breathing room to function again, and that is what is being tested in this trial. As noted above the ENCORE-PH is similar to the ENCORE-LF. The ENCORE-LF, which has yet to begin, will test patients with Liver Cirrhosis in general.

ENCORE-NF

This is another important trial to talk about. The ENCORE-PH and ENCORE-LF will be important trials as well but they carry one major advantage. That is that there is no other oral drug being developed for Liver Cirrhosis. That means if both of those trials are successful there is no competition. That does depend though upon an IV drug by Galectin failing to meet the endpoint in October 2017. That remains to be seen, but most in the biotech industry will be watching to see if Galectin has an ace up its sleeve. The ENCORE-NF trial, on the other hand, will have a lot of competition. There are about 20 or more biotech companies developing a treatment for NASH Fibrosis. Two of the big major players are Genfit (GNFTF) and Intercept Pharmaceuticals. These will be further discussed in the "competitors subsection" below. The ENCORE-NF trial is set to recruit a total of 330 patients with confirmed NASH CRN fibrosis stage 1 to 3. The patients will be treated over a 72-week period with either 5mg, 50mg of Emricasan, or placebo. The primary endpoint of the study is an improvement in fibrosis by at least one stage versus placebo without worsening of steatohepatitis using NASH CRN. The key point with this study is to reduce fibrosis in these patients. Whether these results turn out better than other already reported phase 2 results from NASH trials remains to be seen. There is, however, one important thing to be bullish about. That is that the NASH Cirrhosis trials, which are more severe than NASH fibrosis, are using 25mg up to 50mg bid dosing. The ENORE-NF trial is using 50mg dosing, but management has put in place a lower 5mg bid dose. It believes that the 5mg dose might be sufficient enough to achieve statistically significant results. The 50mg bid dosing was put in place just in case the 5mg dose is not enough. But that seems highly bullish that management thinks that Emricasan is so strong that it can probably work in NASH Fibrosis patients with such a small dose of 5mg instead of needing higher doses.

ENORE Trials

The whole ENCORE trials carry a lot of risk, but the good news here is that management is cautious. That's a good thing. For instance, in the trials above treatment is brought out to many weeks. The ENCORE-NF trial is 72 weeks of treatment. The ENCORE-PH is 24 weeks of treatment, and the POLT-HCV-SVR is 2 years of dosing. The second good aspect of the clinical trials is that they are reduced in risk. That is the fact that the trials are being done with 2 to 3 different doses of Emricasan against placebo. This doesn't guarantee success, but it at least reduces risk slightly. The more doses there are, the more shots on goal there are to achieve clinical success against the placebo.

Analyzing Ad Hoc Data

Novartis may have liked the synergistic possibilities and the fact that Emricasan is the only oral drug in development for Liver Cirrhosis. The point is that Novartis more than likely did their homework before shelling out $50 million upfront to Conatus, with the potential to earn $650 million over time. This could have been done with respect to ad hoc data that Conatus released back in January of 2016. This data will be analyzed in this section. It will give a little more insight into preliminary data that showed some clinical activity against NASH diseases. It could also explain why Novartis chose to partner with Conatus as well.

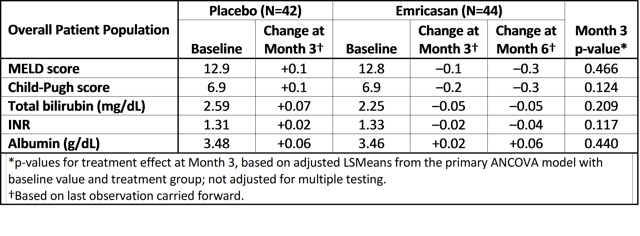

The first item to take a look at is ad hoc data for the treatment of all cirrhosis related patients up to the 6 months time point. These patients continued to show directional improvement compared to baseline from placebo at both the 3-month and 6-month time points. That is that Emricasan performed better than placebo at both time points. This concept is illustrated in the chart below:

