Buy & Strong Buy Upgrades - June 7, 2016

Upgrades to "buy" or "strong buy" with complete forecast and valuation data are presented by one-month forecast return. Vera Bradley (VRA) is the leader here.

|

Ticker |

Company Name |

Market Price |

Valuation |

Last 12-M Return |

1-M Forecast Return |

1-Yr Forecast Return |

P/E Ratio |

Sector Name |

|

VERA BRADLEY |

14.88 |

-15.05% |

32.50% |

1.18% |

14.19% |

16.78 |

Retail-Wholesale |

|

|

GRUPO FIN SANTR |

9.08 |

-2.91% |

1.91% |

0.66% |

7.94% |

13.83 |

Finance |

|

|

PRGX GLOBAL INC |

5.47 |

-16.78% |

21.56% |

0.53% |

6.34% |

34.19 |

Business Services |

|

|

INTEL CORP |

31.68 |

-0.03% |

-0.50% |

0.53% |

6.30% |

12.90 |

Computer and Technology |

|

|

REDWOOD TRUST |

14.49 |

-22.33% |

-8.87% |

0.52% |

6.25% |

10.60 |

Finance |

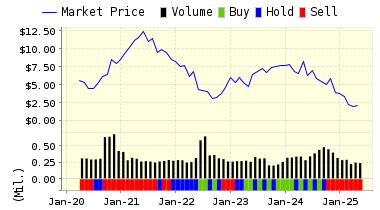

Below is today's data on Vera Bradley (VRA):

Vera Bradley Designs, Inc. is a designer, producer, marketer and retailer of accessories for women. Its products include handbags, accessories and travel and leisure items. It sells its products through two reportable segments Indirect and Direct. Its indirect business consists of sale of Vera Bradley products to independent retailers in the U.S. as well as select national retailers and third party e-commerce sites. Its direct business consists of sales of Vera Bradley products through its full-price stores, its outlet stores, verabradley.com, and its annual outlet sale in Fort Wayne, Indiana. Vera Bradley Designs, Inc. is headquartered in Fort Wayne, Indiana.

Recommendation: We updated the recommendation from BUY to STRONG BUY for VERA BRADLEY on 2016-06-06. Based on the information we have gathered and our resulting research, we feel that VERA BRADLEY has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and P/E Ratio.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

15.06 | 1.18% |

|

3-Month |

15.04 | 1.07% |

|

6-Month |

14.87 | -0.08% |

|

1-Year |

16.99 | 14.19% |

|

2-Year |

13.00 | -12.66% |

|

3-Year |

9.84 | -33.85% |

|

Valuation & Rankings |

|||

|

Valuation |

15.05% undervalued |

Valuation Rank |

|

|

1-M Forecast Return |

1.18% |

1-M Forecast Return Rank |

|

|

12-M Return |

32.50% |

Momentum Rank |

|

|

Sharpe Ratio |

-0.56 |

Sharpe Ratio Rank |

|

|

5-Y Avg Annual Return |

-23.43% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

41.52% |

Volatility Rank |

|

|

Expected EPS Growth |

4.89% |

EPS Growth Rank |

|

|

Market Cap (billions) |

0.61 |

Size Rank |

|

|

Trailing P/E Ratio |

16.78 |

Trailing P/E Rank |

|

|

Forward P/E Ratio |

16.00 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

3.43 |

PEG Ratio Rank |

|

|

Price/Sales |

1.19 |

Price/Sales Rank |

|

|

Market/Book |

2.15 |

Market/Book Rank |

|

|

Beta |

1.14 |

Beta Rank |

|

|

Alpha |

0.13 |

Alpha Rank |

|

Market Overview

|

Summary of VE Stock Universe |

|

|

Stocks Undervalued |

52.33% |

|

Stocks Overvalued |

47.67% |

|

Stocks Undervalued by 20% |

21.97% |

|

Stocks Overvalued by 20% |

15.98% |

Sector Overview

|

Sector |

Change |

MTD |

YTD |

Valuation |

Last 12-MReturn |

P/E Ratio |

|

Basic Materials |

1.95% |

5.02% |

34.74% |

11.03% overvalued |

16.97% |

29.01 |

|

Oils-Energy |

2.47% |

3.88% |

15.86% |

7.20% overvalued |

-31.07% |

24.08 |

|

Consumer Staples |

0.47% |

1.61% |

6.52% |

6.72% overvalued |

4.38% |

23.77 |

|

Utilities |

0.54% |

1.24% |

7.34% |

6.31% overvalued |

3.06% |

23.32 |

|

Multi-Sector Conglomerates |

0.61% |

1.28% |

6.01% |

5.44% overvalued |

-8.96% |

18.20 |

|

Industrial Products |

1.34% |

1.99% |

7.90% |

4.66% overvalued |

-8.18% |

21.97 |

|

Aerospace |

0.57% |

0.36% |

-1.60% |

1.58% overvalued |

-2.54% |

19.03 |

|

Computer and Technology |

0.57% |

1.12% |

8.20% |

0.54% overvalued |

-9.49% |

28.21 |

|

Business Services |

0.78% |

1.28% |

12.80% |

0.70% undervalued |

-9.05% |

23.16 |

|

Consumer Discretionary |

0.37% |

0.99% |

3.31% |

1.23% undervalued |

-10.69% |

23.55 |

|

Finance |

0.54% |

0.66% |

2.99% |

1.25% undervalued |

-3.90% |

16.04 |

|

Construction |

0.51% |

0.08% |

20.75% |

2.62% undervalued |

-3.92% |

20.09 |

|

Medical |

0.98% |

2.06% |

-3.51% |

3.63% undervalued |

-20.19% |

27.29 |

|

Transportation |

1.42% |

1.79% |

3.60% |

6.21% undervalued |

-26.89% |

13.87 |

|

Auto-Tires-Trucks |

0.55% |

-0.21% |

-0.52% |

8.14% undervalued |

-15.48% |

12.01 |

|

Retail-Wholesale |

0.46% |

0.82% |

-2.82% |

10.93% undervalued |

-12.42% |

22.27 |

Valuation Watch: Overvalued stocks now make up 47.67% of our stocks assigned a valuation and 15.981% of those equities are calculated to be overvalued by 20% or more. Eight sectors are calculated to be overvalued.

Disclosure: None.

Disclaimer: ValuEngine.com is an independent research provider, producing buy/hold/sell recommendations, ...

more