A Turnaround Is Imminent For Micron Technology, Inc

Micron Technology, Inc. (NSDQ:MU) has become saddled with debt after the acquisition of Inotera; its total and net debt aggregated to $9.63 billion and $3.48 billion as on 02 June 2016, respectively. The situation was so bleak merely 6 months ago that Micron was downgraded as analysts weren’t sure if the chipmaker would be able to service its debt. Its outstanding debt has remained pretty much unchanged since then but the light at the end of the tunnel is starting to appear. In fact, I’m of the opinion that Micron’s debt situation would vastly improve over the next few years. Let’s take a closer look to have a better understanding of the matter.

The Debt Situation

- Let’s get privy with Micron’s debt situation first. I’d like to point to readers that Micron’s overall debt-to-equity ratio currently stands about 79%, out of which only 6% is short-term, while the remaining 73% is long-term in nature. These debt levels are pretty high considering that most of the other chipmakers operating in the segment carry much lower leverage levels on their books. This is evident in the table below. Granted that Seagate and Western Digital operate with a higher leverage, but we also have to take into account that their diverse businesses rake-in a stable stream of cash flows, unlike Micron.

| Company | Short Term Debt/Equity | Long-Term Debt/Equity |

| Micron | 6% | 73% |

| Intel | 6% | 39% |

| Seagate | 0% | 259% |

| Western Digital | 1% | 152% |

| Rambus | 0% | 30% |

| SunEdison Semiconductor | 5% | 46% |

- I went through Micron’s SEC filings to see what was really going on with its debt situation. The thing to note here is that the bulk of Micron’s debt has been raised at very high-interest rates, with its 2023 notes carrying a coupon rate as high as 7.5%. So I think it's safe to say that interest payments on Micron’s liabilities alone bring down the chipmaker’s profitability by a great deal. To put things in perspective, Micron’s interest expense over the past 12 months stood at $359 million which is pretty high considering the fact that the chipmaker generated just $645 million in EBIT over the period. This goes to show that about 55% of the company’s EBIT (Earnings Before Interest and Taxes) gets watered down due to interest payments. And we haven’t even started talking about debt repayments yet.

(Click on image to enlarge)

(Source: Micron)

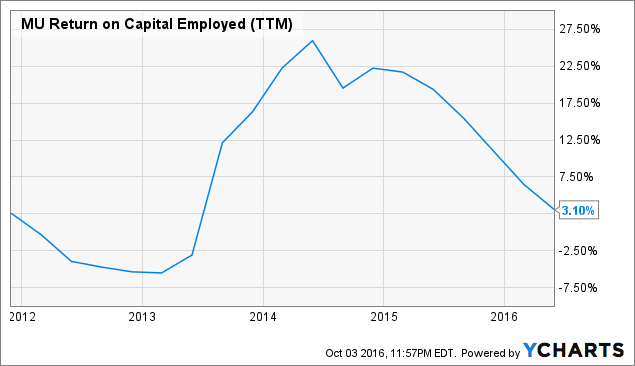

- The most concerning factor of all is that Micron's ROCE (Return on Capital Employed) stands at just 3.1%. This means that it's borrowing at a high-interest rate, but generating low returns out of it, not even enough returns to pay the interest on the borrowed cash!!! Ideally, ROCE is expected to be at least twice the interest rate, otherwise, you're losing money on the debt raised.

(Click on image to enlarge)

Reason to be optimistic

Granted that Micron’s debt situation looks scary at the first glance, but as I said earlier, light at the end of the tunnel is starting to appear.

- First of all, the company generates most of its revenue from the DRAM segment with about 60% revenue coming in from the sale of DRAM products. The thing to note here is that this segment is expected to experience a phase of rapid growth going forward. Micron’s management projects that between FY15 and FY17, DRAM bit shipments would increase by up to 30% whilst the cost of manufacturing these bits would come down by up to 25%. So this factor alone should vastly improve the profitability of Micron’s DRAM segment.

(Click on image to enlarge)

- We also have to take into account that DRAM pricing environment is improving. SK Hynix and Samsung have cut down on their DRAM production over the past few months due to slowing down PC sales, which in turn, is resulting in the commodity’s ASP appreciation. In fact, DRAMeXchange reported only last week that DRAM prices have risen to their 7-month highs and that prices of the commodity could further increase by 10% over the next quarter. This is another factor that should aid in improving Micron’s profitability.

- But what exactly would happen when Micron’s profitability improves? It would start generating more returns from the same amount of employed capital. As a result, I estimate that by the end of 2017, the chipmaker’s ROCE would rise to somewhere between 10% and 15%. This would be sufficient for Micron to service its interest payments and it might as well free up some cash for the chipmaker to redeem its notes over the coming years. The metric is calculated as follows:

ROCE = EBIT / Capital Employed

- Also, as Micron’s balance sheet continues to improve due to the aforementioned factors, its creditors might be willing to restructure the company’s debt. We saw this happening in BlackBerry and AMD’s case earlier this year, so it’s highly probable that Micron is next in line. If such a development does take place, the chipmaker’s interest expense would decrease and that should, in turn, further boost its profitability. So that’s another prospective positive trigger for the company.

Putting it all together

Micron may have been a debt-ridden company but I’m of the opinion that its debt situation will vastly improve over the next few years. This would not only have a positive impact on Micron stock price but also makes it a solid candidate for any potential M&A related activity. Hence, it’s a good time to be bullish on Micron stock.

Disclosure: I do not hold any positions in the stocks mentioned in this post and don't intend to initiate a position in the next 72 hours. I am not an ...

more