Apple Must Diversify Its Revenue

It was recently Apple's 40th birthday, but no celebrations were to be had. Apple released its earnings report yesterday plunging the stock down over 8%, or 40B in market cap. This is such an extraordinary company, with uncountable amounts of accolades that transcended from a few people in a garage to a company that looked like it was going to be the first company with a trillion dollar market cap almost a year ago. As a shareholder, I felt the need to examine where the company's future growth prospects are, and why the sentiment in the stock changed. I have never doubted Apple's management as they continue to amaze year after year. However, I believe a large change in the company's revenue strategy may be in order to regain investor confidence and position the company for future success.

If we take a look at the graph below we see that Apple (NASDAQ: AAPL) has had a bad past 10 months, although it looks like it is starting to show signs of life.

Some of the reasons for this relative inertia are as follows:

1) Apple had an explosive run up until late spring last year, and some people wanted to take money off the table

2) Others trumped the Apple Watch a failure, and were angry when the company sought to camouflage its sales by lumping together Apple TV, iPods, and Apple Watch

3) It's the slowest sales growth since the iPhone first came out in 2007, with revenue up a meager 1% year over year Sales of iPads declined 25% during the last quarter, which included the holiday shopping season

4) Some people believe that the year of FANG is over, and 2016 will be a year of return to value and blue chip stocks

5) The Apple car is very hyped up as we have no idea if or when this product will be rolled out, and we have heard rumors of multiple delays and engineers leaving

There are probably many more reasons (warranted or not) why people have decided to flee or not invest in Apple. Amazingly, though, Apple is still putting up record numbers (see following excerpt here from the Techradar website:)

"Tim Cook mentioned no fewer than three new records for the December quarter, with the US$75.9 billion of revenue joined by an all-time high quarterly net income of US$18.4 billion and 74.8 million iPhone unit sales. To put the iPhone sales into some perspective, that works out at an average of 34,000 iPhones sold per hour, 24 hours a day, seven days a week, for 13 straight weeks. That's almost 567 iPhones sold per minute, or nine every second."

To me that indicates it is still a cash cow. While I think that there are plenty of iPhone sales left to go before market saturation, the company needs to start thinking about its future. I find the situation similar to Gilead Sciences (NASDAQ: GILD). Here and here, are articles explaining the issue.

Both are money-printing machines, but their products are seen facing headwinds in the midterm future, and management should make decisions to help the company thrive and prosper long-term. While I agree with the Gilead article that the company needs to look at acquiring other companies, Celgene (NASDAQ: CELG) seems like an expensive acquisition to me and they could probably scoop up a few smaller companies for cheap.

But this article isn't about Gilead, so let's stay on topic. I believe Apple needs to do the same. Yes, Apple does make a lot of small acquisitions each year that no one has ever heard of, but it's time to start swinging for the fences. A dividend hike and share buyback only helps so much. Such a strategy will cut dilution, and each share will become more valuable; the increase in dividend may bring in [DGI] (Dividend Growth Investors) as well as mutual funds, but this isn't going to generate more revenue when their products start to slow down in sales.

The problem with product sales is there will always be a point of saturation, and you're forced to come up with new products that people may or may not want. Apple has done an excellent job of creating the Apple ecosphere, which drives product sales. But too many products can lead to cannibalization: a reduction in sales volume, sales revenue, or market share of one product as a result of the introduction of a new product by the same producer.

What Apple needs, and what many great companies have, is a recurring business model via services, not product sales. In the 21st century, mobile payments, and electronic wiring of money has taken off. It seems plausible to me that eventually no one will have physical money anymore: no coins, no cash, maybe just silver and gold in a safety deposit box in case of an apocalypse or as a hedge for inflation and market downturns. Millenials use it on a daily basis, and the trend is growing. I'm sure you've all heard it before.

"Yo bro, can you Venmo me for those drinks last night?"

"Ah man, I don't have any cash, want to just pay for this and I'll Chase QuickPay you?"

"I'm running into CVS, need anything? Dude it's going to take too long. Don't worry I have ApplePay I wont even have to take out my wallet."

People are predicting that ApplePay will generate ~$500 million in the next few years. That is a drop in the bucket for them but there are additional growth opportunities, especially when combined with other companies.

Let's take a look at VeriFone (NYSE: PAY).

It, like many other tech companies, has had a rough year. Although it has had a strong snapback rally since it hit $20 a share, with only a 3B market cap it would not be financially stressful for Apple to acquire this company. Then again, Apple has 233B (following this most recent earnings report) in cash sitting in Ireland, so, if they really wanted to, they could buy any company even though they would have to pay a huge tax. VeriFone generated 2.15B in revenue last year! Buying this company while it's market cap is suppressed due to investor anxiety seems like an easy one as future cash flow generation from it's operations will result in a short payback period (the period of time required to recoup the funds expended in an investment, or to reach the break-even point). Apple could then encourage people to use ApplePay on all their machines through promotions or slight discounts, which would lead to increased revenue on two fronts as it makes money via the VeriFone transaction and the ApplePay charging the bank to utilize its service simultaneously.

