Amedica: Buy For A Bounce

TM editors' note: This article discusses a nano cap. Such stocks are easily manipulated; do your own careful due diligence.

Thinly traded nano-cap Amedica (AMDA) is a biomaterial company that develops and commercializes silicon nitride for biomedical applications. The stock has been trading with massive volatility lately and we wanted to bring it to your attention because we believe it is setting up for a bounce trade at $1.15 here.

We think it is a buy on a mean reversion, but the science behind the name is rather solid as well. Take a look at the crazy action in the last 5 days:

Source: BAD BEAT Investing

In the last two trading days, this nano-cap stock rocketed on a 32x surge in volume in response to its announcement of positive study data supporting the value proposition of its silicon nitride spinal implants. There are several key studies underway. Data released this week was from the Single Center Retrospective Comparative Study

This was a clinical study comparing silicon nitride spinal implants to allograft spacers in cervical fusion. The results show showed faster and more effective outcomes with silicon nitride.

“While silicon nitride might have been expected to perform better in light of its properties, the surprising finding in our study was how good the outcomes with silicon nitride proved to be. Significantly earlier and more effective bone fusion was observed with silicon nitride than allograft spacers at 3- 6-, and 12-month time points after surgery, all the way to 24 months” -Dr. Micah Smith, principal investigator.

The completion of a retrospective survey of over 2,000 silicon nitride spinal implants implanted in more than 1,000 patients over the last eight years was also completed. The study was designed to understand clinical outcomes from silicon nitride implants in spine fusion from four different clinics in the US.

“Preliminary data analysis toward publication of this study is very encouraging in this large cohort of patients derived from our long-term surgeon users. Not only are the data consistent with our other clinical studies, but the outcomes corroborate our basic science understanding of the surface chemistry of the material, the key strength of silicon nitride"

Finally, there is the Silicon Nitride Against PEEK [SNAP] study. The SNAP study was a 24-month double-blinded multicenter randomized controlled human trial for lumbar fusion comparing intervertebral cages from either silicon nitride or polyetheretherketone [PEEK].

The study showed that fusion using silicon nitride cages was at least non-inferior to PEEK devices. Preliminary data at 3, 6, and 12-months on the Roland Morris Disability Questionnaire and VAS back and leg pain scores, as well as quantitative radiographic data at 24 months, appear to confirm the study’s hypothesis of silicon nitride’s non-inferiority.

Why is the stock tanking now?

So the stock rallied on this impressive data, so why is the stock falling? The answer is a cash-raising offering.

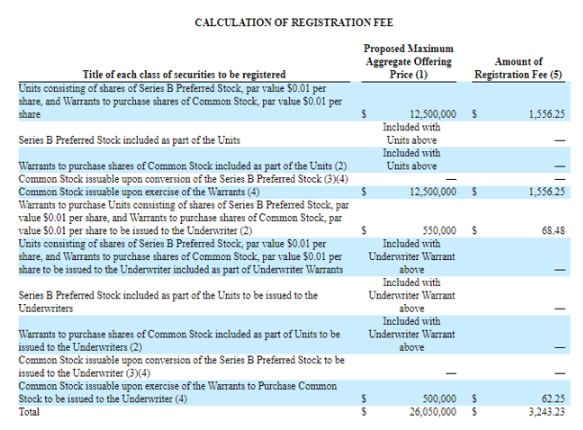

Below is the table from the Shelf registration.

Source: Shelf registration

The company is offering 12,500 units, with each unit consisting of one share of Series B Preferred Stock, par value $0.01 per share, with a stated value of $1,100 per share (the “Series B Preferred Stock” or “Preferred Stock”), convertible at any time at the holder’s option into a number of shares of common stock, par value $0.01 per share as described below and warrants to purchase shares of our common stock at an initial exercise price equal to the conversion price, at a public offering price of $1,000 per unit.

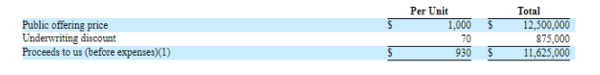

Source: SEC filings

Cash use

Unclear at this time, but general corporate purposes. As stated in the prospectus:

"Other than amounts required to be paid to certain lenders, our management will have broad discretion as to the use of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of commencement of this offering. Accordingly, you will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. It is possible that, pending their use, we may invest the net proceeds in a way that does not yield a favorable, or any, return for us. The failure of our management to use such funds effectively could have a material adverse effect on our business, financial condition, operating results and cash flows."

Final thoughts

The stock flew, probably too high. Now it has pulled back almost to where it started, which we think is an overreaction, so we are playing a mean reversion bounce.

Disclosure: Long AMDA

Quad 7 Capital is a leading contributor with various financial outlets, and pioneer of the BAD BEAT Investing philosophy. If you like the material and want to see more, ...

more