If you look at the chart above you can see two distinct points comparing Emricasan and placebo. Patients that take the placebo compound get a +0.1 from baseline in the MELD score, that means they got worse. On the other hand, patients that took Emricasan improved with a -0.1 score from baseline. The negative score means a reduction in the liver disease which means patients got better. What's most important with the data above is the change from month 3 to month 6 in the Emricasan group. Those patients showed a nice improvement going from a -0.1 to a -0.3 score. Both MELD -- Model for End-Stage Liver Disease -- and Child-Pugh Score are tools used to determine mortality rates in patients with Liver Cirrhosis. One thing many will notice is that the p-values are close to 0.1 but not actually there. There is a reason for this happening. As mentioned before the way Emricasan works is that the more a patient takes the drug the better the improvement will come over time. Well, the data evaluated in the graph above is only for the 3-month p-value. The 6-month p-value has yet to be released or evaluated. It is possible that the directional improvement from baseline to month 6 could show statistical significance or be close to it. That point could be argued all day but there is one thing to keep in mind. The p-value above is calculated only for 3 months of treatment with Emricasan. The ENCORE trials described thus far are set to treat patients over a 24-week, 72-week, 2 year period respectively -- 96-weeks. If Emricasan has close to statistical significance at month 3 p-values, then there is a high likelihood that by a year or more the trial should reach statistical significance. This is what the current phase 2b trials are testing for. There is no guarantee that it will happen, but it does make sense in a way for directional improvement.

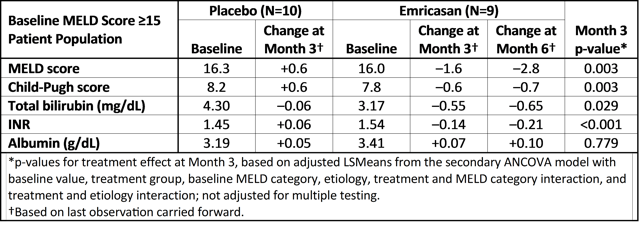

Putting aside the above data, Conatus noticed something even more good that Novartis probably saw as well. That was the subgroup analysis from the ad-hoc data. The subgroup analysis was performed on patients with a MELD score of greater than or equal to 15. That means these patients were sicker than the analysis shown right above in the overall patient group. This new chart showing the subgroup analysis can be seen below:

Again the chart above only shows the p-value measured at months 3. But this time after 3 months of treatment these patients who were really sick with high MELD scores of 15 or higher, showed statistically significant improvement after taking Emricasan. That is that, as shown above, both the MELD score and Child-pugh scores achieved statistical significance in the Emricasan group. Why is this important? Because compared to the other patient groups, these are the ones that have a severely decompensated liver. That's not to say that the patients with MELD scores of less than 15 are not important but most patients above 15 are classified as being in danger of having increased mortality. This can be explained with the next chart below:

| MELD Score | Percentage | Mortality Rate |

| 40 or more | 71% | 3 months |

| 30 to 39 | 53% | 3 months |

| 20 to 29 | 20% | 3 months |

| 15 or below | 2% to 6% | 3 months |

What this chart above displays is that the higher the MELD score a patient has the greater the mortality rate. As noticed in the graphic above this one the patients that were treated with Emricasan that had a MELD score of 15 or higher all achieved statistical significance after 3 months of treatment. We don't know what the MELD scores were, they could have been anything 15 and above. The point stands that Emricasan helped the sickest bunch of the Cirrhosis patients compared to placebo. Taking a look at the graphic directly above patients with a MELD score of 40 or more have a 71% chance that they will not survive the next 3 months and so on. What this means is that Emricasan, in the sub-group analysis, was able to help improve patients with a higher MELD score than 15. That could eventually translate to reduced mortality rates for these patients with a severe liver disease, and may not need to rely on a liver transplant. Speaking of MELD score, that is exactly what Doctors use along with some other measurements to determine what patients should be placed on the top of a liver transplant wait list.

Competitors

There are no competitors for Conatus in the NASH Cirrhosis space. However, there are plenty of competitors in the NASH Fibrosis space. This section will explore the two big competitors that have seen the best results to date in the NASH Fibrosis space, and that have completed up to phase 2 trials. To this date there are no FDA-approved drugs for NASH Fibrosis.