Apple would also be acquiring some technology, that Verifone only recently acquired itself. Last October VeriFone acquired Curb, a taxi and car-for-hire electronic hailing payment and media business. The company connects customers with both insured professional drivers, and licensed taxi drivers, and so far is servicing 100,000 customers a month. Its main competition is Uber, Lyft, and Way2Ride, a mainly based NYC service which allows customer's to directly hail NYC cabs. The app/service has been very successful and is being run by none other than VeriFone. I'm not sure exactly what VeriFone plans to do with both Curb, and Way2Ride, but a rollup could be on the way to create an even larger competitor to both Lyft and Uber. Apple has already expressed interest in a car, maybe it would like to try it's hand at a consumer taxi payments service, that's paid for using the new ApplePay (with the VeriFone merged into it), with a driver who is driving a new Apple Car!? Wishful thinking maybe, or future reality, only time will tell.

The next company Apple should look at acquiring is PayPal (NASDAQ: PYPL). It has performed pretty well through market turmoil ever since it went public and was spun off from eBay (NASDAQ: EBAY). With a market cap of 48B, PayPal is no walk in the park when it comes to acquisitions. However, Apple has a lot of money in the bank, literally. It also just issued a 5B bond sale and has ample access to the capital markets and could start a revolving credit facility whenever it needed it. PayPal's transaction volumes passed $80bn in the fourth quarter of last year. It aggressively added to its customer base in the last two quarters of 2015 to ~180M users which was a 10% increase from 2014. PayPal is also looking to aggressively expand into Europe partnering with Vodafone allowing users of Android phones to make purchases through a Vodafone Wallet App run by PayPal.

This competes with my ApplePay thesis, but it shows PayPal aggressively trying to expand its business into a lucrative market, and allows them to reach more customers world wide. PayPal has also cozied up with Ali Baba and AliPay (Ali Baba's mobile payment service). As the fastest, or now maybe only one of the fastest growing mobile markets, it is a good move for PayPal.

CEO Daniel Schulman is looking for ways to monetize its peer-to-peer payment application Venmo, due to its popularity with millenials. In 2015, Venmo more than tripled its growth rate and processed $7.5 billion in payments. PayPal's revenue has surged to ~9.5B dollars. Apple could then roll PayPal, Venmo, and ApplePay up into some sort of mobile payments / electronic wiring app and service that would be enormously profitable.

The cross profitability across different mobile and merchant website transactions would be huge in my opinion. Or, they could keep PayPal separate, and combine Venmo with ApplePay. This would allow peer-to-peer payments, and greater mobile in-browser payments. Revenues increased by 19% in 2014, and another 21% in 2015, expecting another strong year of growth at around ~19%.

We know that Apple is looking to get into the P2P market, as the WSJ reported it as early as last year. They are working on a system that is similar to Venmo's and would be in direct competition with them. There isn't a lot of time to adopt these new features before its widespread. Facebook (NASDAQ: FB) messenger, and Snapchat have already set up ways to send money through their apps. Personally, I haven't tried it, and don't feel comfortable using it because its not a bank or a reliable financial services institution, but that could change.

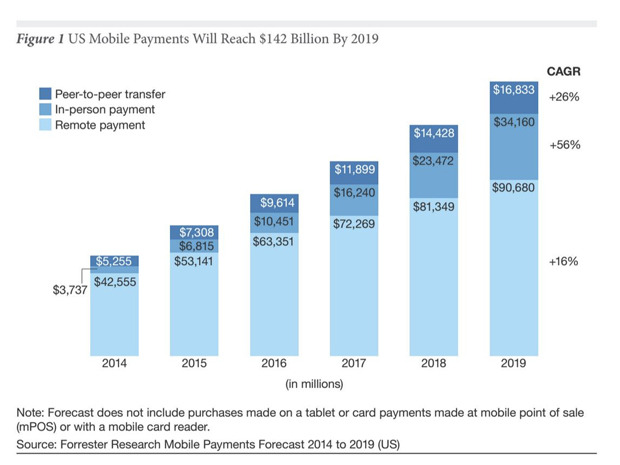

Here's an interesting chart:

The US Mobile Payment Market will reach $142 Billion dollars by 2019. That's a lot of money, and it's not even factoring in the amount of money to be made on transactions made outside of the continental United States. Estimates vary, but by 2020, worldwide mobile payments could exceed 3 Trillion dollars. Who doesn't want a piece of that action?

