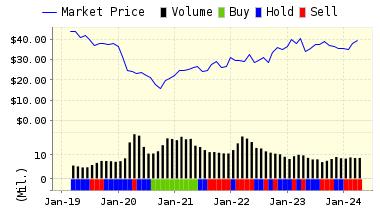

BP Swings To Loss

BP p.l.c. (BP) is the holding company of one of the world's largest petroleum and petrochemicals groups. Their main activities are exploration and production of crude oil and natural gas; refining, marketing, supply and transportation; and manufacturing and marketing of petrochemicals. They have a growing activity in gas and power and in solar power generation. BP has well-established operations in Europe, North and South America, Australasia and Africa.

BP posted its first results since the announcement of their massive Deepwater Horizon settlement a few weeks ago. As we noted at the time, the 2010 spill was a disaster for the Gulf and BP's reputation, exposing lax safety practices and a seeming lack of concern on the part of the firm and CEO Tony Hayward. Hayward's legendary "Sorry" speech, which was a PR disaster, led to his widespread ridicule and eventual resignation.

Today, the company reported a loss in excess of $6 billion due to lower oil prices and the massive hit to the bottom line from the settlement. The company tried to spin this as a good thing, as "paying the piper" removes uncertainty related to the spill moving forward. BP no longer has claims pending from the US government or the five Gulf states effected by the massive oil spill.

According to the Wall Street Journal, the total cost of the spill to the company has now exceeded $55 billion and the company had to sell off @$40 billion in assets to deal with the disaster. BP plans to continue to shed assets to pay off clean up costs and legal fees. While the major lawsuits were settled earlier this month, they still have to meet pay out schedules in excess of $18 billion for the next 18 years.

BP reported earnings of $0.43/share, which missed estimates of $0.48/share by five cents. Company net income came in at $1.3 billion, which was a miss of analyst estimates for $1.64 billion--and well below last year's figure of $3.6 billion. Despite the lower profits, the company will keep its dividend of $ 0.10/share.

And, the company's issues are not purely spill related. BP is the first big company to report this quarter, and analysts are waiting to see how its rivals fare. That should give a good indication of how big oil is going to fare with current crude prices. Crude oil is down yet again, despite a recent recovery. Today, the commodity was trading at @$53/barrel, down from recent prices in the high $60/barrel range--and from significantly hire prices in the $110/barrel range a year ago.

Current BP Group Chief Bob Dudley noted that “in the past few weeks oil prices have fallen back in response to continued oversupply and market weakness and the recent agreements regarding Iran. I am confident that positioning BP for a period of weaker prices is the right course to take, and will serve the company well for the future.”

Supply is way ahead of demand currently, as the US energy boom has challenged OPEC supremacy. We also could see slowing demand from China and an increase in supply when Iranian sanctions are removed and that nation brings oil to market in an unfettered way once again.

Below is today's more extensive data on BP:

ValuEngine continues its HOLD recommendation on BP PLC for 2015-07-27. Based on the information we have gathered and our resulting research, we feel that BP PLC has the probability to ROUGHLY MATCH average market performance for the next year. The company exhibits ATTRACTIVE Company Size but UNATTRACTIVE Earnings Growth Rate.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

36.17 | 0.33% |

|

3-Month |

36.89 | 2.32% |

|

6-Month |

37.33 | 3.54% |

|

1-Year |

37.46 | 3.90% |

|

2-Year |

35.27 | -2.17% |

|

3-Year |

41.22 | 14.35% |

|

Valuation & Rankings |

|||

|

Valuation |

6.57% undervalued |

Valuation Rank |

|

|

1-M Forecast Return |

0.33% |

1-M Forecast Return Rank |

|

|

12-M Return |

-28.81% |

Momentum Rank |

|

|

Sharpe Ratio |

0.24 |

Sharpe Ratio Rank |

|

|

5-Y Avg Annual Return |

6.49% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

27.11% |

Volatility Rank |

|

|

Expected EPS Growth |

-38.98% |

EPS Growth Rank |

|

|

Market Cap (billions) |

109.56 |

Size Rank |

|

|

Trailing P/E Ratio |

11.52 |

Trailing P/E Rank |

|

|

Forward P/E Ratio |

18.87 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

n/a |

PEG Ratio Rank |

|

|

Price/Sales |

0.34 |

Price/Sales Rank |

|

|

Market/Book |

1.39 |

Market/Book Rank |

|

|

Beta |

1.70 |

Beta Rank |

|

|

Alpha |

-0.36 |

Alpha Rank |

|

VALUATION WATCH: Overvalued stocks now make up 47.96% of our stocks assigned a valuation and 17.49% of those equities are calculated to be overvalued by 20% or more. Nine sectors are calculated to be overvalued--with two at or near double digits.

Disclosure: None.

ValuEngine subscribers can easily check out all of our top-rated STRONG BUY stocks with our "5-Engine ...

more