Accelerating Into The Carvana IPO

Summary

Carvana Company (Pending:CVNA) expects to raise $210 million in its upcoming IPO ($242 million if the underwriters exercise their option to purchase additional shares). Based in Phoenix, Arizona, Carvana is a leading ecommerce platform for selling used cars.

Carvana will offer 15.0 million shares at an expected price range of $14-16. If the underwriters price the IPO at the midpoint of that range, CVNA will have a market capitalization of $2 billion. This assumes underwriters exercise their option to purchase additional shares.

The company filed for the IPO on March 31, 2017.

The lead underwriters are BofA Merrill Lynch, Citigroup Global Markets, Deutsche Bank Securities, and Wells Fargo Securities. Underwriters are BMO Capital Markets, JMP Securities, Robert Baird & Company, and William Blair & Company.

Business Summary: Ecommerce Platform for Selling Used Cars

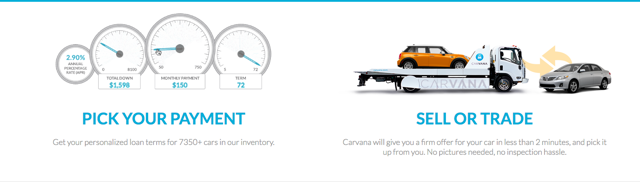

(Source: Company Website)

Carvana, LLC sells used cars online. The company was incorporated in 2012 and is based in Phoenix, Arizona. It has distribution centers in Atlanta, Georgia; Nashville, Tennessee; and Charlotte, North Carolina. It also has physical presence in Houston, Austin, Dallas, San Antonio, and Pittsburgh, Texas; and St. Louis, Missouri.

The company launched in January 2013, and since then, it has bought, reconditioned, sold, and delivered close to 27,500 used cars to consumers through its website. This generated $541 million in revenue. Carvana continues to expand into new markets and increase market penetration in current markets. The in-house distribution network covers 21 metropolitan areas. Its growth has increased organically by adding two markets in 2014, six in 2015 and 12 in 2016.

Use of Proceeds And Highlights From Management's Analysis

Carvana seeks to seamlessly improve the used car-buying experience by offering all phases required, including purchasing, financing, optional purchase protection insurance, selling used cars, vehicle sourcing and acquisition, inspection and reconditioning, photography and merchandising, and logistics and fulfillment.

Since launching to customers in Atlanta, Georgia, in January 2013, the company has experienced strong growth in sales through its website. During the year ended December 31, 2016, the number of vehicles sold to retail customers grew by 187.6% to 18,761, compared to 6,523 in the year ended December 31, 2015. During the year ended December 31, 2015, unit sales grew by 209.9% to 6,523, compared to 2,105 in the year ended December 31, 2014.

The company intends to use the net proceeds of this IPO to pay down debt and for general corporate purposes, including covering $5.5 million in expenses and acquiring new LLC units.

Potential Competition: eBay, Independent Used Car Dealerships, and Franchise Dealerships

Carvana faces competition from a wide array of market players, including eBay (Nasdaq:EBAY), CarMax (NYSE:KMX), independent used car dealerships, and franchise dealerships. Franchise dealerships account for approximately 29% of the used car market, and independent dealerships account for approximately 71% of the market.

If Carvana prices at the midpoint of its proposed range, it could have a P/S of 5.5x; this is well above that of KMX (0.7).

Executive Management Highlights

Co-founder Ernie Garcia has served as president and CEO since the company's inception. His previous experience includes positions at Quantitative Analytics, DriveTime, and RBS Greenwich Capital. Mr. Garcia holds a B.S. in Management Science and Engineering from Stanford University.

CFO Mark Jenkins has served in his position since July 2014. He was a professor in Finance at the Wharton School of the University of Pennsylvania. He holds a Ph.D. in economics from Stanford University and a B.S.E. from Duke University in Mathematics and Civil Engineering.

Conclusion: Consider A Modest Allocation At Most

We like that Carvana is unique among its IPO peers this week (spanning biopharma, specialty retail, financial lending, tech, oil & gas, and other sectors); in addition, its platform is intriguing, allowing consumers to research and identify a vehicle, inspect it using 360-degree vehicle imaging technology, obtain financing and warranty coverage, and purchase the vehicle/schedule delivery or pick-up.

At the same time, the company's growing losses give us pause. For the year ended December 31, 2016, a loss of ($93 million) was booked, more than 2X the ($36.8 million) loss for the prior-year period.

We suggest a modest allocation in this IPO.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in CVNA over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more