Analysts Remain Positive But Cut Price Targets On LinkedIn Following Q1’15 Results

By Carly Forster

LinkedIn Corporation (NYSE: LNKD) only slightly beat its first quarter 2015 earnings expectations, which were reported the prior evening. Following the report, LinkedIn shares plunged nearly 19% due to the lackluster earnings forecast for the next quarter and full year.

LinkedIn provided revenue guidance of $670 million to $675 million for the second quarter, compared to analysts’ consensus of $718 million. The company also expects $0.28 earnings per share, versus analysts’ consensus of $0.74.

LinkedIn attributed its lower outlook to foreign currency headwinds, sales execution issues, a decrease in display advertising, and the assimilation of its recently acquired startup, Lynda.com.

Steve Sordello, CFO of LinkedIn, said of the report and guidance, “LinkedIn demonstrated continued solid growth during the first quarter… This performance comes amidst the backdrop of several important strategic investments to better position the business to execute on our long-term roadmap.”

Many analysts cut their price targets on LinkedIn following the company’s lower-than-expected guidance; however they also remained bullish on the stock.

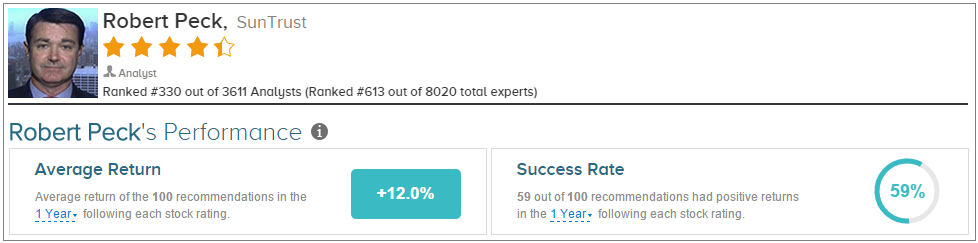

On May 1st, SunTrust analyst Robert Peck reiterated a Buy rating on LinkedIn, though he cut his price target from $275 to $250. The analyst pointed out that “the education of the marketplace and execution across the sales cycle is ongoing and a driver of the conservative guidance.” He added, “Traffic and page views all decelerated… While Sponsored Updates was strong, Display was weak particularly in Europe on shift to programmatic.”

On average, Robert Peck has a 59% success rate recommending stocks and a +12.0% average return per recommendation.

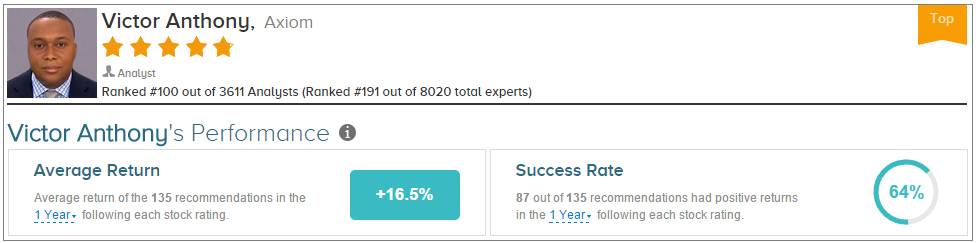

Similarly on May 1st, Axiom analyst Victor Anthony reiterated a Buy rating on LinkedIn but more significantly cut his price target on the stock from $300 to $230. The analyst noted, “While the guidance was surprising, it has not shaken our belief in the strength of LNKD’s business model […] For Investors who missed the last leg up in the stock, the pullback creates and opportunity to revisit the story.”

Victor Anthony has an overall success rate of 64% recommending stocks and a +16.5% average return per recommendation.

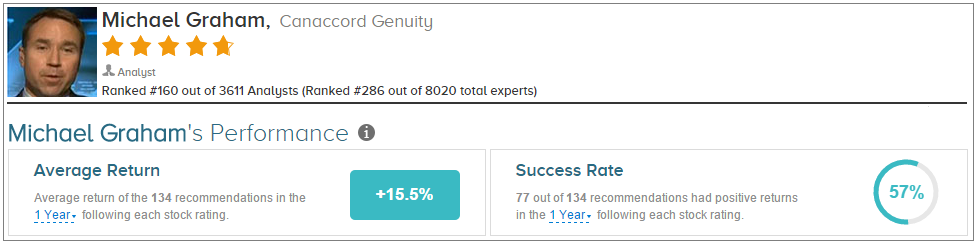

Canaccord Genuity analyst Michael Graham also reiterated a Buy rating on LinkedIn on May 1st and slashed his price target from $300 to $250. He explained, “While the stock’s expensive valuation leaves no room for speed bumps, we remain convinced of LinkedIn’s long-term opportunity. We are encouraged by rapid growth in Sales Solutions, and believe any material weakness in the stock will likely provide a good long-term entry point.”

Overall, Michael Graham has a 57% success rate recommending stocks and a +15.5% average return per recommendation.

On average, the top analyst consensus for LinkedIn on TipRanks is Moderate Buy.

To see more recommendations for LinkedIn, visit TipRanks today!

Disclosure: Sarah Roden writes about stock market news. She can be reached at more