Blackrock Still Has A Large Runway Of Growth

BlackRock is the largest asset manager in the world, and as of the most recent quarter, they have $5.7 trillion in assets under management (AUM).

They own the leading iShares brand of ETFs and have a massive institutional asset management business that includes both passive and active investment funds and services.

Here’s a breakdown of where their AUM and fees are derived, and you can click the image for a bigger view:

(Click on image to enlarge)

Source: Q2 2017 BlackRock Earnings Supplement

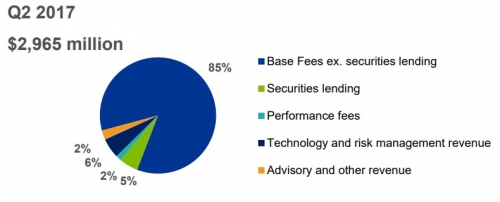

And here’s a chart of where their revenue is derived:

Source: Q2 2017 BlackRock Earnings Supplement

BlackRock’s Headwinds

BlackRock (NYSE: BLK) has massively outperformed the market since its IPO in 1999, but with a rich price-to-earnings ratio of over 20, BlackRock now faces some headwinds.

First of all, with such a large scale already achieved, some people doubt BlackRock’s continued ability to grow their $5.7 trillion in AUM at a decent pace. Most of their revenue comes from fees derived from their AUM, and that continues to require market growth and/or capital inflows to continue to expand.

Secondly, investors are increasingly shifting to passive investments. Moody’s Investors Service estimates that passive funds constitute 28% of assets under management in the United States today, and that this will expand to 50% within the next 4-7 years. Blackrock is on both sides of that divide; passive and active. As you can see in the chart above, only 28% of BlackRock’s AUM is in active investment, but 48% of their fees come from that segment. The margins there are much more attractive than for passive investing.

And as active management becomes less popular, BlackRock will cannibalize the most profitable part of its business with the less profitable part of its business. It’s not as bad as it is for pure-play active managers, but for BlackRock it’s still not a great scenario. As perhaps the most extreme example, BlackRock manages most of the Thrift Savings Plan for federal employee and military investors, and charges an average expense ratio of just 0.039%. Institutional and passive management just isn’t that profitable.

Thirdly, BlackRock keeps cutting fees on their ETFs and passive funds. This is great for investors, but not so great for BlackRock. Ideally, you want to invest in a company that can increase its top line by both volume and pricing, but while BlackRock is able to keep expanding their volume (AUM), they don’t have significant pricing strengths. With competitors like Vanguard offering rock-bottom expense ratios, BlackRock is forced to do the same.

Fourth, next time we have a recession or market correction, BlackRock’s AUM will temporarily decrease, and most of their revenue comes from fees that are charged based on a percentage of AUM. Equities account for over half of their AUM, so if equities around the world drop by an average of 20%, they’re going to take an impact to their fees. Furthermore, now that we’ve finished a 30-year secular interest rate decline in the United States that has fueled great bond returns, some investors are now concerned that, with rising rates, bond prices will decrease. This would also hurt BlackRock’s AUM and fees.

BlackRock’s Growth Runway

While I don’t believe BlackRock will provide returns going forward equal to what they’ve done since their IPO, there’s still a large growth scene ahead for them.

Here are two particularly interesting facts mentioned during the Blackrock Q2 conference call:

- Europeans have 70% of their savings in cash

- Only 10% of global equity market cap is held in passive funds and ETFs

The rest of the world has not caught up to America’s focus on investing. Market penetration and investor knowledge of the benefits of passively managed index funds, ETFs, and low-cost robo advisors is lacking globally.

BlackRock is making headway in expanding their iShares brand of ETFs to Europe and Asia. And they recently bought a significant stake in Scalable Capital, a new European robo advisor that manages portfolios for clients that consist of Vanguard and iShares ETFs. Retail investing has better margins than institutional investing, and BlackRock can bring a lot of technology to the table when partnering with various companies.

Furthermore, although passive investing is taking assets from active managers, it’s also taking assets from individual stock pickers. People managing active portfolios are increasingly using passive ETFs to get exposure to target geographic regions or market sectors that they believe will outperform. And Robo Advisors generally use ETFs as their investments for clients, which often means Vanguard or iShares.

BlackRock offers significantly more ETF diversity than Vanguard due to their more active-focused investment strategy. They cater not only to the passive investor, but also to active investors that are using ETFs for specific purposes. They also allow for lesser-used investment approaches, like investing in an equal weighted index rather than a market capitalization weighted index.

BlackRock’s passive funds and low-cost ETFs have a huge opportunity ahead for acquiring new institutional business as well. Banks, insurance companies, and other institutions can increasingly use ETFs for their hedging strategies and for holding mortgage-backed securities.

Although BlackRock’s fat-margin active business is under fire over the long term, their profitable passive investment platform has better prospects than ever. Up to 90% of equity assets are still not held in index funds and ETFs, and the company is well-positioned to take their fair share.

Aladdin & Final Thoughts

BlackRock has a hosted operating system called Aladdin that company management expects will provide a bigger chunk of revenue over the next few years. Right now, only 6% of their revenue comes from technology and risk management, but that will probably grow.

Aladdin was originally developed for use inside of BlackRock, but is now marketed to other companies, and is even used by some of BlackRock’s rivals. It is a useful platform for both institutions and the retail investing market because it allows portfolio managers to more easily analyze risk and manage their positions. It helps consolidate the vast resources of “Big Data” into human-understandable information.

BlackRock hopes that wealth managers will increasingly use Aladdin to differentiate their services from their competitors, which will benefit them, their clients, and BlackRock.

Overall, the company is positioning itself to be everywhere. They manage assets for institutional clients, they’re the largest provider of ETFs, they now have a stake in a foreign robo-advisor that uses their ETFs, and they are marketing their technology platforms and tools to wealth managers across the globe.

Disclosure: This author has no positions in any stock mentioned and does not plan to open any positions in any stocks mentioned for at least 72 hours after publication of this ...

more