But Our Interests Are Aligned!

Harold Hill: Ladies and gentlemen, either you are closing your eyes to a situation you do not wish to acknowledge, or you are not aware of the caliber of disaster indicated by the presence of a pool table in your community!— “The Music Man” (1962)

For those of you who have somehow never seen a high school production of “The Music Man”, the plot goes something like this. A con man by the name of Harold Hill comes to River City and convinces the town folk that their youth are on the slippery road to perdition, and that the only solution is to establish a wholesome marching band that Hill is happy to lead. Just pay in advance for those band uniforms and instruments, please.

The modern use of stock-based compensation is a confidence game, in the true sense of the word, that would be very familiar to Harold Hill. What’s the slippery road to perdition? My goodness, it appears that your management team doesn’t have enough skin in the game. Surely disaster is nigh! The solution? Why, stock-based compensation, of course. Wholesome profits for all will flow like water once management’s interests are “properly aligned” with shareholders. Just pay in advance, please.

I know it seems like I’m picking on Marc Benioff, the new savior of Time Magazine. I mean, I guess I did call him a modern-day robber baron in yesterday’s In Brief note. But honestly, I say that in the nicest possible way. Marc Benioff is a freakin’ genius, an absolute master coyote who plays the metagame better than anyone whose last name doesn’t rhyme with Mayzose or Stuffit. Hats off to anyone who figures out the market zeitgeist and parlays that into not only billionaire-dom, but liquid billionaire-dom.

No company has played the stock-based compensation game better than Benioff’s brainchild, Salesforce.com, to the benefit of not only Benioff, but everyone in management (particularly sales) at Salesforce. Here’s how it works.

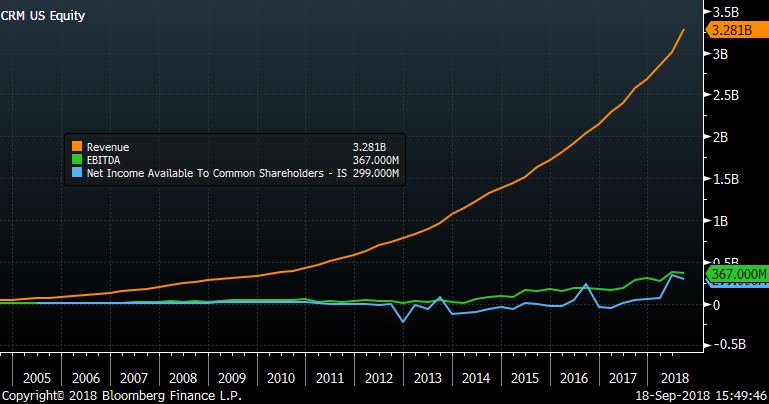

Since Salesforce became a public company, its revenues have grown at a wonderful clip. Its EBITDA (earnings before interest, taxes, depreciation and amortization) and net income available to common shareholders… not so much.

Where have all the revenues gone, if not into earnings and net income? Well, if you read the Wall Street analyst reports about Salesforce “beating its earnings estimates” every quarter, you’d think that this chart above must be wrong. Why, Salesforce has lots of profits! Sure, it trades at a high P/E multiple, as befits a company with such great revenue growth, but the consensus Wall Street earnings estimate for this quarter is $0.50 per share. With 756 million shares outstanding, that’s about $375 million in earnings this quarter alone. What gives?

What gives (among other things) is stock-based compensation. The earnings estimates that you’ll hear the CNBC analysts talking about Salesforce “beating” or “missing” are pro-forma earnings. They do not include stock-based compensation. Actual money paid to employees? Yes, that’s included. Stock paid to employees in lieu of actual money? No, that’s not included. If you included stock-based compensation (and all the other pro forma adjustments) as actual expenses, which of course they are, then the consensus Wall Street earnings estimate for this quarter is not 50 cents per share. It’s 2 cents per share.

Since it became a public company in 2004, Salesforce.com has paid its employees $4.8 billion in stock-based compensation. That’s above and beyond actual cash compensation. For tax purposes, it’s actually expensed quite a bit more than that, namely $5.2 billion. The total amount of net income available for common shareholders? $360 million. On total revenue of $52 billion.

Note that none of this includes the money that Benioff himself made in stock sales from 2004 through 2010, where he sold between 10,000 and 20,000 shares of stock in the open market PER DAY, EVERY DAY, for SIX YEARS.

In the immortal words of Ron Burgundy, I’m not even angry. It’s AMAZING what Benioff has been able to pull off for himself and his people. Nor am I suggesting in the least possible way that any of this is illegal or immoral or ethically suspect.

What I am saying is that this is a confidence game in the true sense of the term.

What I am saying is that investors have paid in advance for their band uniforms and instruments.

What I am saying is that you can sell a lot of software if you pay your sales team handsomely and investors don’t care about the expense or the profitability of those sales.

What I am saying is that this is only possible within a vast Wall Street and media ecosystem that tells investors not to care about the expense or the profitability of those sales.

What I am saying is that we have all seen this movie before.