BlackBerry Is Now The Software Company John Chen Envisioned

Pundits have predicted BlackBerry's BBRY demise due to its flailing handset division and SAF run-off. I have countered that software would gain enough traction to offset woes in other divisions. That thesis is actually beginning to play out.

Revenue for FQ3 was up 12% sequentially. Most importantly, hardware saw a sequential decline in revenue for the first time in over a year, and revenue from software/services offset the decline in SAF. While SAF declined by $38 million (18% Q/Q), software and services revenue more than doubled by $81 million to $154 million; revenue from software and services more than offset the diminution in SAF.

BlackBerry Is The Software Company John Chen Envisioned

At a November 2014 investor day BlackBerry CEO John Chen spooked the market when he suggested SAF revenue could fall by 50% to $800 million in FY16. With hardware flailing, software and services was the likely candidate to make up for the SAF revenue short fall. It actually accomplished that feat this quarter, implying that BlackBerry has become the software company Chen had envisioned.

Software And Services A Major Contributor To Gross Margin

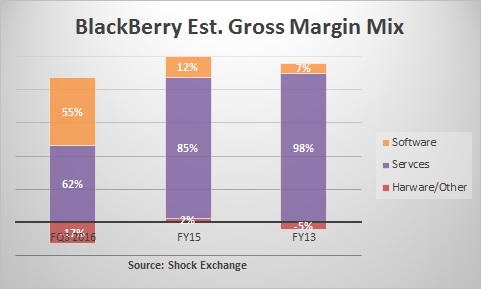

The story for FQ3 was not only the sequential increase in revenue, but the pick-up in gross margin from 38% in FQ2 to 43% this quarter. The following chart illustrates the contribution to BlackBerry's gross margin from each of its operating segments.

- For reporting purposes BlackBerry groups cost of sales by [i] hardware and other and [ii] software and services (including SAF). The company does not break out cost of sales per segment on a quarterly basis. In the above chart, "services" refers to SAF.

- I showed margins for FY13, FY15 and the most recent quarter. FY14 gross margin was negative, so the contribution by each segment was not relevant. The loss, however, came from the hardware segment.

- Gross margin from software and SAF were 85% - 86% in FY13 and FY15. I assumed it was the same for FQ3. The difference relates to hardware and other.

- Margins for hardware and other were -5% and 2% in FY13 and FY15, respectively. In periods where BlackBerry's hardware margins were negative or extremely low, the company was plagued by non-cash charges for inventory write-offs and/or supply commitment charges related to BlackBerry devices.

- Given the assumptions on margins for software and SAF, it implies a -17% margin for hardware this quarter.

The contribution to BlackBerry's total gross margin for the software segment increased from 7% in FY13 to 12% in FY15 to 42% this quarter. Meanwhile, the gross margin contribution for SAF has declined from nearly 100% in FY13 to 47% in the most recent quarter. From a bottom-line perspective, as software goes, so goes BlackBerry.

Good Technology Shaping Up To Be A Game Changer

Management expects Good Technology revenue of about $160 million over the next 12 months - more than double BlackBerry's quarterly run-rate from M&A activities. In addition, the gross margin contribution from software was likely positively impacted by Good. Once the Good deal is integrated, I expect BlackBerry to potentially exceed the 40% margins (company-wide) management has targeted.

I thought the Good deal could change the game and it is shaping up that way. Beyond the revenue and margin contribution, Good gives BlackBerry the capability of building secured solutions directly into a client's operating system; this was formerly a chink in BES 12's armor. It also gives BlackBerry a partner that could potentially help it make strides in the area of operational analytics -- another BES 12 vulnerability.

I am long BlackBerry

Regardless of how well Blackberry is doing, I think it will be hard for $BBRY to shake it's image as "yesterday's" company.

Susan, the Shock Exchange agrees with you. However, with more data being put on line, it makes security paramount. Major hacks or security breaches could bring BlackBerry back into favor.