A Perspective About Tiffany & Co.

Tiffany & Co. (TIF) has been a winning trade on our part. We believed that Tiffany & Co. was offering growth at value prices and we highlighted the name a year ago as a 'Diamond on Sale.' Recently it was our view that the stock had now given us a solid return, and it was time to go buy something nice. To be clear, we said that you should take some profits and let the rest run.

In this column, we want to check back in on the name as we hold a core position. It is our thesis that while we continue to like the name long-term, shares are a bit ahead of themselves for a new purchase. Given the historical volatility in the name, however, we believe that you will get the chance buy shares in the luxury retailer in the future. Overall, we think performance is very solid. Let us discuss the performance and our thoughts on valuation.

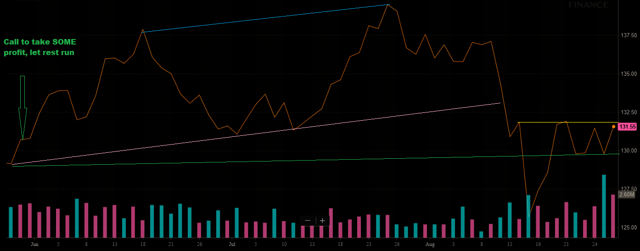

Recent price action suggests stock is searching for direction

There is no doubt that we saw a hefty gain in the name in the last year. Recall there was a huge gap up following Q1 earnings, prompting us to take profits. Since then shares are about flat, but we did miss out on a few more points of gains:

Source: BAD BEAT Investing

While there have been ups and downs, the overall move has been higher, until recently. We continue to believe shares are a touch ahead of themselves right now, even though recent performance is strong, including in Q2. Our chartist believes the stock is searching for direction in recent sessions, and another break below $130 or a gap up above $135 would be bearish, or bullish, respectively. However, it is unclear at this time on the shorter-term chart. Longer-term the stock is still in an uptrend. With this information at hand, let is turn to the fundamentals.

Fundamental discussion

As the economy continues to be solid in North America and in key markets of Asia, in addition to the fact that there is more money in the pockets of higher-end consumers thanks to the recent tax cuts in the U.S, Tiffany & Co. registered another solid quarter. While retail has been painful in general the last two years, the stronger names have been in rally mode in the last 6-8 months. Tiffany is one of these names, as it has performed very well, both operationally and from a shareholder's perspective.

We must acknowledge however that some weakness persists in certain lines of operations within the Tiffany enterprise. However, even with this weakness, the company is demonstrating that it is still a strong, profitable retailer. So, how was the just released Q2? In short, the company's second quarter was solid. We were looking for strong sales but were once again surprised by the magnitude of the increase here.

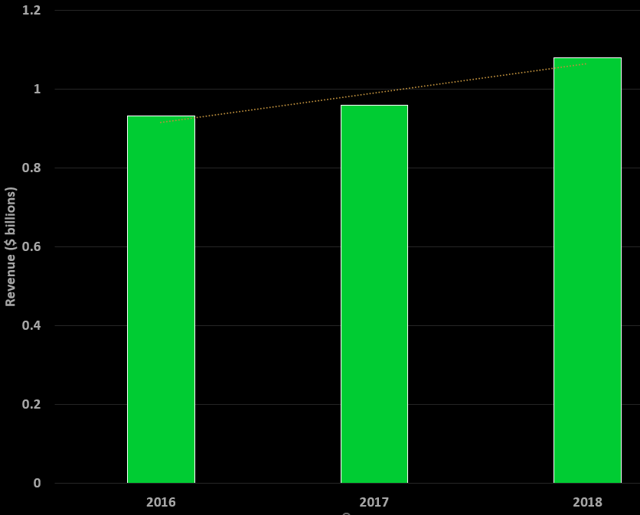

Tiffany easily surpassed our top-line estimates and surpassed the $1 billion revenue mark, coming in at $1.08 billion and rising 12.5% from last year:

Source: SEC Filings, graphics by BAD BEAT Investing

These results far surpassed our expectations for high-single-digit growth, which we thought was a bullish outlook. We did believe that the company was turning the corner this year and we anticipated strong sales, but were genuinely surprised by the recent earnings result.

Global net sales rose 12.5% year-over-year but adjusting for currency sales were up 11.3%, still good enough for a double-digit increase. Further impressive was the fact that comparable sales rose 8% while jumping 7% on a constant-dollar basis. Truly impressive and at the higher end of our expectations for mid-single-digit increases.

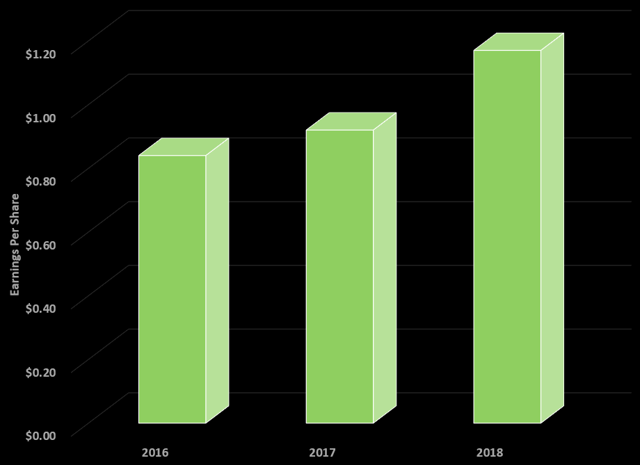

This is a direct result of a rise in consumer discretionary spending in the United States but also a direct result of new innovative advertising campaigns, the paper flowers brand, and strength in every single region. Strategic investment spending has ramped up a bit, but the higher top line suggests that the spending plan is working. We are very pleased by the performance. Overall, factoring in expenses and the significant boost in sales, net earnings were up 26% to $145 million or $1.17 per share versus $115 million or $0.92 per share last year:

Source: SEC Filings, graphics by BAD BEAT Investing

This bottom line was driven by the significantly better than expected sales result. While expenses rose, margins are improving, and share repurchases helped bolster the earnings per share figure. Overall the earnings far surpassed our expectations for a $1.05 per share result. Further, this earnings per share result was a beat of $0.16 versus consensus estimates. It was a remarkable quarter. What is important to realize is that every geographic segment is improving.