The first pharmaceutical company that saw amazing results in its phase 2 trial against NASH Fibrosis was Intercept Pharmaceuticals. Back in August of 2014, the phase 2 trial known as FLINT was stopped early by the FDA because patients taking OCA treatment achieved statistically significant results in an interim look. The stock rose 60% at first in after-hours hitting a high of $378.50 per share. In the days ahead, the stock breached a high of $462 per share. The stock since has been trading lower, currently trading at around $114.37 per share. The main reason for falling so much is that while the study achieved statistically significant results investors were worried about two safety issues. The first is severe itching in some patients and the other was elevated cardiovascular risks. The phase 2 trial showed that the primary endpoint of the NAFLD Activity Score with no increase in liver scarring was statistically significant. That is that 46% of patients responded in the OCA group, compared to only 21% in the placebo group. Again, these results are amazing, but the safety issue continues to weigh down the stock.

The second company seems to have a decent efficacy profile in NASH Fibrosis, but a better safety profile compared to Intercept. This pharmaceutical company is a French company by the name of Genfit. It too had decent phase 2b study data for the treatment of patients with NASH Fibrosis. The problem is that its decent results only stem from a sub-analysis group of patients. With its first phase 2 trial showing placebo being stronger. Genfit then analyzed data and has showed that a subgroup of 120 patients with a higher dose of 120 mg/d achieved significant results on the primary endpoint of the study compared to placebo with a p-value of p = 0.01. That is that 29% of patients responded with Genfit's Elabfibranor compared to only 5% of the patients in the placebo group.

Taking a look at both these competitors in the NASH Fibrosis space, they each established efficacy in phase 2 trials. They are each now currently running phase 3 trials with higher patient populations to determine if the efficacy thesis on their compounds hold true against NASH Fibrosis. The Genfit trial as shown here on the clinical trials website it set to report results sometime in 2021. The reason for taking so long is that it is estimated to enroll up to 2000 patients. The Intercept phase 3 trial shown here is also set to list results in 2021 as well. It is also going to recruit up to 2000 patients as well. What makes Conatus special is that the fact that the phase 2 results haven't been reported yet. This might give it a significant advantage. Nobody knows if the results will be good or bad for Conatus, but the company has stated that if the results are really good then it might be able to seek regulatory approval without the need of phase 3. Of course, this all depends upon how good the results are and what ends up being decided after the company meets with the FDA.

Financials

According to the 10-Q SEC filing Conatus reported on November 8, 2016, that it had $31.1 million in cash as of September 30, 2016. In addition, since inception, the company has been continuing to obtain a deficit. Conatus has continued to obtain a deficit totaling $145 million since the company started. When this 10-Q SEC report was filed on November 8, 2016, it stated that it had sufficient capital to last for at least 12 months of operations. That estimate was with the reported cash of $31.1 million and all ongoing phase 2b ENCORE clinical trials.

With this potential Novartis deal, things just changed drastically. That is because of the infusion of $50 million in cash that was already received by Conatus. Adding the $50 million received from Novartis with the prior cash flow of $31.1 million brings the total cash to $81.1 million. If Novartis chooses to license Emricasan that would add an additional $7 million as well, bringing the total cash to $88.1 million. With this new cash on hand Conatus then changed the amount of time it has for ongoing operations, and that is a huge positive for shareholders. The estimate now is that Conatus has enough cash to last until 2019. With a majority of the catalysts coming into play in 2018, this gives the company plenty of breathing room.

The good news is that even with the cash only lasting until 2019, there is the added possibility of milestone payments from Novartis up to $650 million. If the company estimated that $31.1 million of cash would be sufficient for 12 months that would give it a burn rate of $31.1/12 = 2.6. That means that there was a burn rate of $2.6 million cash in place before the deal. With Novartis assuming half of the costs of the phase 2b trials that could bring the burn rate down to approximately $1.3 million per month, for a total 12 month or yearly burn rate of $15.6 million. This added money could be used by the company for many years to come. This is pending positive milestone payments being received.

