Bio-Rad Laboratories - Chart Of The Day

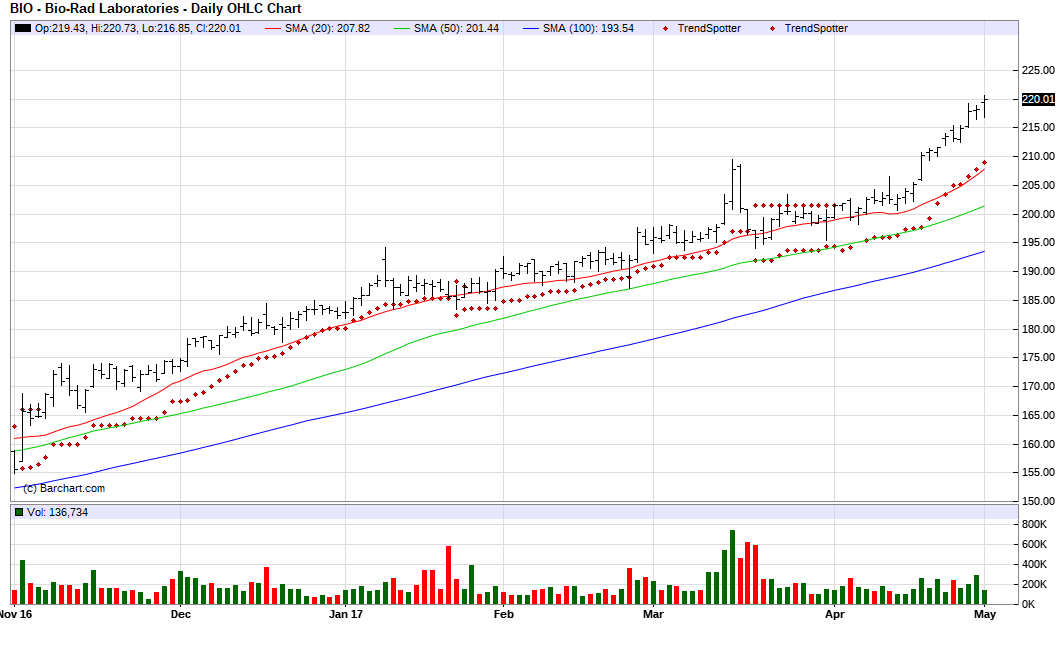

The Chart of the Day belongs to Bio-Rad Laboratories (BIO). I found the medical products stock by using Barchart to sort today's Top Stocks to Own list first for the most frequent number of new highs in the last month, then again for technical buy signals of 80% or more. Since the Trend Spotter signaled a buy on 4/4 the stock jumped 8.99%.

Bio-Rad Laboratories, Inc., together with its subsidiaries, engages in the manufacture and supply of products and systems for the life science research, healthcare, analytical chemistry, and other markets worldwide. The company's products are used to separate complex chemical and biological materials, and to identify, analyze, and purify their components. It operates in two segments, Life Science and Clinical Diagnostics. The Life Science segment offers electrophoresis, image analysis, molecular detection, chromatography, gene transfer, sample preparation, and amplification products and services. The Clinical Diagnostics segment provides control, autoimmune, diabetes, and blood virus testing products. Bio-Rad is renowned worldwide among hospitals, universities, major research institutions, as well as biotechnology and pharmaceutical companies for its commitment to quality and customer service. The company is headquartered in Hercules, California.

The status of Barchart's Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

- 96% technical by signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 10.37% in the last month

- Relative Strength Index 83.72%

- Technical support level at 217.66

- Recently traded at 220.01 with a 50 day moving average of 201.43

Fundamental factors:

- Market Cap $6.46 billion

- P/E 75.10

- Revenue expected to grow 1.90% this year and another 3.90% next year

- Earnings estimated to increase 194.70% this year, 5820% next year and continue to compound at an annual rate of 8.82% for the next 5 years

- Wall Street analysts issued 1 strong buy and 1 hold recommendation on the stock

Disclosure: None.