Better Dividend Aristocrat: Sherwin-Williams Or PPG?

PPG Industries (PPG) is a Dividend Aristocrat. It has increased its dividend for 44 years in a row, which is certainly an impressive feat.

That said, there may be a better Dividend Aristocrat to buy, and it happens to be one of PPG’s biggest competitors.

Sherwin-Williams (SHW) has 38 consecutive years of dividend increases under its belt.

PPG has a higher dividend yield than Sherwin-Williams right now, but Sherwin-Williams has stronger growth potential going forward.

This article will discuss why Sherwin-Williams is the better Dividend Aristocrat, in a matchup of two giants of the paint and coatings industry.

Business Overview

Winner: Sherwin-Williams

Sherwin-Williams and PPG compete directly in the paint industry.

Sherwin-Williams operates four business segments:

- Paint Stores (66% of revenue)

- Consumer (13% of revenue)

- Global Finishes (16% of revenue)

- Latin America Coatings (5% of revenue)

The Paint Stores business is by far Sherwin-Williams’ largest. It owns more than 4,000 stores. It also provides protective and marine services, automotive finishes, and product finishes.

Source: 2016 Financial Community Presentation, slide 5

Sherwin-Williams generated 4.6% revenue growth in 2016. Diluted earnings-per-share increased 7.5% for the year, to $11.99.

PPG supplies paints just like Sherwin-Williams, along with other manufactured products including coatings, optical products, and specialty materials.

It operates three segments:

- Performance Coatings (58% of revenue)

- Industrial Coatings (39% of revenue)

- Glass (3% of revenue)

PPG serves the industrial, transportation, consumer products, and construction industries. It generates approximately $15 billion in annual sales.

It has significantly shifted its business model toward Performance Coatings in recent years. This transformation worked, as the Performance Coatings segment posted 10% compound annual growth from 2005-2016.

Source: March 2017 Investor Presentation, page 11

Unfortunately, growth has slowed more recently.

PPG’s growth was more muted than Sherwin-Williams’ in 2016. PPG reported flat revenue for the year, along with 7% growth in adjusted earnings.

Both companies have strong positions in the industry, but Sherwin-Williams is a more consistent performer.

Competitive Advantages & Recession Performance

Winner: Sherwin-Williams

Sherwin-Williams has a more recession-resistant business model, due in part to its stronger brand.

It had higher growth last year, and also performed more consistently during the Great Recession as well.

For example, PPG’s earnings-per-share during the Great Recession were as follows:

- 2007 earnings-per-share of $2.52

- 2008 earnings-per-share of $1.63 (35% decline)

- 2009 earnings-per-share of $1.02 (37% decline)

- 2010 earnings-per-share of $2.32 (127% increase)

- 2011 earnings-per-share of $3.44 (48% increase)

- 2012 earnings-per-share of $3.03 (12% decline)

PPG’s earnings fell significantly during the downturn. The company performed very well in 2010-2011, but took a step back in 2012, even though the U.S. economy was firmly out of recession by that time.

Sherwin-Williams also suffered from the Great Recession, but its earnings-per-share decline was not nearly as severe as PPG’s. And, Sherwin-Williams enjoyed a sharper earnings recovery after the recession ended:

- 2007 earnings-per-share of $4.70

- 2008 earnings-per-share of $4.00 (15% decline)

- 2009 earnings-per-share of $3.78 (5.5% decline)

- 2010 earnings-per-share of $4.21 (11% increase)

- 2011 earnings-per-share of $4.14 (2% decline)

- 2012 earnings-per-share of $6.02 (45% increase)

PPG’s earnings fell further during the recession than PPG, and were far more volatile in general.

One reason for Sherwin-Williams’ relative out-performance during the recession, could be a stronger brand. This gives Sherwin-Williams a competitive advantage.

Growth Potential

Winner: Sherwin-Williams

Both companies have an outlook for growth, thanks largely to the strength of the U.S. housing market.

However, just as Sherwin-Williams outperformed PPG in 2016, it did so again in the first quarter of 2017.

