A Portfolio With A 5% Dividend Yield, 5.5% Dividend Growth, And 20+ Years Of Dividend Increases

Energy and Utilities: Your Yin And Yang Income Strategy

Income is on every retiree's (or soon-to-be retiree's) mind. Interest rates are on the rise, at least for now, with 10-year treasury notes yielding around 2.5% (as of the middle of December of this year). This is decent news for those on a fixed income.

But as we've written previously, for most people, relying on treasuries is still not going to cut it. For one, 2.5% is still a pretty low number, even if it is up a bit from recent lows. Also, increasing interest rates often accompany higher inflation. So locking in at 2.5% or 3% at this stage means you'll also have to maintain your purchasing power somehow without inflation eating away at it. And of course, no one really knows what interest rates will do. They may not budge from here at all.

In recent years, retirees have somewhat reluctantly turned to stocks for their income needs. The reluctance stems from the volatility inherent in the stock market: A retiree with money in the markets in 2008 was hit with a pretty big shock for a while there. Anything less than a sure thing can be nerve-wracking for a retiree.

Here's a method that uses stocks to generate income, but with lower volatility. It depends on stocks, yes, but on their dividends, not on selling them for capital gains.

Complementary Forces

Consider your heating oil, gas, and electricity bills. They probably don't fluctuate all that much. You can count on periodic increases from time to time, but that's about it. But if you own a car, you know that things are different at the gas pump. Gasoline prices can and do fluctuate regularly, and sometimes substantially.

Both public utilities (think Southern Company, Xcel, or whomever sends you your electricity bill) and long-established integrated oil and gas companies (think Exxon, Chevron, and Shell) tend to generate excess cash flow that they can't or don't want to invest in other projects. These companies return that cash flow to shareholders in the form of dividends (or distributions, in the case of limited partnerships).

In a very general sense, and with some caveats we won't get into here, when gasoline prices are going up, there's a good chance that utilities' costs--that is, their raw material costs--are going up too. The prices of oil, coal, and natural gas are loosely correlated to one another.

When fuel prices go up, it's a positive for oil and gas companies, but not so good for utility companies (again, in a very general, caveat-laden sense.) A company like Exxon can simply pass the cost on to those fueling up their cars. Profits--and often share prices--rise. Most utilities, however, can't just raise rates, at least on a short-term basis, as those rates are often regulated. So rising fuel costs can hurt their profitability--and their share prices.

At this point, you can probably see where we're going with this. Depending on the direction of fuel prices, one industry gets hurt, and one benefits--smoothing out a portfolio's volatility if you're an investor in both sides.

The beauty of it is that the dividends just keep coming regardless. Not guaranteed, of course, but pretty close.

Putting The Duality Into Practice

Have a look at this list of large-cap companies (and limited partnerships). It's a mix of companies in the businesses we're talking about, along with a couple of pipeline companies too. All of them have boosted their dividends (or distributions) for 10 or more years straight; some of them have done so for decades.

|

Company |

Ticker |

Industry |

Yield |

Avg Annual Dividend Growth |

Consecutive Dividend Increase (Years) |

|

AmeriGas Partners |

Propane |

8.4% |

5.5% |

12 |

|

|

CenterPoint Energy |

Utility Electric/Gas |

4.3% |

4.9% |

11 |

|

|

Chevron |

Oil & Gas |

3.9% |

8.5% |

28 |

|

|

Consolidated Edison |

Utility Electric |

3.8% |

2% |

42 |

|

|

Dominion Resources |

Utility Electric/Gas |

3.8% |

7.2% |

13 |

|

|

Duke Energy Corp |

Utility Electric/Gas |

4.5% |

2.2% |

12 |

|

|

Enterprise Products Partners |

Pipelines |

6.3% |

5.7% |

19 |

|

|

ExxonMobil |

Oil & Gas |

3.3% |

10.6% |

34 |

|

|

National Grid PLC |

Utility Diversified |

5.2% |

3.1% |

25 |

|

|

Southern Co |

Utility Electric |

4.5% |

3.6% |

16 |

|

|

Spectra Energy |

Pipelines |

5.6% |

7.4% |

10 |

|

|

Averages |

|

|

4.9% |

5.5% |

20 |

Data as of 12/15/16. Average annual dividend growth over the past five years.

An equal-weighted portfolio of these stocks would get you not only a nearly 5% dividend yield, but also a dividend growing by nearly 6% annually. That's a pretty compelling number in almost any market environment.

There are more companies where these came from, too--steady dividend payers and dividend growers in these industries. Their shares will go up and down to be sure, but likely in a less volatile fashion than the market overall--and, since you're not relying on realizing capital gains for income (or as much income), it won't matter to you as much.

Meet Our Contestants

Here's a simple test case, where we put a couple's portfolio through a couple of different scenarios. We have a 60-year-old couple wondering whether they are in a position to retire or not. They have $800,000 in investment accounts, and expect their total annual spending in retirement will be around $60,000.

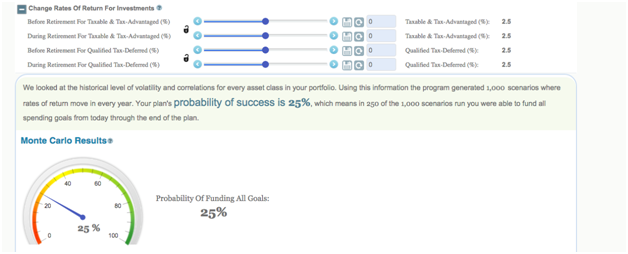

As is often the case with couples nearing retirement, our couple is skittish about stock market gyrations. They are considering moving all of their assets to those 2.5%-yielding treasuries. Running their plan through WealthTrace's Monte Carlo simulation, here's what the plan looks like:

You can use WealthTrace to run a retirement plan through 1,000 market simulations. Find out more.

A 25% probability of success is not going to cut it. They simply need more income. But the prospect of moving their investments to the stock market and hoping for capital appreciation to cover their retirement income this late in the game is unsettling. They remember 2008.

There is a middle ground, however. With a portfolio of dividend payers like the one we mentioned above, our couple can be pretty confident in a 4.9% return on that $800,000 in the form of dividends. That's about $39,000 (pre-tax) right there.

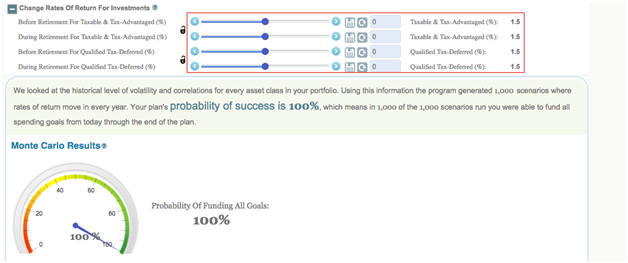

If we enter that $39,000 as an additional cash inflow, and conservatively assume our portfolio will only return 1.5% annually, things look a lot better:

The stocks of energy companies and utility companies don't have completely inverse relationships by a long shot. Increasingly, utilities' inputs are coming from renewable sources, for example, so they're not as sensitive to fossil-based fuel costs as they used to be. But there is definitely enough of a relationship to consider making this strategy a powerful part of a retirement income plan.

What would increasing your savings rate or investing in different asset classes do to your retirement plan? Could you handle a stretch of stock-market volatility? WealthTrace can help you find ...

more