Bull Market Carries On, But It Hasn't Carried Everything With It

September 29, 2017 will mark the final trading day of the Q3 2017 period and with that may come some significant rebalancing in the asset management community. So if you were hoping for a little volatility to shake things up in the near-term you may just get it by month’s end. And with the end of the quarter on the horizon we’ll be heading straight into the Q3 earning’s reporting season.

After double-digit Q1 and Q2 earnings reported already in 2017, Q3 may seem like somewhat of a let down. Q1 earnings growth was a spectacular 13.6% and met with earnings growth of 11.1% in the Q2 2017 period. As of right now, earnings are only expected to grow some 3.3% on revenue growth of 5% for the Q3 2017 period. Q3 earnings estimates have come way down and are forecasted to come in lower than 2016’s 4% earnings growth. This is in part due to seasonality and Hurricane Harvey. But estimates are rarely accurate and will likely find earnings growth higher than present estimates. That has been the trend at least.

The S&P 500 closed at a record level of 2,500.23 on September 15, 2017. This record has not been without its fare share of fits and starts, but it has been without a 3% pullback in quite some time. In fact it has been exactly 10 months since the last 3% pullback in the S&P 500. The only time in recorded history that beats the current trend of the S&P 500 not pulling back 3% would be from 1994 to December 1995. Goes to show how different a time period we are in what with quants, algorithms and ETF investing. For all the value assumed in historic rendering/modeling that asset managers employ, it’s extremely difficult to model for the future as the investing landscape and tools for which to invest have changed over the last decade or so. That difficulty breeds discontent and is, in part, one of the reasons why people say this is the most unloved bull market in history. “It’s over extended, unhealthy and found wanting for a correction of sorts”, but will that correction come or not remains to be seen.

The broader market and investing landscape is not the only thing to have been found changing over the last decade or so. The consumer and retail landscape has also been undergoing a seismic shift. Where once malls and brick & mortar shops were the hub of retail consumption that is becoming a thing of the past. Malls are less and less trafficked with each passing quarter as consumers give way more and more to e-commerce consumption or experiential consumption. Retail brands like Macy’s (M), J.C. Penney (JCP), Target (TGT), Kohl’s (KSS), Dillard’s (DDS) and so many more traditional retailers have witnessed and continue to witness hardships from this seismic shift in the retail climate. The number of brick & mortar retail store closings will surpass the level of store closing from the Financial Crisis period. On 9/19/17 after the closing bell, we may officially hear how many stores Bed Bath & Beyond (BBBY) plans to shutter as the company reports its quarterly results. I’ve long since warned investors about the deteriorating gross margins from the retail operator and am hoping that some restructuring of the business operation can find investors near-term relief. Maybe even the CEO steps aside as he has largely led the retailer into this steep decline without bringing about meaningful changes along the way.

The retailers are largely “no-touch” investment vehicles at this point. By that I do indeed mean they are not long-term investments. While all the aforementioned brands are attacking the shift to e-commerce retailing with a plethora of initiatives, none of these initiatives are true offsets or have the ability to “overcome” long-term. By and large, the initiatives put forth by these named retailers are Band-Aids and suitable for swing trading and short term investing. Whether it be Target’s 12, new private label brand introductions and focus on pricing or J.C. Penney’s dive into appliances and build out of Sephora, these are temporary solutions to an irreparable problem. The problem is quite simply exampled by understanding the following with respect to brick & mortar vs. e-commerce retail spending shift: Imagine you have 2 cups in front of you, one that is filled completely to the top with water and the other having only been filled some 9% with water. That is brick & mortar retail spending compared with e-commerce retail spending. Brick & mortar retail has seemingly peaked and filled its glass to the limit over the many decades. Over the last 15 years we have witnessed the syphoning of brick & mortar retail sales flowing to the e-commerce cup. And that pace of syphoning sales has accelerated in recent years with brick & mortar retailers participating with their own brands in the e-commerce spending shift.

Three retailers have had me deeply concerned since 2016 and with respect to their abilities to compete in a healthy manner during this evolving state of retail consumption. J.C. Penney, Bed Bath & Beyond and Macy’s have undoubtedly been brutalized over the last couple of years and possibly even longer when we look specifically at the multi-year share price declines for each retail brand. While J.C. Penney and Macy’s may be bottoming near-term, I don’t believe these bottoms will prove to express a long-term resurgence in the brands. And if I were to choose a positive swing trade in either name over the next 3-9 months it would likely be JCP due to its relatively high beta and stage in the business cycle which may find the brand expressing a higher dollar per square foot productivity level than that of Macy’s and on a year-over-year basis. The vast number of initiatives put in place by JCP, that included store closings and revamping its merchandise will likely express a bottoming effect in results. Such a bottoming should also result in easier comps going forward. I like J.C. Penney’s “throw everything into the store and see what sticks” approach. They are leaving no stone unturned and trying to appeal to a wide audience of consumers that has always been the largest consumer demographic, low-middle income America.