As noted before, Novartis would also be responsible for taking all costs associated with all the phase 3 trials. That means that no burn rate would be necessary for Conatus if all ENCORE trials make it through phase 3. Of course, that could all change because Conatus has noted that it will reveal new programs that it will add to its pipeline to increase shareholder value in the coming year. This means it will either acquire a new drug product or expand to other liver diseases. Remember, according to the deal Conatus still has limited options to target other liver diseases with Emricasan. This funding will definitely be easy if milestones are met with the added $650 million in payments. Conatus at that point, will not have to worry about raising any additional capital.

NASH Market Potential

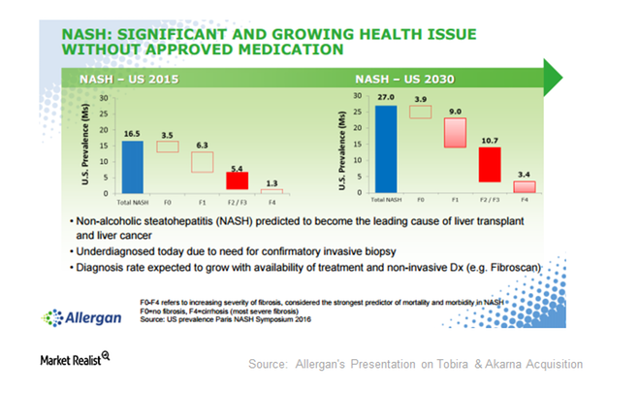

The potential market in both NASH Fibrosis and NASH Cirrhosis is huge. Just taking a look at the NASH fibrosis market is more than enough to garner a lot of interest from big pharmaceutical companies. Allergan (NYSE: AGN) back in September of 2016 paid $1.7 billion to acquire Tobira Therapeutics. Tobira had finished up a phase 2 trial in NASH Fibrosis that missed its primary endpoint of the study. The primary endpoint of the study was to improve the NAFLD activity score in NASH patients. That NAFLD activity score tracks inflammation and liver damage. If that is the case then why was it bought out? That is because the trial met its secondary endpoint of the study which was an improvement of fibrosis in the liver. Fibrosis of the liver meaning scarring of the liver due to NASH. The trial showed that patients taking Tobira's cenicriviroc drug achieved statistically significant improvement of scarring of the liver. The company noted that was an endpoint that the FDA agrees is sufficient for approval. With that in mind, Tobira had decided to move on to a phase 3 trial. The secondary endpoint being met by Tobira was in July of 2016, and then the company was bought out a few months thereafter by Allergan. Allergan cited the important market potential for NASH fibrosis as seen in the picture below:

Allergan makes the case on why it spent so much much to acquire Tobira. Paying $1.7 billion to acquire the company may seem like a lot. The truth is that Allergan estimates that the market potential for NASH could reach $8 to $10 billion. That means if Allergan's NASH drug is ultimately approved by the FDA it will make back its acquisition cost and then some. It is estimated that NASH affects between 2% to 5% of the total American population. Many analysts estimate that over time the market could reach around $40 billion by the year 2025. This makes it a lucrative market, with the possibility to house multiple players. Nobody knows which biotech will get to market first, but there will be plenty of room for multiple players. For Conatus it all depends upon the trial results which are set to come rolling out starting early 2018. That is the inflection point, and depending upon the data could garner quicker approval by the FDA.

