Ares Capital Dividend Is Safe

We believe that Ares Capital (ARCC), a business development company, is a one that should be on your radar. Most specifically, the dividend appears to be more than safe, because there has been consistent coverage. In this column we review a few key metrics and management comments that you should be aware of.

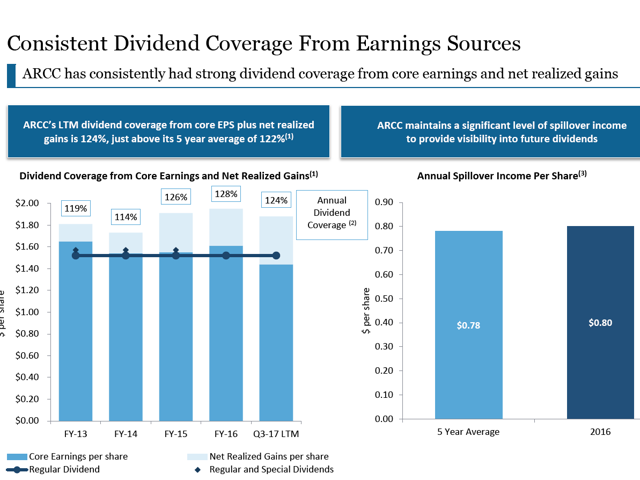

Source: ARCC Earnings Call Slides

The waiver of income fees is something you need to be aware of. In connection with the ACAS acquisition, Ares Capital Management LLC has agreed to waive up to $100 million in income based incentive fees for ten calendar quarters beginning Q2 2017 (up to $10 million per quarter) to support the dividend of the combined company during the integration and portfolio repositioning period.

“We found $100 million fee waiver from our external manager to support the transaction so I think I will just say that running American Capital is a very important business for Ares management. That being said we haven’t independent board that we discuss our free range with we would be talking to them, we would be talking to the manager I am not worried that I am going to have that conversation. I think when we look forward we have enough levers to pull against such that will position the company that we want to have that conversation. Let me just remind you that we don’t have the highest fees by a wide margin in the industry. So feel our investors are little long period of time have gotten pretty nice return on stock and we look to past couple of quarters, we are re-positioning things to delivering those.”

Source: ARCC Earnings Call

In addition, the company could continue to waive $10 million per quarter in perpetuity:

Q. “If you had the management company waive $10 million of fees for the quarter, if your core NII is let’s say with the full $10 million was be above the dividend of $0.38, should we expect that Ares management would still waive $10 million and possibly put you at $0.39 or $0.40 or should we look at the waiver as being something that just kind of bridges the gap between core NII and the dividend?”

A. “Well, the fee waiver is meant to be quite exclusive, right. So, as I mentioned in the stated remarks, the board and Ares management and obviously the team and I’m part of those has decided to waive $10 million a management fees this quarter has agreed to do it for nine quarters following this on a hard and fast basis and there’s really nothing more to it than that.”

Source: ARCC Earnings Call

For the quarter ended September 30, 2017, ARCC had non-interest income of $56 million compared to base case projected $50 million. Net investment income was around $0.36 per share and net realized gains totaled $0.08 per share to help cover the current quarterly dividend of $0.38 per share. Further, the company had around $0.80 per share of undistributed income carried forward into 2017.

“We reported third quarter core earnings of $0.36 per share, a $0.02 improvement from the $0.34 per share we reported in the second quarter. The improved earnings were driven by higher yields on our investment portfolio due to the resolution of the SSLP and the early returns from our ongoing portfolio rotation effort. In addition to these core earnings, we generated another quarter of net realized gains, which totaled an additional $0.08 per share. When taken together, our core earnings plus our net realized gains were $0.44 per share, which is a measure that we believe, is the best proxy to evaluate our dividend. They are again well in excess of our historical regularly quarterly dividend of $0.38 per share.”

Source: ARCC Earnings Call

Finally we think we will see better dividend coverage thanks to two key issues

- Increased leverage and portfolio growth

- Continued rotation out of non-income producing equity investments

Quad 7 Capital has been a leading contributor with various financial outlets since early 2012. If you like the material and want to see more, scroll to the top of the article and hit ...

more