Best Russell 1000 Stocks According To Lynch Principles: Consider IPG Photonics

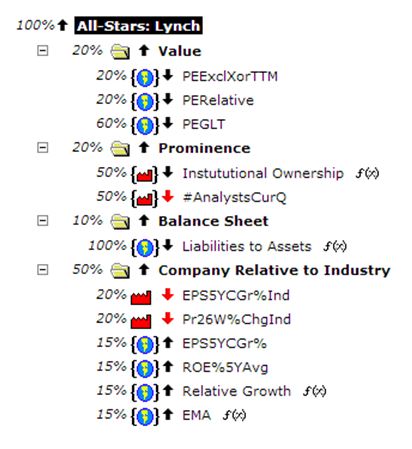

A Ranking system sorts stocks from best to worst based on a set of weighted factors. Portfolio123 has a powerful ranking system which allows the user to create complex formulas according to many different criteria. They also have highly useful several groups of pre-built ranking systems, I used one of them the “All-Stars: Lynch” in this article. The ranking system is based on investing principles of the well-known investor Peter Lynch.

The “All-Stars: Lynch” ranking system is quite complex, and it is taking into account many factors like; trailing P/E, relative P/E, PEG ratio, institutional ownership, liabilities, sales growth and EPS growth, as shown in the Portfolio123's chart below.

Back-testing over seventeen years has proved that this ranking system is very useful.IPGP

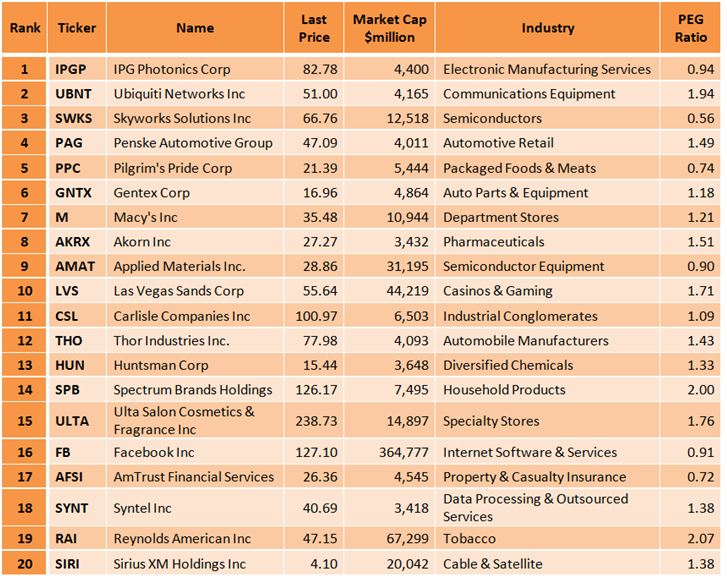

After running the "All-Stars: Lynch " ranking system for all Russell 1000 companies, on September 11, I discovered the twenty best stocks, which are shown in the table below. In this article, I will focus on the first ranked stock; IPG Photonics (IPGP).

According to IPG Photonics, it is the leading developer and manufacturer of high-performance fiber lasers and amplifiers for diverse applications in numerous markets.

IPGP Stock Performance

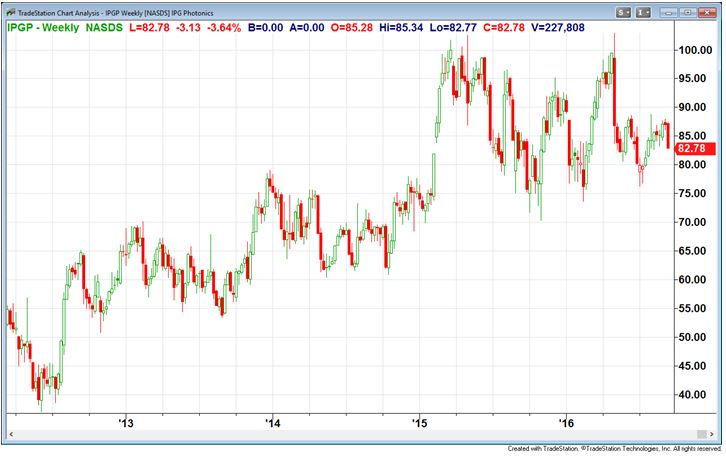

Since the beginning of the year, IPGP's stock is down 7.2% while the S&P 500 Index has increased 4.1%, and the Nasdaq Composite Index has gained 2.4%. However, since the beginning of 2012, IPGP's stock has gained 149.2%. In this period, the S&P 500 Index has increased 69.2% and the Nasdaq Composite Index has gained 96.8%.

IPGP Daily Chart

IPGP Weekly Chart

Charts: TradeStation Group, Inc.

Growth

IPG Photonics has recorded substantial growth in the last few years. The company's annual average sales growth over the last five years was very high at 24.7%, and the average EPS growth was extremely at 31.9%. The average annual estimated EPS growth for the next five years is also high at 12%.

Valuation

Regarding its valuation metrics, IPGP's stock is pretty cheap. The trailing P/E is at 18.48, and the forward P/E is low at 15.92. The Enterprise Value/EBITDA ratio is low at 9.56, and the PEG ratio is very low at 0.94. The PEG ratio - price/earnings to growth ratio - is a widely used indicator of a stock's potential value. It is favored by many investors over the P/E ratio because it also accounts for growth. A lower PEG means the stock is more undervalued.

Conclusion

IPG Photonics is a leading company in a growing market. The company has recorded substantial growth in the last few years, and considering its valuation metrics; the stock is pretty cheap. Moreover, IPGP is ranked first among all Russell 1000 companies according to Lynch principles. All these factors bring me to the conclusion that IPGP's stock is a smart long-term investment.

Disclosure: None.