Thursday, February 23, 2017 4:14 PM EDT

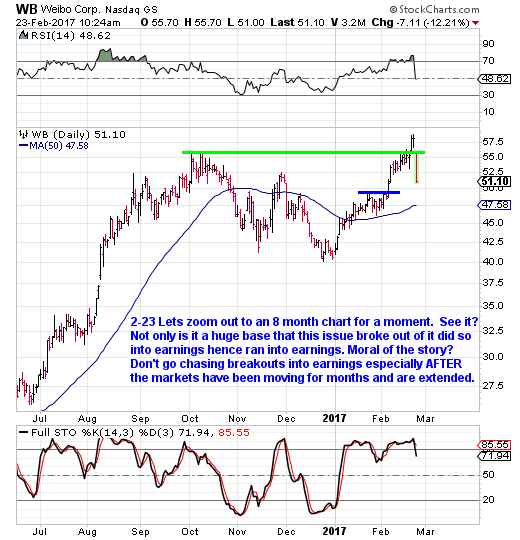

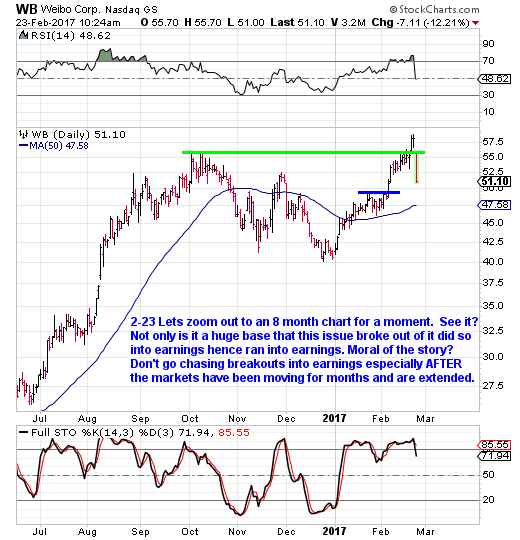

Let's take a look at WB as today's action should not come as a surprise.

If you've been on this list for any amount of time you know I am not a big fan of three things. One is chasing stocks, another is buying breakouts in extended market climates AFTER a run in the overall market has been made. And lastly trading ahead of reactionary news-driven events like earnings. WB is another example of exactly why.

This morning WB reacted to earnings and it wasn't pretty; but what does one expect when you buy breakouts AFTER an issue has been running going into earnings? That in itself is just foolish, as earnings reports are 50/50 reactionary odds and NOT investing.

There is more to breakouts than just BLINDLY buying them, you know. Besides, that breakout took place AFTER the stock ran from $40 to $56 and buying the breakout was doing so AFTER it ran 40% in 2 months!

Now that all said, this brings up the question of what, if anything should we be thinking about IF we were to consider going long at some point. Well that's where the chart below comes into play.

Disclosure: None.

Disclaimer: THESE ARE NOT BUY RECOMMENDATIONS! Comments contained in the body of this ...

more

Disclosure: None.

Disclaimer: THESE ARE NOT BUY RECOMMENDATIONS! Comments contained in the body of this report are technical opinions only. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Amazing Power Patterns reserves the right to refuse service to anyone at anytime for any reason. Amazing Power Patterns is not an investment advisor, hence it does not endorse or recommend any securities or other investments. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. All trademarks, service marks and trade names appearing in this report are the property of their respective owners, and are likewise used for identification purposes only. The member/subscriber agrees that he/she alone bears complete responsibility for his/her own investment/trading decisions. Amazing Power Patterns.com and all affiliates shall not be liable to anyone for any loss, injury or damage resulting from the use of any information. Trade at you're own risk, this information is strictly for educational and informational purposes only. Amazing Power Patterns.com and all affiliates assumes NO responsibility whatsoever for any losses experienced by anyone who uses its educational materials to make financial decisions. All charts courtesy of stockcharts.com

Want to know more? Visit our website. Have you enjoyed good results from our newsletter or have a comment or question? Contact us at customercare@amazingpatterns.com We'd love to hear from you. If you enjoy these newsletters, tell a friend!

less

How did you like this article? Let us know so we can better customize your reading experience.