Appliances, shoes, Sephora, fine, jewelry, flooring, furniture & furnishings, salons, portrait studios, HVAC system and services, toys, athleisure apparel, gum and candy at the cash wraps are all J.C. Penney’s hopes and dreams for turning it’s beleaguered retail ship around. If some of the initiatives sound funny for a traditional retail department store operator it’s because they are funny. Toys and candy aren’t going to right all that ails J.C. Penney any more than it has for Toys ‘R’ Us.

Toys ‘R’ Us Inc. could file for bankruptcy as soon as the next few weeks, as nervous suppliers have tightened terms for the retailer ahead of the crucial holiday selling season, according to people familiar with the matter.”

When I listen to retail management teams getting into the business of “bad business categories” with extreme competition I hope to find investors critical of these actions. Like toys, appliances are also a bad business category, which takes up ample floor space with low gross margins in any big-box retail store. Just ask HHgregg! Oh wait, you can’t. But you can still ask Sears Holdings Corp. (SHLD) for a little while longer at least. Having said that and recognizing the continuation of bad business categories finding bankruptcies, those sales as miniscule as they prove to be have to go somewhere and that somewhere is what J.C. Penney hopes to be for certain consumers and at least for the time being. Throw it against the wall J.C. Penney and see what sticks.

Then there is Macy’s. Oh boy do we have all the right makings for all the wrong outcomes with this brand. I say that because Macy’s has long since been established as a limited consumer demographic, retail operator. The brand has largely been associated with the upper middle-to high income demographic. When you start from this retail consumer demographic there is largely only once place to go and that is down. And down is nothing new to Macy’s, formerly known as Federated Department Stores prior to its former bankruptcy protection and before the turn of the century. The worst part of Macy’s business operations is that it simply hasn’t found a way to broaden its brand image to appeal to a wider, larger consumer demographic and starting at the upper end that is an extremely tall task to accomplish. Most consumers, to this day, believe Macy’s is an expensive retail brand and forgo the shopping experience the retailer offers. As the gap between low-middle and high-income demographics expand, Macy’s continues to struggle.

In order for Macy’s to truly appeal to a larger consumer demographic, increase its foot traffic (down mid-single digits in Q2 2017) and revenue run rates it will have to do much of what J.C. Penney and/or Target is/has been doing. Macy’s has to offer more things, come down further in price point and more broadly address its retail footprint. I would greatly, greatly, greatly consider reading through Macy’s Q2 2017 earnings transcript. Macy’s generates some 75-80% of its revenues from apparel sales. Some 70% of its retail sq. footage is dedicated to apparel racks and tables. With this in mind and reading through its Q2 2017 transcript, how many times does the retailer talk about its apparel business? Now that we are all on the same page, are you alarmed? I know I continue to be alarmed, especially for those investors who believe the management team is doing enough to turn the tide….long-term. I don’t doubt that the retailer can also find a bottom for results, a bottom low enough to jump over even if only for a brief period of time. But long-term Macy’s is an apparel retailer despite its avoidance to discuss its core business. We’re talking about a retailer that still focuses on brands like Tommy Hilfiger and Ralph Lauren Polo. I wore these brands in high school myself when they were the top selling brands for teens and young adults. That hasn’t been the case since the late 90’s. That won’t likely be the case going forward. But when you walk into a Macy’s, how much apparel retail space do these two brands occupy in Macy’s? But let’s not talk about apparel, as that isn’t what Macy’s likes to talk about.

Macy’s likes to discuss Backstage. The off-price, discount, treasure hunt merchandise assortment brand experience that presently occupies retail space in some 38 of its stores across the nation. Yes, 38 stores for which the Backstage initiative has proven to lift comps in these Macy’s locations. Macy’s has 728 stores folks. While 38 Backstage concept shops are a good start, it’s little more than a Band-Aid, which still lacks the ability to plug a rather sizable hole in sales. Sales for Macy’s fell another 5.4% in the Q2 2017 period. Sales are not only expected to fall roughly 4% in 2017, but they are expected to fall another 3% in 2019. That’s your big picture takeaway folks and that’s the value that analysts presently see from the Backstage initiative.

While 38 Backstage stores-within-store concepts will certainly grow across the Macy’s store portfolio in the coming quarters, scaling Backstage will take ample time for which management offers no time frame of certainty. Investors in M shares would be wise to consider if the time is worth the risk, knowing Backstage hasn’t offset the gaping hole in sales coming from the core apparel business. Remember apparel is some 75% of Macy’s sales whether it’s happening online or in stores.