While it isn't typical for Apple to acquire big companies, it has made a few large acquisitions in the last few years. On May 28 2014 Apple announced " it has agreed to acquire the critically acclaimed subscription streaming music service Beats Music, and Beats Electronics, which makes the popular Beats headphones, speakers and audio software. As part of the acquisition, Beats co-founders Jimmy Iovine and Dr. Dre will join Apple. Apple is acquiring the two companies for a total of $3 billion, consisting of a purchase price of approximately $2.6 billion and approximately $400 million that will vest over time."

With this 3 Billion dollar acquisition, Apple hoped to bolster its iTunes subscription model and increase revenue, as the twenty first century has brought in the pirating of music on a new level, and no longer a reliance on Apple's iTunes store to acquire music. iTunes has become more of a hanger for music. When they created iTunes Match which allows people to back up songs purchased or not for ~$20 a year, they conceded the fight against piracy, but smartly sought to make a fraction of the money it lost buy encouraging people to use its service. Apple also gained multiple other big ticket sales items in the process, along with lots of rights to the Beats name that is so often used in product advertising, especially music videos.

In 1988, Apple acquired NeXT, a computer company founded by Steve Jobs after he was kicked out of Apple. This then brought him back into the fold when his company was bought for 400 million dollars. Translated today that is ~$820,000,000 according to DollarTimes. Quite a large acquisition for a company back then, and would have still been a very large acquisition today. It is possible that PayPal may be out of its usual target range for acquisitions, but VeriFone is certainly not.

Other people have theorized about large acquisition targets for Apple. Andres Cardenal of The Motley Fool believed that Apple and Netflix (NASDAQ: NFLX) together made sense. Right now Netflix is sitting at a 45B Market Cap. That's pretty close to the market cap of PayPal and proves my point that other people believe that large acquisition targets exist, and that Apple is a potential suitor.

Dan Ives, a well-respected analyst on The Street at FBR Capital Markets said late last year that he thought that Tesla (NASDAQ: TSLA), Box (NYSE: BOX), Adobe Systems (NASDAQ:ADBE), and GoPro (NASDAQ: GPRO) were potential acquisition targets. With market caps of 31B, 1.5B, 48B, and 1.5B respectively, these fit the profile in regards to market cap of the companies I have offered up in my thesis.

In his research note Mr. Ives says:"We believe Cook's crystal ball is now focused on building out new technology growth frontiers/product areas for the next decade...with $200 billion of cash in the coffer (and growing), we can finally envision Apple making a larger acquisition, as the conditions are ripe for Cook to make a move".

Others have also come out recently and supported my idea.

Evan Niu of the Motley Fool in an interview with CNBC said that Tim Cook is trying to shift investor focus from hardware to the services business which adds up to around 10B in service revenue, which is bigger than the iPad, mac, and is now the second largest business for Apple in terms of revenue. Niu also says that "more importantly that is a recurring figure, with a billion devices that are regularly buying content" something I have been preaching throughout this article.

John Petrides, managing director and portfolio manager at Point View Wealth Management, told CNBC's " Squawk Box" that Apple management "needs to wake up here and stop focusing purely on selling really cool widgets ... [and] focus on the subscription side of the business." Another individual who sees my viewpoint of what Apple should be doing.

While my ideas may have seemed a little radical due to the nature of the size of the acquisition, today's earnings call led by Tim Cook may have quelled those fears.

Finally, something I have been waiting to hear for years happened on the earnings call today. " We're always looking in the market about things that could complement things that we do today, become features in something we do, or allow us to accelerate entry into a category we're excited about. So as I have said before, our test is not on size. We would definitely buy something larger than we bought thus far. It's more about the strategic fit and whether it's great technology and great people. And so we continue to look, and we stay very active in the M&A market."

I was very excited when I saw this. Finally, Tim Cook may be ready to swing for the fences, instead of bunting or trying to get on first base.

I really hope that he looks to grow the services unit of the business instead of look to buy or create another innovative product.

A recurring revenue model is what Apple needs to restore investor confidence, and create new long term sustaining revenue streams. Entering the mobile and electronic payment systems space will allow them to become a dominant player in a rapidly growing sector.

Disclosure: more

great article, thanks. I agree, Apple cannot afford to rest on its laurels. It has been a tremendous run for Apple from the 70's thru the first decade of 2000, but nowadays, the competition has already caught up. Why pay twice or three times more for a smart phone when Samsung and many upstart Chinese companies are producing similar products albeit largely inferior but nonetheless functionally similar versions of the iphone. What Apple needs is to remain unique in the market place by creating unbeatable products that noone else is doing, or take a page from Google and buy up other companies' technologies in the same way Google did with Waze and manay other companies. Please Apple, heed this request before you become irrelevant!

Thanks for reading Joe, I concur.