ARM Holdings: An Investment Opportunity Renewed

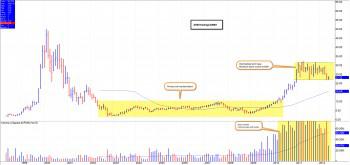

I believe in always asking questions. Why did ARM Holdings (ARMH) enjoy such a massive price rise - to $32 from $4 in 2 years - and then spend the last 18 months trading sideways? Well, okay, the obvious reason is the stock moved in line with the market's rally from the March 2009 low. But the market continued higher, albeit marginally, over the past 18 months and ARMH is stopped dead in its tracks. Will this sideways action be a top or base?

Concerns increase about competition, especially from Intel (INTC). ARM, though, can hold its own against Intel in the mobile app processor market, argues Gareth Jenkins (from UBS), who adds:

- 75% of the top smartphone apps are specifically written with ARM-based processors in mind

- ARM continues to innovate with solutions such as its big.LITTLE architecture; and

- Intel has to compete with 15+ app processor vendors (most of whom use ARM CPU cores).

Intel is ARM's No. 1 competitor in the server market - but ARM's distributed partner model translates to long term success. (Contrast with Intel's one size fits all, top down solutions.) In fact, the essence of ARM's server solution is, Low power usage-> less power needed-> less heat-> less cooling-> less electricity-> less costs = more profits. For purchasers of ARM's solutions, the bottom line is this: large up-front costs = even larger savings long term.

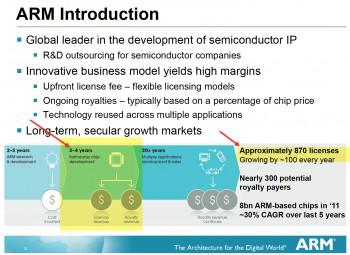

The profoundly bullish item for ARM's future, though, is this peculiar item: ARM signs license deals with its partners today, co-designs products with its (new) partners, and the royalties flow in later. The typical lead time for the royalty payments (from licenses), on average, is ~3 1/4 years. Stop, for a moment, and consider that the massive revenue and earnings growth ARM showed in 2009, 2010, and 2011 were a result of license deals signed 2005-2008. Two presentations display this relationship quite adeptly...

The graphic above highlights the relationship between license deals (step 1) and royalty payments (steps 2 and 3), and the time factor for all.

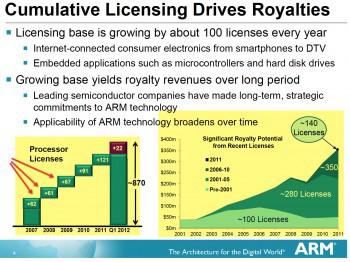

The graphic above showcases… well, that license deals drive royalty payments. (The two graphics above come from a longer, and very interesting presentation, available here.)

Note the slowdown from 2007 to 2008 - and the explosive growth that begins anew in 2009. The notable takeaway is the exponential increase in licenses signed during 2009, 2010, 2011 and that continues in 2012. The absolute numbers of license deals show an exponential growth, and an increasing numbers of deals each year. A minor plateau of license deals signed during 2008 manifest with ARMH shares going nowhere fast throughout 2011 and 1H 2012.

The sideways trend for ARMH shares is about to change, perhaps exponentially so. Just as the license deals, and their consequent royalty payments, propelled the shares higher (with the added tailwind of a favorable market), the diminution of license deals from 2007/2008 caused the sideways trend of the past 18 months. Now, though, 3 years after the resumption of explosive growth in license deals, the royalty payments will begin to flow in, which will cause revenues to explode higher, likely to commence this year (2012), and certainly by next, 2013. Couple increasing revenues with increasing earnings from a lower corporate tax rate in England (phased in beginning 2012/2013), and ARM enjoys a situation in which revenues and earnings each are goosed higher, unexpectedly so by Wall Street analysts and investor constituencies.

Most investors invest with a rear view mirror, and see only (price) risk, especially after a mighty rise. Even I can get caught up, almost lost, as the next person with the daily headlines and the steady drumbeat of terrible events from around the world. The prize rarely, if ever, lies behind us, though; but ahead. I remain undaunted, unstinting, bullish on our future: for life, for the market, and for ARM/ARMH.

ARMH qualifies, I believe, as a screaming buy. While it should be pushing on the top end of its intermediate term base ($22-32), instead it languishes at the low end, which reason I attribute to the headline-grabbing events in Europe and sovereign debt. Sooner or later, that issue will find a resolution or, more likely, investors will shrug it off in favor of the newworry du jour. When that perception comes to pass it would relieve some of the ephemeral pressure on the shares. And lead to a higher share price. With all due respect for the unknown unknowns, ARMH's rocket ship ride will not end here ($22), nor even its recent recovery high of $32.

Yes, ARMH shares are expensive, and the sideways trend of the past 18 months has done little to distill that rich valuation. Moreover, the future I see includes an even richer valuation - pending just how explosive the company's revenue and earnings growth proves to be. I suspect that $22 will prove to be another time we say, retrospectively, "Why did I not buy that low?"

Disclosure: I am long ARMH.