Sherwin-Williams is off to a great start to 2017. First-quarter net sales increased 7.3% year over year, to a record $2.76 billion.

Comparable-store sales, which measures sales at stores open at least 12 months, increased 7.5%. Once again, the Paint Stores segment was a key growth driver, with a 12% revenue increase for the quarter.

Revenue growth was due to higher architectural paint sales, as well as higher prices. Sherwin-Williams possesses meaningful pricing power, which is an indication of its strong brand.

Meanwhile, PPG reported 3% growth in constant-currency sales last quarter, along with 6% growth in adjusted earnings-per-share.

PPG racked up excellent earnings growth from 2012-2014, but the company experienced weakening demand from its end markets in 2015 and 2016.

Source: March 2017 Investor Presentation, page 35

PPG’s core Performance Coatings segment posted a 1% decline in first-quarter sales. And, PPG’s slower earnings growth is due to increases in raw materials costs.

For the full year, Sherwin-Williams expects to generate earnings-per-share of $13.65-$13.85. This range represents growth of 14%-16% growth for 2017.

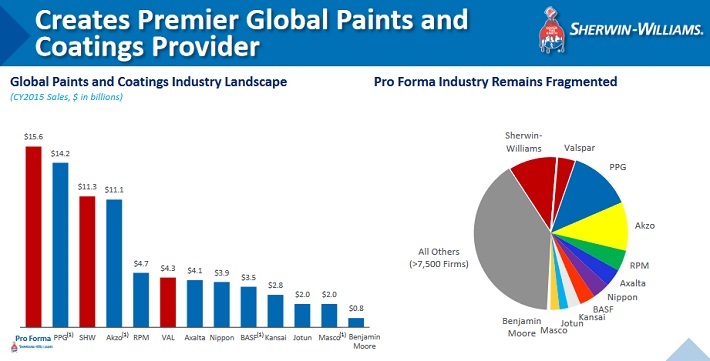

Another compelling growth catalyst for Sherwin-Williams is the 2016 acquisition of Valspar, for $11 billion.

The acquisition will allow Sherwin-Williams to leapfrog PPG in the paints and coatings industry.

Source: Acquisition Presentation, page 10

From 2010-2015, Valspar grew sales by 7% per year. This will instantly add to Sherwin-Williams’ growth.

The deal will also expand Sherwin-Williams’ scale and distribution, both in the U.S. and international markets. Management expects the acquisition to be immediately accretive to earnings, with annual cost synergies of $280 million by 2018.

Sherwin-Williams’ stronger earnings growth potential also makes it the better pick for dividend growth moving forward.

Dividends

Winner: Toss-Up

Sherwin-Williams has an annual dividend payment of $3.40 per share. Based on its current share price, the stock has a dividend yield of 1%.

Meanwhile, PPG pays a dividend of $1.60 per share, good for a 1.4% dividend yield.

Both companies have below-average dividend yield, relative to the S&P 500 Index, which yields 2% on average.

Between the two stocks, PPG’s dividend yield is much more attractive. PPG investors would receive 40% more dividend income each year than from Sherwin-Williams, based on their current dividend yields.

However, Sherwin-Williams is far more attractive than PPG, from the perspective of dividend growth. Both stocks are Dividend Aristocrats, but PPG has paid a flat dividend for five quarters in a row.

Over the past five years, PPG has increased its dividend by approximately 3% per year. In the same time period, Sherwin-Williams has delivered 9% compound annual dividend growth.

Sherwin-Williams has raised its dividend at roughly three times the rate of PPG, in the past five years. If both stocks held the same dividend growth rates going forward, Sherwin-William’s yield on cost would surpass PPG’s in roughly seven years.

Final Thoughts

Sherwin-Williams and PPG are both highly profitable companies with strong brands. They have generated earnings growth for many years, which has fueled their long histories of dividend growth.

However, going forward, Sherwin-Williams could be the more rewarding stock.

It is expanding its store count, and is generating strong growth in its core business. It stands to grow even more, thanks to the Valspar acquisition.

While PPG offers a higher dividend yield, Sherwin-Williams is the more attractive of these two Dividend Aristocrats.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more