Action Remains Tight - Sunday, Oct. 9

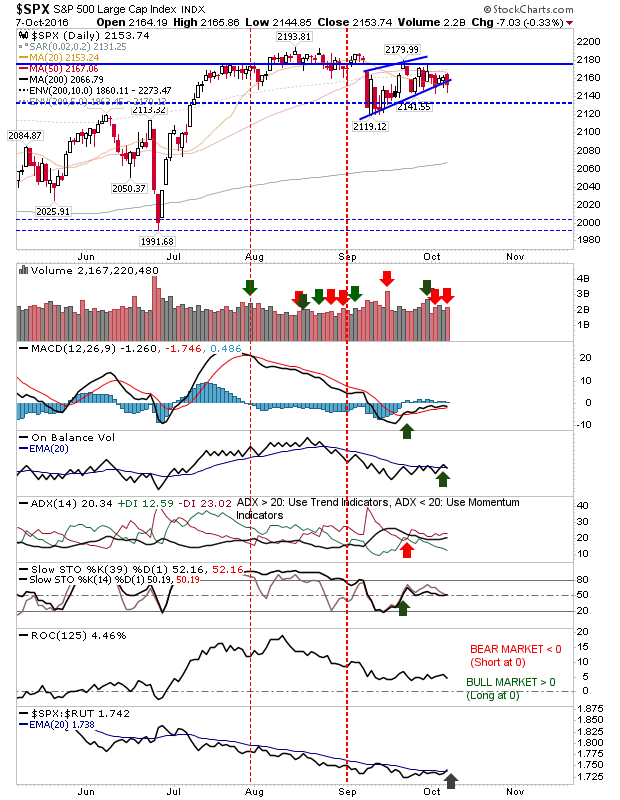

For a while on Friday it looked like Bears had the breakthrough, but Bulls came back at the end to push indices back inside scrappy consolidations. If there is a concern for bulls it's that the S&P now finds itself bumping against the 50-day MA. Volume also climbed to register as distribution for the index. The one plus for bulls is that the index has started to outperform against small caps.

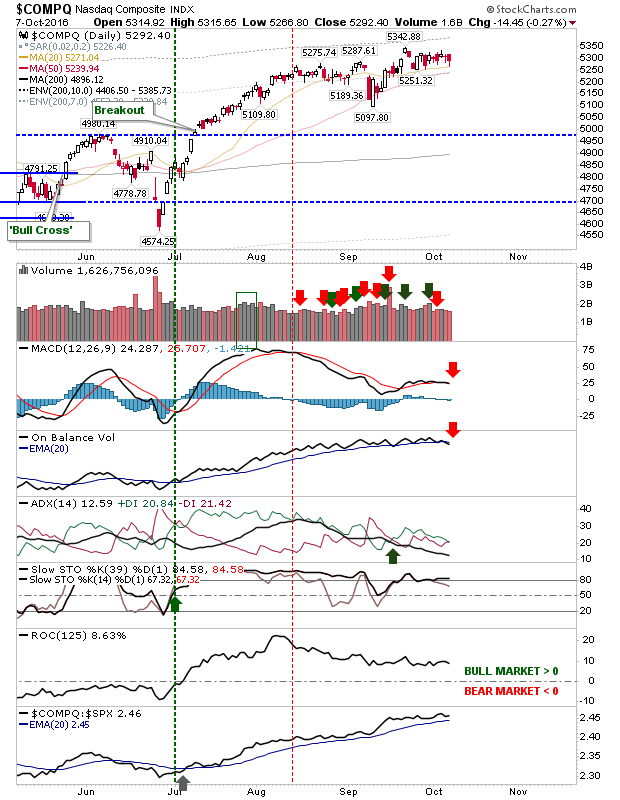

The Nasdaq has stronger price action but weaker technicals. Both the MACD and On-Balance-Volume have triggered 'sell' triggers while the index itself trades above 50-day and 20-day MAs. The risk is that technicals are suggesting these MAs won't hold as support for much longer. However, all bulls need is a push above 5,343 and shorts will be left scrambling; a feasible target for Monday.

Bears will be looking to the internal breadth weakness of Nasdaq Bullish Percents, Nasdaq Summation Index and Percentage of Nasdaq Stocks above the 50-day MA are all on 'sell' triggers having peaked in July.

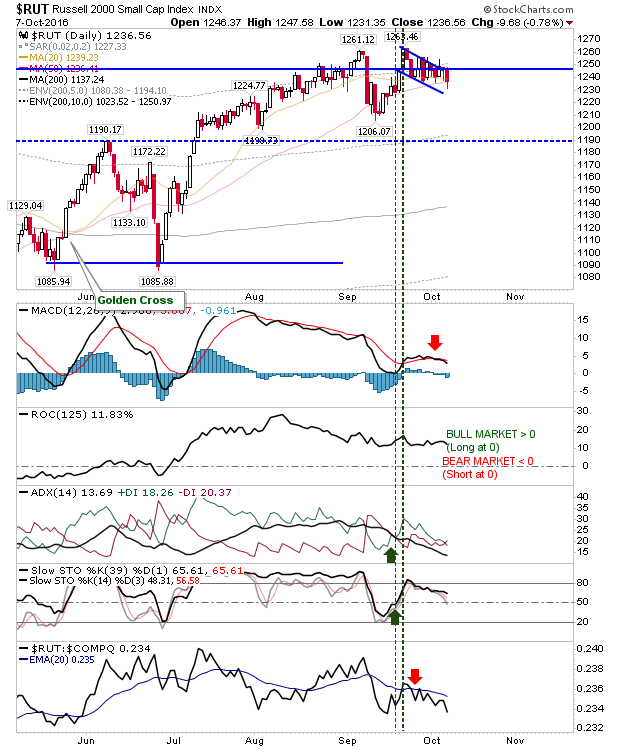

The Russell 2000, which is now underperforming against the S&P and Nasdaq, still has the look of a 'bull' flag with the 50-day MA holding as support despite a 'sell' trigger in the MACD. Aggressive buyers may still look to this as an opportunity in early action for Monday.

The longer term picture from a breadth perspective has been consistent in favouring a period of bearishness (lasting longer than a few weeks), but markets haven't delivered on that outlook. If markets do manage to keep going higher then these weak breadth metrics will offer room for upside before these too become overbought.

For Monday, bulls can look to the Russell 2000 and its continual mapping of the 'bull flag'. Bears can track the S&P and look for a shorting opportunity on an eventual (?) break down from its bearish rising wedge.

Disclosure: None.

Thanks or sharing