Cincinnati Financial: A High-Quality But Expensive Dividend King

The last financial crisis made many financial corporations cut their dividends, but Cincinnati Financial (CINF) managed to keep its dividend growth streak alive. The company has raised its payout for 57 years in a row, which makes the insurance company one of the Dividend Kings.

Cincinnati Financial’s dividend yield is substantially higher than that of the broad market, but shares are not very cheap right here. The growth outlook is compelling and investors will likely see solid total returns going forward.

Business Overview

Cincinnati Financial isn’t the biggest insurance company by far: Others like Chubb (CB), Prudential (PRU), ING (ING) or AIG (AIG) are substantially bigger. Cincinnati Financial has nevertheless managed to perform extremely well over the decades, providing an 11,800% total return since going public.

Dividends, which have been rising over the last 57 years, and which include stock dividends and special dividends, have played a major role in the company’s great returns in the past.

(Click on image to enlarge)

Source: Cincinnati Financial presentation

Cincinnati Financial’s insurance business is focused on the commercial sector, where the company generates about two thirds of its premiums. One quarter of Cincinnati Financial’s revenues are derived from personal insurance, whereas life insurance and reinsurance make up just a small amount of premiums.

Cincinnati Financial is focused on growing the business in the long run, through book value growth and rising investment income. Shareholders are participating via rising dividends, and since insurance companies oftentimes trade based on their book value, share prices are rising as well.

Growth Prospects

When it comes to the company’s earnings, Cincinnati Financial has several avenues for growth. The first one is premium growth, which is primarily achieved through a rising number of agencies. Cincinnati Financial has increased the number of agencies it cooperates with by more than 40% since 2009, spanning 42 states. This means that there is still some potential for geographic expansion in the US, and once the company is active in all markets it can increase its market share.

Agencies the company has been working with for a long time are the ones who are most profitable for Cincinnati Financial:

(Click on image to enlarge)

Source: Cincinnati Financial presentation

The company benefits from a rising market share the longer it works with an agency. The big increase in the number of agencies the company works with over the last couple of years should result in a big premium growth rate over the coming years, as Cincinnati Financial’s market share rises at these relatively new locations.

Rising premiums allow for margin increases, as many of the company’s costs are more or less fixed. Higher premiums and flat costs therefore lead to growing operating earnings.

On top of that Cincinnati Financial’s investment income keeps growing at an attractive pace as well. This is partially due to the fact that the company is putting a lot of its investment money (36%) into stocks, which, on average, are a more profitable asset class compared to bonds.

Cincinnati Financial also benefits from rising interest rates, as the money the company invests into bonds (government bonds as well as corporate bonds) will produce higher returns going forward.

Yields for two and ten year treasuries as well as for high grade bonds are at five year highs right now. This means that Cincinnati Financial (as well as other bond investors) can produce significantly higher investment income going forward compared to the returns generated in the past.

Cincinnati Financial keeps an eye on diversifying its assets, among its stock portfolio no single company’s shares make up more than 4% of its investments. The same principle is true for Cincinnati Financial’s bond portfolio, where no corporate exposure is higher than 0.7% of the total bond portfolio. With no excessive reliance on the success of one single company Cincinnati Financial’s investment income is relatively robust.

Analysts are forecasting an eight percent EPS growth rate over the coming years, which seems realistic based on the above factors: Premium growth, margin expansion (operating leverage) and higher investment income should be able to drive the company’s earnings going forward.

Competitive Advantages & Recession Performance

Cincinnati Financial isn’t the biggest insurance company by far, and yet it has a very strong track record. Unlike many other financial companies, including peer AIG, Cincinnati Financial wasn’t forced to cut its dividend during the last financial crisis.

Cincinnati Financial’s earnings were impacted during the last financial crisis, but not completely wiped out — and the company avoided heavy losses that hurt shareholders of many other companies. Compared to other financial corporations Cincinnati Financial fared rather well.

Earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $3.54

- 2008 earnings-per-share of $2.10 (41% decline)

- 2009 earnings-per-share of $1.32 (37% decline)

- 2010 earnings-per-share of $1.68 (27% increase)

As you can see, earnings declined significantly from 2008-2010. That said, it did remain profitable during the recession, which allowed it to continue increasing dividends each year. And, the company enjoyed a strong recovery in 2010 and thereafter, once the recession ended.

This solid (relative) performance during the last financial crisis and the strong long term track record can be explained by the company’s focus on delivering value in the long run. Unlike other financial corporations Cincinnati Financial did not engage in very risky bets in the past, and has kept its balance sheet very strong.

Cincinnati Financial carries a BBB+ credit rating from Standard & Poor’s, and a credit rating of A3 from Moody’s.

This focus on remaining financially healthy has been rewarded with strong ratings for Cincinnati Financial’s business units as well as for the corporation as a whole. Cincinnati Financial is a healthy and strong company that has fared well relative to other financial corporations in the past — that will likely continue to be the case.

Valuation & Expected Returns

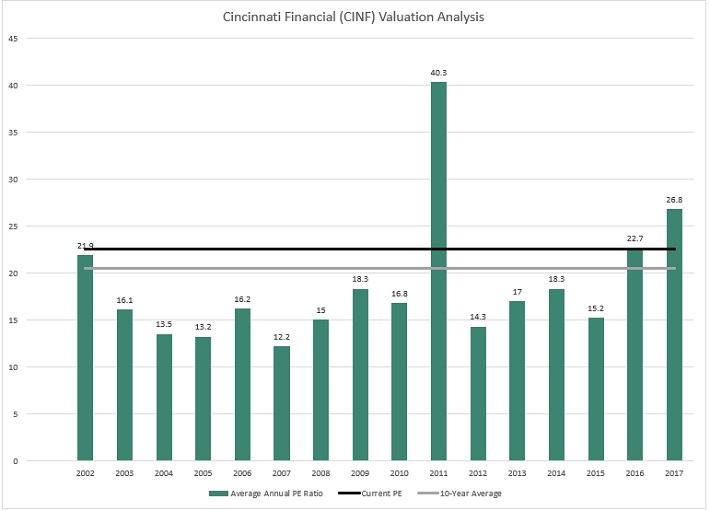

Cincinnati Financial doesn’t look especially cheap. The stock trades for a price-to-earnings ratio of 22.5, based on ValueLine estimates for 2018 earnings-per-share of $3.25. This is above the average price-to-earnings ratio of 20.5, over the past 10 years.

(Click on image to enlarge)

Source: ValueLine

On top of that the price to book multiple of 1.5 is not very low, either. Shares of the company have, however, gotten significantly cheaper over the last year. One can argue that a premium valuation is justified for a stable and rather low-risk financial company such as Cincinnati Financial. This is especially true when we factor in the strong record of total returns and the decades-long dividend growth history.

The rather high valuation puts a limit on total returns going forward, though: If Cincinnati Financial increases its EPS by 8% a year through 2023, and if shares trade at 20 times earnings by the end of 2023, share prices would rise by 4.5% a year. When we then add the dividend (which yields 2.8% right now), we get to a total return range of 7%-8% a year.

That’s not a bad return at all, but not an extremely high return either. Returns could be lower, if the price-to-earnings ratio declines to the 10-year average for the stock.

Final Thoughts

The financial sector isn’t usually where Dividend Aristocrats reside, and it is even harder to find a Dividend King there. Cincinnati Financial has managed to grow its dividend for decades, though, and there is a good chance of ongoing dividend growth.

With a cash flow payout ratio of roughly 40% and a 2.8% dividend yield Cincinnati Financial looks like a solid income investment. However, the stock does not appear to be undervalued at this time.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more