Worldwide strength

There was strength in all regions, and despite the increased spending to push sales higher, gross margin came in at 64.0% versus 63.5% through the first half of the year. The increase reflects favorable product costs and price increases globally across all product categories and regions. There were also changes in the product mix which benefited the quarter. This is reflected further by segment.

Looking deeper into the regional data, we can see where pockets of strength lie. In the American region, total sales jumped 8% on a constant dollar basis to $475 million. Comparable store sales rose 8% as well. These sales were up thanks to advertising campaigns as well as increased spending by domestic residents.

What about internationally? Well internationally, sales were even stronger on a year-over-year comparable basis. In the Asia-Pacific region, total sales spiked 28% to $301 million thanks to huge sales increases in Greater China, while comparable store sales were up 10%.

It was not just China that was strong. In Japan, the company saw total sales rise 11% to $155 million, with higher local resident spending noted. Further, comparable sales were up 9%, bringing the year-to-date comparable sales increases to 14% in this region. That is a phenomenal improvement that would make any retailer envious.

A lot of pain had been felt by retailers in Europe. However, Europe also was mostly positive in the quarter for Tiffany. European sales on an absolute basis were up 5% but benefited greatly from foreign exchange rates. If we account for these rate impacts, sales edged out a gain of 2%, but comparable sales were down 1%. This was a small blemish on the quarter. There were new store openings that may have hurt comparable sales, while management noted tourism spending is down recently. This is an area we will be closely watching as shareholders and a firm that trades the name frequently.

If there was one real 'weak' spot in the quarter, it was in the wholesale business. This line makes up only a small 3-4% of overall revenues usually each quarter. It has not been a great 2018 thus far. So-called 'other' net sales fell 21% to $24 million in the quarter, marking the second quarter in a row of a 20% plus decline. However, we believe that this headwind is temporary and sales will bounce back as demand ramps up for diamonds globally as the holiday shopping season approaches

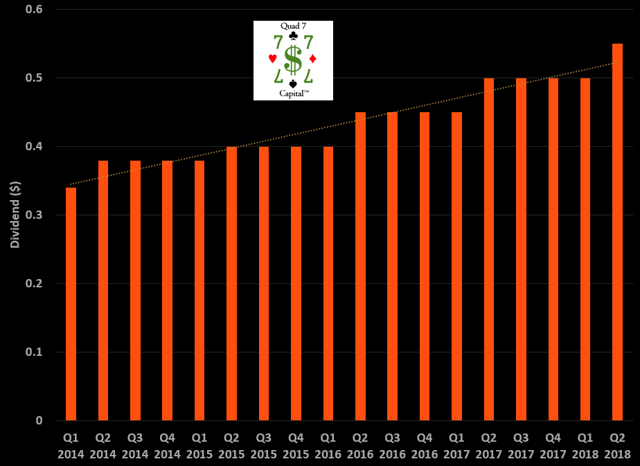

Dividend growth

We would be remiss if we did not mention that despite shares trading at nearly 40 times trailing earnings, and around 30 times forward 2019 expectations, the name offers dividend growth. While the valuation is tough to justify a new buy, even with the marked earnings growth being demonstrated, we enjoy being paid to hold the house's money which we are letting run. The company has now increased its dividend another 10% and will be paying $0.55 quarterly, continuing a long history of dividend growth:

Source: Street insider dividend history, graphics by BAD BEAT Investing

Many may not consider Tiffany a dividend growth name, but as you can see, it clearly is. While the yield is low at just 1.7%, considering our recommendation to let the rest of your investment ride, reinvested dividends can help compound gains over time.

The company is also boosting shareholder value as it is in the middle of instituting a $1 billion share repurchase program. In Q2 alone the company repurchased $266 million worth of stock, which we believe helped put a floor under share prices and boosted earnings per share. We would argue that we would have liked to have seen significant buying this time a year ago when shares were much cheaper, but even buying at recent highs these repurchases will continue to boost earnings per share.

Final thoughts

We think that the stock will continue to move higher over time but given that we recommended the name at $84 and we are trading at $130 at the time of this writing, it is still wise to lock in some of these 50% plus gains. Our recommendation is to take out the initial investment and let the rest ride. In other words, if you invested $20,000 at those levels, take this out, and let the remaining $10,000 run. The stock pays a growing dividend on top of offering what we view as the potential for further capital gains. We would not, however, be new buyers at the present valuation.

Sales are turning around and earnings are growing. A premium valuation relative to the sector and to the general market average of about 18 times earnings is likely justified, but the valuation is stretched in our opinion. If shares do break well below $130 again, we think a better place to re-enter the name would be around $110 a share. This is because we foresee earnings per share of $4.60-4.80 this year, so at the high end of this range, the stock is still trading at 23 times forward earnings, a level we would be comfortable recommending new entry. That said, continue to hold shares because we see the name moving higher in the longer-term, but wait for a better price.

Disclosure: No positions in any stock mentioned.

Pioneer of the proven trading philosophy BAD BEAT Investing, Quad 7 Capital, (parent company of Quad 7 Research, Quad 7 Partners, and Quad 7 ...

more

#Macys has been having a hard time lately with poor sales, in particular to Chinese tourists. How has #Tiffanys fared? $M $TIF