Best E-Commerce Stock: Amazon Vs. Ebay

Amazon (AMZN) and eBay (EBAY) are long-time rivals in e-commerce, and they both offer some interesting traits for investors. Amazon is a disruptive force in the retail industry, and the company is positioned for continued growth in the years ahead. eBay comes way behind Amazon in terms of growth, but the business is far more profitable and the stock looks undervalued at current levels.

Amazon Is All About Growth And Competitive Strength

Amazon has a relentless competitive drive, and management is deeply focused on long-term growth, even if it comes at the expense of current profit margins. Amazon sells its products at competitively low prices to gain market share in a wide range of retail categories, and it's also investing huge sums of money in areas such as building its distribution network and digital content.

Back in 1995, Amazon was making only $511,000 in revenue per year. Fast forward to 2018 and the company is estimated to generate $233.48 billion in revenue and growing at full speed. In the process, Amazon has consolidated its leadership position in online retail and cloud computing infrastructure, and the company is now also a big player in hardware and digital content.

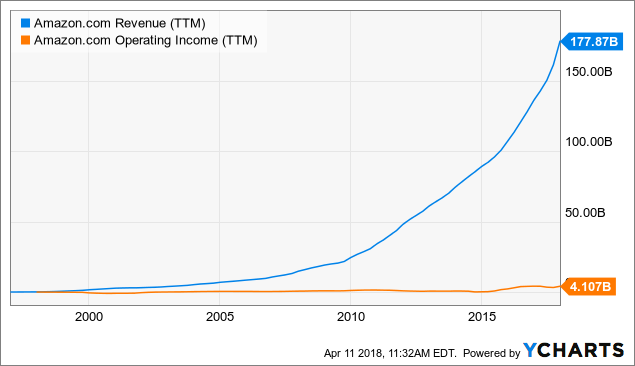

Depending on which area of the income statement you focus on, this strategy can be described as a massive success or a complete failure: Sales are growing at an extraordinary speed considering the company's size, but profit margins are low and volatile.

Amazon delivered $177.9 billion in revenue for 2017, growing 31% versus 2016. It takes a unique business to generate that level of growth from such a gargantuan revenue base.

On the other hand, the company made only $4.1 billion in operating income during the period, representing only 2.3% of revenue and falling 2% in comparison to $4.2 billion in operating income for 2016.

AMZN Revenue (TTM) data by YCharts

The Amazon Prime program creates customer loyalty. According to data from Feedvisor, 85% of Prime members visit Amazon at least once a week and over 45% of Prime members purchase from Amazon once a week or more often. Amazon also offers brand differentiation, operational efficiency, and a strong focus on customer service.

These unparalleled competitive strengths have allowed Amazon to gain market share across a wide variety of retail categories over the past several years, and there is no reason to believe that this dynamic is going to change any time soon.

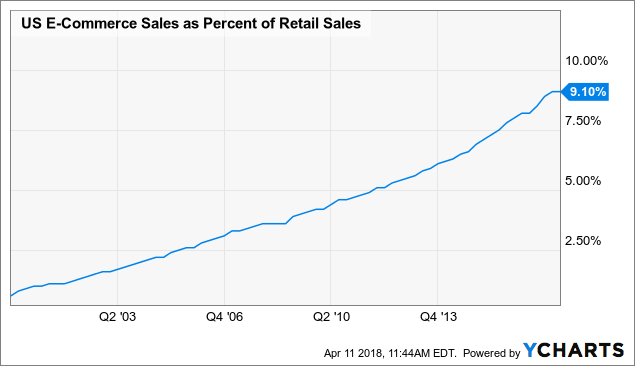

US E-Commerce Sales as Percent of Retail Sales data by YCharts

Online retail is rapidly gaining share versus traditional retail, but online still represents a relatively small 9.1% of the overall retail industry in the U.S. Amazon is positioned to be both the main driver and the leading beneficiary from growing online retail sales in the years ahead.

The Whole Foods acquisition is opening intriguing possibilities for Amazon in groceries and related categories. In addition, the company is the top player in cloud computing infrastructure, while also expanding into digital content and hardware. When looking at Amazon's multiple growth engines, it's easy to see that the company offers attractive growth prospects for investors.

