Bottom Fishing For Value: Week Ended April 22

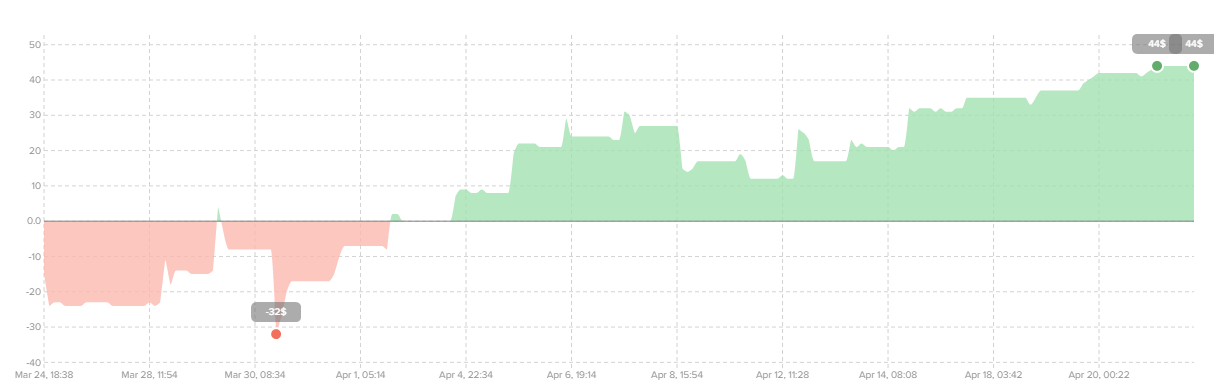

The continued decoupling between energy sector weakness and the market helped push stocks higher. Bottom fishing for value strategy now has a +681% ROI. Past calls, like long Intel (INTC), are still playing out. Intel’s quarterly report included a massive 12,000 job cut.

Pundits blame the weakening PC market, but Intel actually grew sales for chips. Its latest iteration of chips, the Skylake chipset, is expensive but profitable. Apple’s (AAPL) latest 12-inch Macbook will use Intel’s Skylake chipset. For now, Advanced Micro Devices (AMD) is not giving much of a challenge. Intel could widen that lead with its low-cost PC platform, dubbed Apollo Lake.

Nearly ten new ideas were introduced. Potash (POT) is already up 21% in ROI. Ranked a long idea, analysts are calling this stock a sell. That call is too late. Disney (DIS) is also up. The stock is slowly gaining back the losses on the stock market.

On the bearish side, 3D Systems (DDD) and Fiat Chrysler (FCAU) are moving higher, despite the headwinds they face this year. 3D Systems’ revenue will be lumpy and its stock is expensive. Fiat is looking for a buyer, but is unlikely to find one. Other notable bullish calls made earlier this month include Ford (F), with an ROI of ~ 20% and 20th Century Fox (FOX) with an ROI of 12%. Both continue to trade at steep discounts. Ford’s dividend yield of 4.4 percent is compelling for value investors seeking income. Fox, along with other cable content providers like News Corp. or CBS, are all bouncing back.

Disclosure: None.

To view details on all stock ideas and strategies discussed, click here. Access is free.