Valuation

Conatus Pharmaceuticals currently trades at $4.61 per share at the time of this writing. That gives the company a market cap of $119.86 million. There is potential upside here, and that value hasn't been realized yet because the entire deal hasn't gone through yet. Remember, Novartis will only decide to take the deal once Conatus starts its phase 2b LC trial. The trial itself is expected to start by the 1st half of 2017. The potential upside comes from the belief that Conatus would receive payments each time a milestone is met. Well, if Novartis chooses to license Emricasan then it would make sense to value Conatus with a higher market cap. The addition of cash should bring the market cap higher close to around $500 million or more. That would value the company at around $23.05 per share on the lower end. One day after Conatus revealed its partnership deal with Novartis, Suntrust raised its price target on the company from $17 per share to $26 per share with a buy rating. This number comes close to my calculated figure of $23.05 per share pending that the Novartis deal goes through. It is pretty clear that over time as Conatus earns the milestone payments it should not stay valued with a market cap of only $119.86 million. In addition, the results coming in 2018 will tell a large story. If Emricasan is proven to work in Liver diseases that should raise the market cap substantially. Taking into account Allergan's estimate, which indicates that a NASH drug could yield the potential to earn up to $8 to $10 billion, that would quickly change the scope of Conatus. Lets evaluate Conatus with one of its peers Intercept Pharmaceuticals. Intercept currently has a market cap of $2.73 billion. If we tack on that market cap of $2.73 billion to Conatus for a successful phase 2b NASH trial in 2018 that would give it a share price of $119.86 per share. Remember this is only pending a positive phase 2b NASH fibrosis report in 2018. That is not adding in the other NASH Cirrhosis trials. As you can see the potential upside greatly overshadows the low risk in place. If Emricasan fails as a drug then the share price could tumble down to a low of $1 or $2 per share. The loss will depend upon where it trades before the major catalysts are announced. The fact still remains that the risk/reward scenario with Conatus is highly attractive at this point in time. A Novartis license should be sufficient to bring the share price to $23.05 per share which represents an increase of 421% from the current price of $4.61 per share. That means in the short term investors could expect an increase of ($23.05 - $4.61 / 4.61) = 421%. For those holding long term if the price eventually reaches higher than $100 per share on positive phase 2b results, the increase would be higher than a 1,000% return. In order for that to happen the NASH fibrosis trial would have to be successful in phase 2 with statistical significance. Like all biotech, it is very risky because the drug could end up failing. Still, that doesn't dismiss that right now the potential gain greatly outweighs the minimal risk of losing $4.61 per share.

Catalysts

- ENCORE-LF NASH Cirrhosis trial -- Set to begin 1st half 2017

- Potential for Novartis to take option to license Emricasan in 2017

- ENCORE-PH NASH Cirrhosis trial -- To report top-line results by 2018

- ENCORE-NF NASH Fibrosis trial -- To report top-line results by 2018

- ENCORE-POLT-HCV-SVR -- To report top-line results by 1st half 2018

Risks

As With many biotechnology companies, there are a lot of significant risks involved. The dependency of success will largely depend on several factors:

- The Conatus partnership with Novartis will only happen if the phase 2b LC trial starts on time

- The deal can blow over even if the phase 2b trial starts. That is if Novartis chooses not to take the option to license Emricasan

- The short-term movement of the stock is very volatile in trading. One must take a long-term approach to investing in the stock

- Most of the results won't happen until 2018, until then the stock may be easily manipulated in either direction

- There is no guarantee that the phase 2b results will yield positive efficacy against all targets

- The company relies on one drug in the pipeline to treat multiple liver diseases. There is a lot of risk involved as it is the only drug in the pipeline

- Even if Emricasan shows positive phase 2b results, it doesn't guarantee success in phase 3 clinical trials

- If Emricasan is eventually proven in phase 3 results there can be no assurance that the FDA will approve the drug in its certain form

- NASH Fibrosis space has 20 or more biotech developing drugs for treatment. There is no guarantee that Emricasan will achieve better results over other drug types in the same industry

- Even with positive results in 2018, there is no guarantee that the stock price will move accordingly

Conclusion

Conatus has one major milestone in place for 2017 that could bring a substantial gain of 400% or more. This milestone is Novartis taking the option to license Emricasan. More gains can be observed in 2018 pending positive phase 2b results in both the ENCORE-NF, ENCORE, POLT-HCV-SVR AND ENCORE-PH trials currently ongoing. A successful drug would target unmet medical needs in both NASH fibrosis and NASH cirrhosis. This would reduce and or eliminate the need for liver transplants. The added capital will help to fund new clinical programs that Conatus would like to explore. This stock pick is a great pick that has a lot of potential in both 2017 and 2018. The NASH market is heating up with many acquisitions in the field. With Conatus trading currently at $4.61 per share or with a market cap of $119.86 million it makes it an attractive speculative investment opportunity.

Disclosure: I am Long CNAT.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is ...

more