BrightView Could Move Lower When IPO Lockup Expires

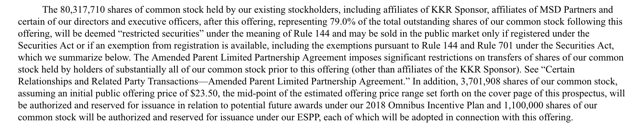

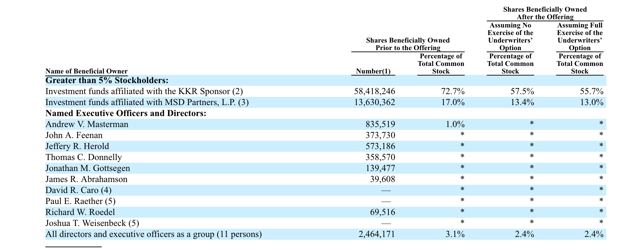

The 180-day lockup period for Brightview Holdings, Inc. (BV) ends on December 25, 2018. When this period ends, the company's pre-IPO shareholders and company insiders may opt to sell their shares in the secondary market for the first time. More than 79% of shares outstanding are subject to trading restrictions. If just a portion of these shareholders sold some of their stock, the secondary market for BV could be flooded and the stock could experience a sudden, short-term downturn.

Aggressive, risk-tolerant investors can take advantage of this trading event by shorting shares of BV ahead of the December 25th lockup expiration.

Shares of BV have headed lower since the stock's premiere. The stock was priced at $22 and closed on its first day of trading at $21.40 for a decrease of 2.7%. BV has a return from IPO of -52.8%.

Business Overview: Provider of Commercial Landscaping Services

Brightview Holdings is the largest provider of commercial landscaping services in the United States. The company has two primary segments: Development Services and Maintenance Services. The Development Services segment provides development and landscape architecture services for new and redesign facility projects. Its services include landscape architecture, project design, management services, landscape installation, tree nursery and installation, irrigation installation, sports fields, pool and water features, and other services.

The Maintenance Services segment provides a portfolio of recurring landscape services for commercial clients. These services include specialty turf maintenance, golf course maintenance, tree care, irrigation maintenance, water management, mulching, snow removal, mowing, and gardening.

The company's clients are typically commercial properties, corporate campuses, public parks, airport authorities, homeowners' associations, international hotels and resorts, municipalities, educational facilities, healthcare facilities, restaurants and retail, hospitals, golf courses, and others. The Maintenance Services segment serves approximately 450 educational facilities, 13,000 corporate campuses and office parks, and 9,000 residential communities.

Brightview Holdings' top ten clients represent approximately 12 percent of its revenue for fiscal 2017, and no single client represents over 3 percent of revenue. They serve four of the five largest U.S. companies and nine of the top ten third-party hotel management firms. The company believes its business model is stable with recurring revenue, strong operating margins, scalability, and low working capital requirements.

Brightview Holdings was founded in 1939, has 19,000 employees, and keeps its headquarters in Plymouth Meeting, Pennsylvania.

(Company information sourced from S-1/A and company website)

Financial Highlights

Brightview Holdings reported the following financial highlights for fiscal year 2018 ended September 30:

- Total revenue increased 5.7 percent in contrast to 2017, totaling a record $2,353.6 million, with 7.4 percent higher Maintenance Services Segment and 1.1 percent higher Development Services Segment revenues

- Net loss was $15.1 million or ($0.18) per share versus a net loss of $37.4 million in 2017

- Adjusted EBITDA improved 12.6 percent to $300.1 million

- Adjusted net income increased 54.8 percent to $90.0 million or $1.08 per share

- Completed five acquisitions with approximately $117.6 million of aggregate revenue, for an aggregate consideration of $104.4 million, net of cash.

Financial information sourced from company website.

Management Team

President, CEO, and Director Andrew Masterman has been with Brightview since December 2016. He previously served in senior positions at Wyman-Gordon, Airframe Products, PCC Fastener Products, ESAB Group, Platinum Group Metals, Walbro Engine Management, Spartan Light Metal Products, and TI Automotive and Walbro. Mr. Masterman holds degree in Business and Engineering.

CFO and EVP John Feenan has been with Brightview since January 2016. He previously served Trinseo Materials Finance, JMC Steel Group, HB Fuller, Jostens, Mannington Mills, Foamex International, Laporte PLC, and IBM. Mr. Feenan holds a bachelor's degree in business and economics from St. Anselm College and an MBA in finance from the University of North Carolina. He is a Certified Management Accountant and a certified green belt, lean six sigma.

Company bios sourced from company website.

Competition: Five Seasons Landscape Management, LandCare, and Yellowstone Landscape

Brightview Holdings notes in its SEC filing that the landscape design, landscaping, and snow removal industries have gone through a period of consolidation in the U.S. Still, the company faces significant competition from both large providers and smaller local companies. Large national companies include Yellowstone Landscape, LandCare, and Five Seasons Landscape Management.

Early Market Performance

The underwriters for Brightview Holdings priced its IPO at $22, at the low end of its expected price range of $22 to $25 per share. The stock has performed poorly on the NYSE. It closed on its first day of trading below its IPO price, and shares have continued to sink to trade around $10 to $11.

Conclusion: BV an Attractive Short Ahead of Lockup Expiration

With the majority of BV's outstanding shares subject to trading restrictions, there is plenty of potential for the stock to falter when the IPO lockup expires on December 25th. During the December 26th session, pre-IPO shareholders and company insiders will be able to sell large blocks of currently-restricted shares for the first time. This group of pre-IPO shareholders and company insiders include eleven individuals and two corporate entities.

Sales of these currently-restricted securities could flood the secondary market and result in a sudden dip in BV's share price.

Aggressive, risk-tolerant investors should consider shorting shares of BV ahead of the company's December 25th lockup expiration. Interested investors should cover short positions late in the trading session on December 26th or during the trading session on December 27th. Due to the company's relatively light trading volume - and the fact that the lockup expiration will take place during a shortened trading week - we would recommend that investors short and cover shares in several smaller trades rather than one single trade.

Disclosure: I am/we are short BV.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more