BDX: A 45-Year Track Record Of Annual Dividend Raises

Becton Dickinson (NYSE: BDX) has an impressive corporate history.

The 119-year-old company makes medical supplies and equipment such as wireless flu detection diagnostic systems, sterilization containers and IV pumps.

It has raised its dividend every year since 1971. Heck, disco wasn’t even on the scene yet. That was a long time ago.

Despite its 45-year history of annual dividend raises and an average double-digit yearly dividend increase over the past 10 years, its yield is below 2%.So it’s not a high yielder, but it is consistent.

But will the company be able to raise its dividend for another 45 years?

That might be tough to predict, but my proprietary ratings database, SafetyNet Pro, does an excellent job forecasting dividend safety over the next 12 to 18 months.

Though Becton Dickinson’s free cash flow growth is expected to slow to a crawling 1% next year, it has soared 64% over the past three years and jumped 90% over the past five.

The good news is that even though growth will slip in 2017, the company creates enough cash flow that it could nearly triple its dividend if it wanted to.

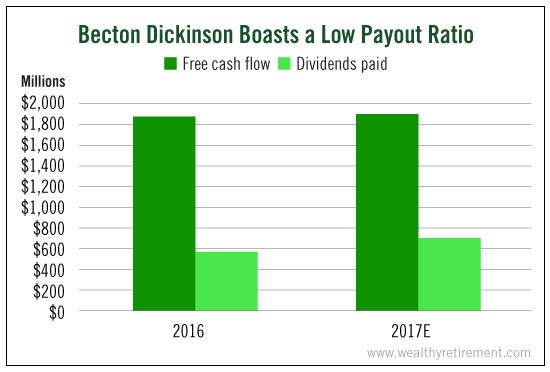

In fiscal 2016, Becton Dickinson’s cash flow was $1.87 billion. It paid out $562 million in dividends.

For 2017, cash flow is projected to be $1.89 billion, and dividends paid will be $687 million.

In other words, the company will pay out only 36% of its cash flow in dividends. That’s a low figure.

I’m comfortable with a company paying out as much as 75% of its free cash flow.

At 36%, only an unexpectedly disastrous year would make Becton Dickinson unable to fund its dividend from cash flow.

The company makes more than enough money to pay shareholders their current dividend as well as one that could be substantially higher.

It has a pristine track record of raising its dividend for 4 1/2 decades, and its business is still growing. This is about as safe a dividend as you’ll find.

Dividend Safety Rating: A

(To learn which other companies are bound to see healthy cash flow – and rising dividends – in 2017, tune in to my LIVE webinar Thursday Jan. 19 at 8:00 p.m. EST. more