Digital sales for Macy’s grew double-digits during the Q2 2017 period and have grown double-digits for 32 consecutive quarters. Again, what investors should recognize from this growth is that it still has not offset where the bulk of Macy’s sales are generated, in-store. How bad are your in-store sales if 32 consecutive, double-digit comp increases online aren’t enough to grow total net sales? Macy’s is a perfect example of the conundrum that has befuddled department store retailers for the last decade or so. Additionally, this is why Macy’s has dedicated itself to closing some 100 stores over the last 2-year period. But if you think store closings will end at 100 count, just because that is what Macy’s has outlined, I would rethink that understanding. I’m of the opinion that just because Macy’s hasn’t outlined additional store closings with its forecast updates, it doesn’t mean more store closings WON’T be announced in the future. More to the point, I think the retailer has another 30-50 stores it may need to shutter come 2018.

The other initiatives, which Macy’s has employed, relate to furniture, fine jewelry and beauty care. Sound familiar? That’s right more of the same initiatives as Kohl’s, Target and J.C. Penney. Unfortunately for Macy’s, the others appeal to a larger audience based on price point. Unfortunately for Macy’s their initiatives only find likeness and not uniqueness. (Wow, uniqueness is a word.)

While I am and have been highly critical of Macy’s for the better part of the last two years, it’s been with an understanding of the challenges the retailer faces coupled with the futility in its initiatives. Had investors taken caution when I challenged Starboard’s investment thesis in early 2016, they largely would have avoided the share price depreciation from the high $40s to where the stock finds itself today in the low $20s. In January of 2016 I offered investors an analytical piece titled Macy's Taking Cue From Peers Who've Seen Mixed Results. It would be a good exercise to read the comments from the article as well.

Here’s my big picture takeaway for investors considering Macy’s presently:

- $24.50…maybe.

- Blue Mercury, Backstage, furniture, mattresses, fine jewelry, store closings, lowering operational costs are all positives, but they aren’t enough.

- Dividend yield is nice, but it hasn’t proven advantageous for investors over the last 3 years.

- I believe store closings will increase come 2018.

- Competitive retail landscape won’t change for the better

- Macy’s appears to be taking steps toward privatization or outright sale as it’s paying down debt and raising cash through asset sales. To do this given the current retail landscape makes little sense unless you do desire a takeout or privatization. Previous debt levels & valuation made acquisition unlikely despite rumors that proliferated, but current actions by Macy’s executives aim in this direction.

- Asset sales have never overcome core business on a valuation basis for any retailer in history and as such long-term M shares will be valued on the strength or weakness of its core business.

- Shorts be aware of the following: **We have reduced our debt by approximately $550 million in the first half of this year, including the repayment of a $300 million maturity in July and the repurchase of approximately $247 million in the open market. Cash flow from operations net of investing activities was $323 million this year, as compared to $222 million last year, an increase of approximately $101 million. The major variances related to the decrease in inventory (3%), lower CapEx and higher asset sales this year as compared to last year. Far easier to lower inventory than to “turn the hose back on”. (It’s a retail terminology and operational thing)

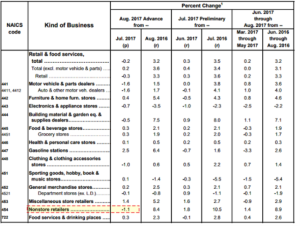

All department store retailers have an uphill climb, but few have the consumer demographic issues that plague Macy’s, Dillard’s and Nordstrom (JWN). Now let’s take a quick peek at August retail sales and why investors should realize that department store retailers continue to struggle even if to a lesser degree month-to-month. The following table is from the U.S. Commerce Department reporting:

While the month-to-month sales for department stores fell a slight .1%, the YOY number fell .8 percent. What proved to be somewhat eye opening in the latest monthly retail sales report was that e-commerce/Nonstore retail sales fell 1.1% month-to-month but still rose sharply by 8.4% year-over-year. The worst YOY sector sales came from electronics and appliance store sales while furniture and home furnishing sales surged by 5.4% year-over-year. In total, August monthly retail sales fell .2% for the period alongside falling auto sales.

Having said all that, the bull market has carried on and on and on. Volatility has remained complacent for far longer than many thought possible and recently achieved new all-time low levels on the VIX. But who would have predicted that VIX outcome…? It’s a little tongue and cheek of course as I predicted as such in the article titled The VIX Will Achieve Its Lowest Levels Ever...In Time . Lastly we have earnings season fast approaching with several key corporate earnings being reported this week. Those earnings reports will brush up against the FOMC meeting and interest rate decision this week as well.

I’m not a buyer of JCP at present levels and look forward to the share price dipping below $4 once again in the interim for the possibility of a swing trade. On the other hand M may prove to break $23 near-term and find Tim Seymour of CNBC’s Fast Money a nice exit point. Mr. Seymour entered a swing trade in shares of M around $19.50 and $23+ a share may prove to be a percentage return the Fast Money trader simply can’t pass up given the headwinds for the retailer and the stage of the retail sector cycle. I actually like that trade by Mr. Seymour and may find myself in it as well. The break and close above $22.50 on September 15th may prove to find the next logical round number for the share price.

Disclosure: I am long M for a swing trade and short volatility utilizing VIX-leveraged ETPs