Best Russell 1000 Energy Stocks According To Buffett Principles: Consider Tesoro

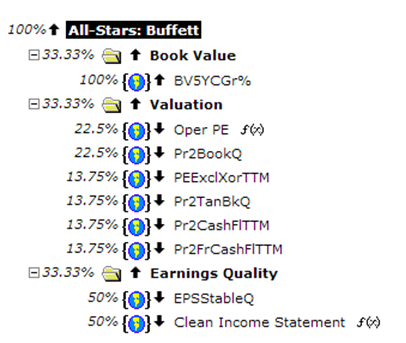

A Ranking system sorts stocks from best to worst based on a set of weighted factors. Portfolio123 has a powerful ranking system which allows the user to create complex formulas according to many different criteria. They also have highly useful several groups of pre-built ranking systems; I used one of them the "All-Stars: Buffett" in this article. The ranking system is based on investing principles of the well-known investor Warren Buffett.

The "All-Stars: Buffett" ranking system is quite complex, and it is taking into account many factors like; book value growth, operational P/E, price to book value, trailing P/E, price to Tangible book value, price to cash flow and EPS Stability, as shown in the Portfolio123's chart below.

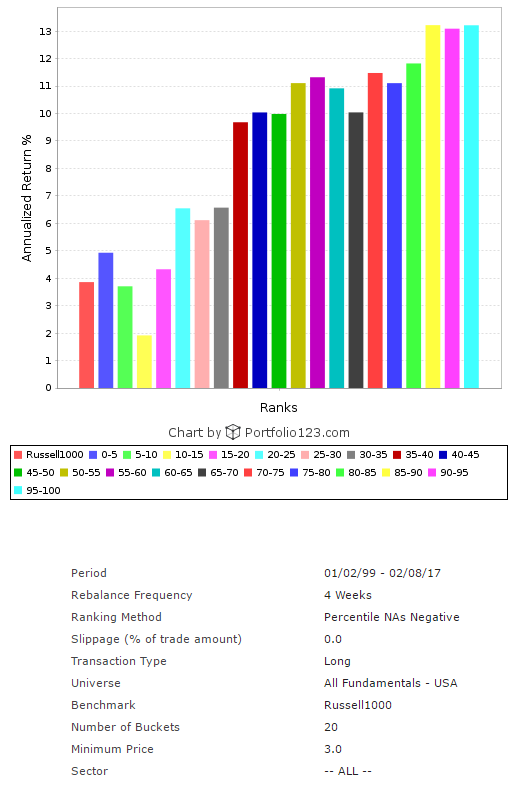

In order to find out how such a ranking formula would have performed during the last 18 years, I ran a back-test, which is available in the Portfolio123 screener. For the back-test, I took all the 6,221 stocks in the Portfolio123 database.

The back-test results are shown in the chart below. For the back-test, I divided the 6,221 companies into twenty groups according to their ranking. The chart clearly shows that the average annual return has a very significant positive correlation to the "All-Stars: Buffett" rank. The highest-ranked group with the ranking score of 95-100, which is shown in the light blue column in the chart, has given the best return - an average annual return of about 13.2%, while the average annual return of the Russell 1000 index during the same period was about 3.9% (the red column at the left part of the chart). Also, the second and the third group (scored: 90-95 and 85-90) have yielded superior returns. This brings me to the conclusion that the ranking system is very useful.

After running the "All-Stars: Buffett" ranking system for all 53 Russell 1000 energy companies, on February 8, I discovered the twenty best stocks, which are shown in the table below. In this article, I will focus on the second ranked stock Tesoro Corporation (TSO).

Tesoro Corporation is one of the largest independent refiners and marketers of petroleum products in the United States.

Last Quarter Results

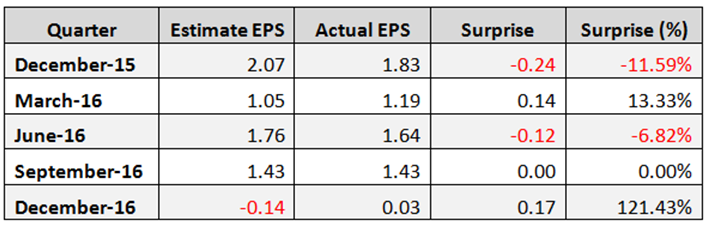

On February 6, Tesoro reported its fourth quarter and full year 2016 financial results, which beat adjusted earnings-per-share expectations by a significant margin of $0.17. The company posted revenue of $6,652 million in the period up 6% year over year, also beating Street forecasts of $6,573 million. Tesoro has beaten earnings per share in two of its previous five quarters, as shown in the table below.

In the report, Greg Goff, Chairman and CEO, said:

"We made excellent progress in 2016 executing our growth and productivity improvement strategies. This included achieving very strong safety and refining availability, delivering annual improvements to operating income and making strategic acquisitions that position the Company for further growth. We returned approximately $500 million to shareholders in the form of share repurchases and dividends and invested in high-return capital projects. We achieved these results despite a challenging market environment characterized by lower refining margins and weaker crude oil differentials,"

Tesoro Stock Performance

Year to date, the TSO stock is down 2.6% while the S&P 500 index has increased 2.4%, and the NASDAQ Composite Index has gained 5.4%. However, since the beginning of 2012, TSO stock price has grown 264.7%. In this period, the S&P 500 Index has increased 82.3%, and the NASDAQ Composite Index has risen 117.8%. According to TipRanks, the average target price of the top analysts is at $100.67, representing an upside of 18.2% from its February 7 close price, which appears reasonable, in my opinion.

TSO Daily Chart

TSO Weekly Chart

Charts: TradeStation Group, Inc.

Valuation

Regarding its valuation metrics, TSO's stock is undervalued. The trailing P/E is very low at 14.64, and the forward P/E is also low at 13.26. The price-to-sales ratio is extremely low at 0.42, and the price to cash flow is low at 6.04. Furthermore, its Enterprise Value/EBITDA ratio is very low at 6.26.

Summary

Despite challenging market conditions characterized by lower crack spreads, Tesoro delivered better than expected fourth quarter results. Moreover, according to the company, it sees an attractive refining market environment in 2017, and high demand for gasoline by consumers. Regarding its valuation metrics, TSO's stock is undervalued. Also, the company is generating strong cash flows and returns value to its shareholders by stock buyback and increasing dividend payments. All these factors bring me to the conclusion that TSO's stock is a smart long-term investment.

Disclosure: I am long TSO stock

Thanks for sharing