On the other hand, the company reinvests most of its cash flows for growth, so both earnings and free cash flows are low and volatile. The value of the company ultimately depends on these key variables, so it's remarkably hard to tell if Amazon stock is reasonably priced or overvalued. It's practically impossible to justify Amazon's valuation based on current earnings or cash flows, and this keeps many investors away from Amazon stock.

A Profitable Business With An Attractive Valuation

As opposed to being an online retailer like Amazon, eBay is mostly an e-commerce facilitator, meaning that the company is in the business of matching buyers and sellers and making a commission on every transaction. This business model has low capital requirements, and eBay doesn't need to worry about factors such as inventory risk, cost of merchandise sold, or distribution costs.

Because of this, eBay generates impressive profitability levels. Operating profit margin amounted to 25.4% of revenue in the fourth quarter of 2017, while non-GAAP operating margin came in at 30.9% of revenue.

eBay has launched a series of initiatives to accelerate growth over the past several years. The company is prioritizing unique product selection and inventory discoverability, launching improved seller tools and investing in technologies such as data-driven merchandising and artificial intelligence to optimize search engine listings and improve the overall customer experience. In addition to that, eBay is expanding into adjacent platforms such as StubHub and eBay Classifieds in order to build additional growth venues.

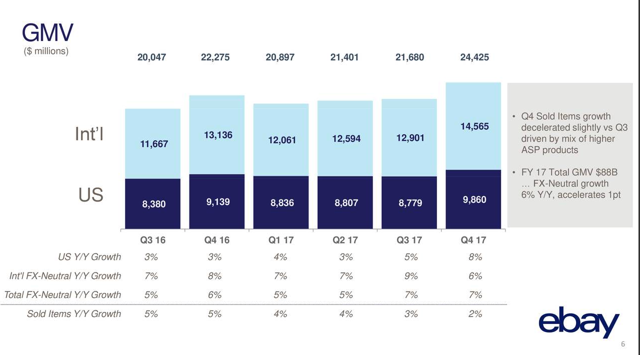

These moves are generating some results, and revenue growth is accelerating. The company produced $2.6 billion in revenue during the fourth quarter of 2017, a year over year increase of 9% and growing 7% on a foreign exchange neutral basis. Gross merchandise volume amounted to $24.4 billion during the period, up by 10% in U.S. dollars and growing 7% on an FX-neutral basis.

Image source: eBay

The fourth quarter of 2017 was a record quarter for eBay, representing the fifth quarter in a row of volume acceleration in the company's US marketplace. eBay can't even begin to compete against Amazon when it comes to revenue growth or size, but it's relevant to note that eBay is making some progress in this area.

Importantly, eBay stock is priced at fairly convenient levels, and it's not much of a stretch to say that the stock is undervalued. Wall Street analysts are on average expecting $2.29 and $2.61 in earnings per share for eBay in 2018 and 2019 respectively. This puts the stock at a temptingly low price to earnings ratio of 17.8 for the current year and 15.6 for next year.

Amazon or eBay?

Even if Amazon and eBay are direct competitors in e-commerce, the two companies could hardly be any more different in terms of what they have to offer to investors. Key return drivers such as growth levels, competitive strengths, profitability, and valuation are notoriously dissimilar.

eBay is no match to Amazon in terms of growth and innovation, but it has a far more profitable business model. Importantly, current valuation levels should buffer the downside risk in a position in eBay unless there is a serious deterioration in the fundamentals. This means that eBay is clearly the right choice for value-oriented investors looking for a business with predictable performance, an attractive entry price, and limited downside risk.

Amazon, on the other hand, is a unique growth story with remarkably solid competitive strengths and a visionary management team. As long as the company continues leading the market in industries such as online retail, cloud computing, and digital media, the stock offers substantial room capital appreciation in the long term. However, profitability is quite volatile and hard to predict, and valuation is a major risk factor for investors in Amazon.

Amazon is hence the right choice for growth-seeking investors willing to accept much higher uncertainty and a bigger downside risk in exchange for superior upside potential over the long term.

Disclosure: I am/we are long AMZN.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more