Anticipating Gilead Q2 Earnings

Gilead (GILD) reports Q2 earnings after hours today. Analysts expect revenue of $6.35 billion and eps of $3.08. The revenue estimate implies a 2.3% decline, up from the 11% decline experienced in Q1. Investors should focus on the following key items:

HCV Revenue Will Continue To Crumble

Gilead is known for having developed a cure for HCV. Heightened competition, political scrutiny over high drug prices, and a decline in the HCV runway have recently punished the company's HCV sales.

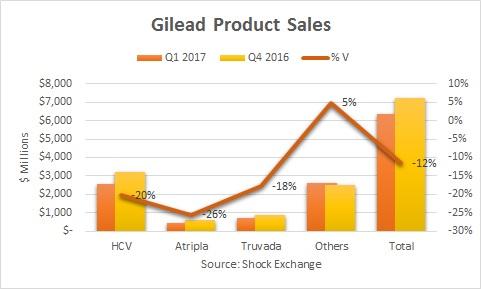

Last quarter HCV product sales fell 20% sequentially to $2.6 billion, while total product sales were off 12%. I expect another double-digit decline in HCV product sales this quarter. HCV still represents over 40% of Gilead's total revenue, so a double-digit decline in HCV and no meaningful pick up in other revenue could cause the company to miss analysts' estimates. Management also anticipates total 2017 HCV revenue of $7.5 - $9.0 billion. If management gives weak full-year guidance it could also trigger negative sentiment for the stock. A Q2 revenue miss or weak guidance could cause GILD to sell off.

HIV Is Cracking

HIV was expected to be the catalyst to offset weakness in HCV. That has not materialized. Total HIV revenue fell 3% sequentially, following a 4% decline in Q4. Atripla and Truvada continue to be cannibalized by single-pill regimens, Genvoya (24% of HIV revenue) and Descovy (8% of HIV revenue). They will likely continue to cannibalize other products, while growth from Stribild (10% of HIV revenue) appears to have peaked.

Meanwhile, GlaxoSmithKline (GSK) and Johnson & Johnson (JNJ) have a two drug combination that could potentially compete with Gilead's three and four-drug combos in terms of efficacy. If the drug garners FDA approval next year it could potentially put a dent in sales for Genvoya, Stribild, and Descovy. I do not believe this risk is currently not priced into the stock, which makes GILD a long-term sell.

No Imminent M&A Deals

GILD bulls want management to make a large, game-changing acquisition. In the past bulls also wanted management to use its cash hoard to engage in share buybacks - look how that worked out. Management has stated its ambitions of expanding into oncology, but has remained disciplined on price. In March I analyzed what a potential deal for Incyte (INCY) would look like; the relative trading multiples for GILD (4.4x EBITDA) and INCY (144x EBITDA) made a deal untenable in my opinion. I believe management has been prudent to remain on the sidelines until a pullback in broader markets occur, and valuations in the biotech sector come down. In the meantime, GILD's upside could be capped while bulls lose patience with the stock.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Manythanks